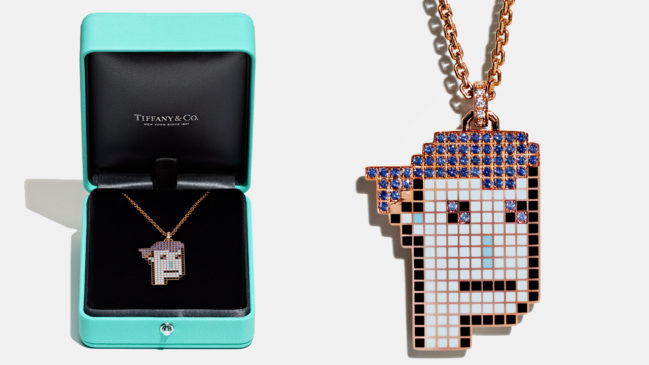

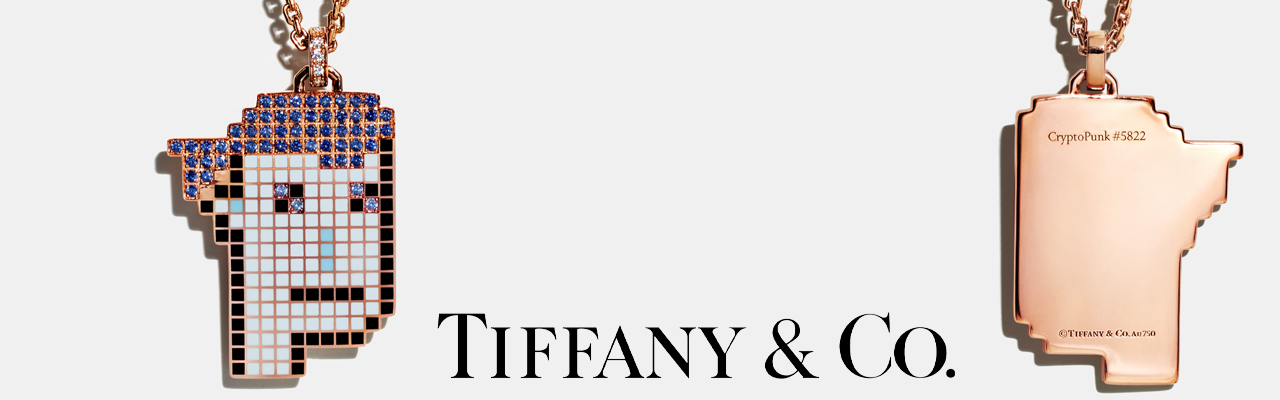

On August 5, 2022, the American luxury jewelry retailer Tiffany & Co. announced that the company’s non-fungible token (NFT) mint called “Nftiff” sold out. Tiffany’s sold 250 Nftiffs for 30 ethereum per Nftiff raking in more than $12.5 million from the sale. The NFTs created by Tiffany’s have to be redeemed by August 12 and so far 94 Nftiffs have been redeemed.

Tiffany & Co. NFT Sale Sells Out Gathering $12.5 Million in Ether

Six days ago, Bitcoin.com News reported on Tiffany & Co. revealing an NFT mint called “Nftiff,” a new product crafted by Tiffany’s that combines non-fungible token technology and luxury jewelry. Since then Tiffany’s has hosted its sale and all 250 NFT units sold out, according to a tweet published by the company on August 5.

Each NFT, otherwise known as Nftiff, sold for 30 ether or just over $50K per NFT on Friday. The combined value of the sale netted more than $12.5 million for the luxury jewelry retailer. “We are sold out of all 250 Nftiff. Until the next mint,” Tiffany’s wrote on Friday. Data stemming from Dune Analytics indicates that 94 Nftiffs have been redeemed so far by a total of 73 Cryptopunk NFT owners. On the same day as the sale, Tiffany’s said:

Nftiff couldn’t be easier. Purchase your NFT through the Nftiff gateway, choose your Cryptopunk and Tiffany artisans will transform it into a bespoke pendant.

Nftiffs Sell for Less Than the Original Sale Price on Secondary Markets

Metrics from cryptoslam.io show the original Nftiff sale and secondary market sales has achieved the top NFT collection ranking by sales volume during the last seven days. There’s been 299 transactions to date from the 182 owners storing Nftiff NFTs on 48 active wallets. Cryptoslam.io data and nftgo.io metrics both indicate that there’s been some secondary sales set for under Tiffany’s original asking price.

Both NFT analytics sites show Nftiff sales have dropped as low as 27 ether and some for 27.5 and 27.8 ETH per Nftiff. This means owners have sold Nftiffs at a loss on secondary markets, like Nftiff #42, which sold 19 hours ago for 27 ether or a hair over $46K. Currently, at the time of writing on Sunday afternoon at 2:00 p.m. (EST), the Nftiff floor price is back to the 30 ETH value Nftiffs originally sold for during Tiffany’s sale.

What do you think about the Tiffany & Co. Nftiff sale? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tiffany & Co. Nftiffs

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.