- The U.S. stock market bull run might continue because portfolio managers don’t see an inflation-led asset bubble as a threat.

- It is hard to accurately measure inflation and strategists say that a bubble won’t likely form in the near term, at least until the year’s end.

- Meanwhile, the Federal Reserve’s average inflation policy and low-interest rates fuel the appetite for high-risk assets.

The Federal Reserve’s average inflation policy and the threat of an asset bubble aren’t moving the stock market. It shows that investors are still skeptical toward the Fed that it would let inflation run high.

At least in the near term, State Street senior macro strategist Marvin Loh believes a bubble isn’t a concern.

Although the stock market has slumped in recent weeks, it makes a prolonged bull run in 2020 more likely.

Don’t Put Too Much Emphasis on Inflation, Asset Managers Say

According to Loh, a bubble could become a concern in 2021 and possibly in 2022. In the foreseeable future, he said it is challenging to see it as an immediate problem.

In the past month, the Nasdaq Composite and the S&P 500 dropped by 9.51% and 6.25%, respectively.

Some investors fear a deep stock market pullback arising from the risk of inflation creating asset bubbles. But as CCN.com reported, 5% to 7% corrections even during bull cycles are typical.

Moreover, despite the 9.51% decline in 16 days, the Nasdaq Composite soared by 59.03% since March 23. At its yearly peak, the Nasdaq Composite climbed by 75.73%, which made a correction inevitable.

Considering historical inflation cycles and stock market trends, Loh said an inflation-triggered bubble isn’t a risk in the near term. He said:

“I don’t think [a bubble] is a concern now. But it probably will be if this continues as we go into next year and probably 2022. They can look past it now, given how many challenges they see in the economy.”

Atop the low probability of a short-term bubble forming, it is also challenging to measure actual inflation.

Thornburg Investment Management’s portfolio manager Jeff Klingelhofer said the fundamental factors that drive inflation remain uncertain.

To support the argument that the stock market rally is vulnerable due to inflating valuations, one has to demonstrate inflation signs.

While Klingehofer acknowledges the U.S. has the “perfect setup for inflation,” he said, “no one knows what drives inflation.”

Economists warn the U.S. economy might decelerate in Q4, which would decrease the likelihood of inflation rate spikes. Watch the video below:

Factors that include deglobalization, big tech breakup, and higher wages are potential drivers of inflation. But the investor emphasized that it is hard to quantify the data to depict inflation accurately.

Favorable Backdrop for the Stock Market Continues

The uncertainty around inflation remains, but the Fed’s policy continues to act as a favorable backdrop for the stock market.

As long as the Fed doesn’t go in overdrive with inflation, a low-interest rate would continue to fuel the appetite for high-risk assets.

Such a relaxed financial environment boosts the prospect of a prolonged stock market uptrend in the near term.

The one missing catalyst that could further propel stocks is a strong dollar. Investors are optimistic around Chinese stocks due to the strengthening of the yuan.

Until the year’s end, one potential catalyst could trigger the U.S. dollar recovery: stimulus.

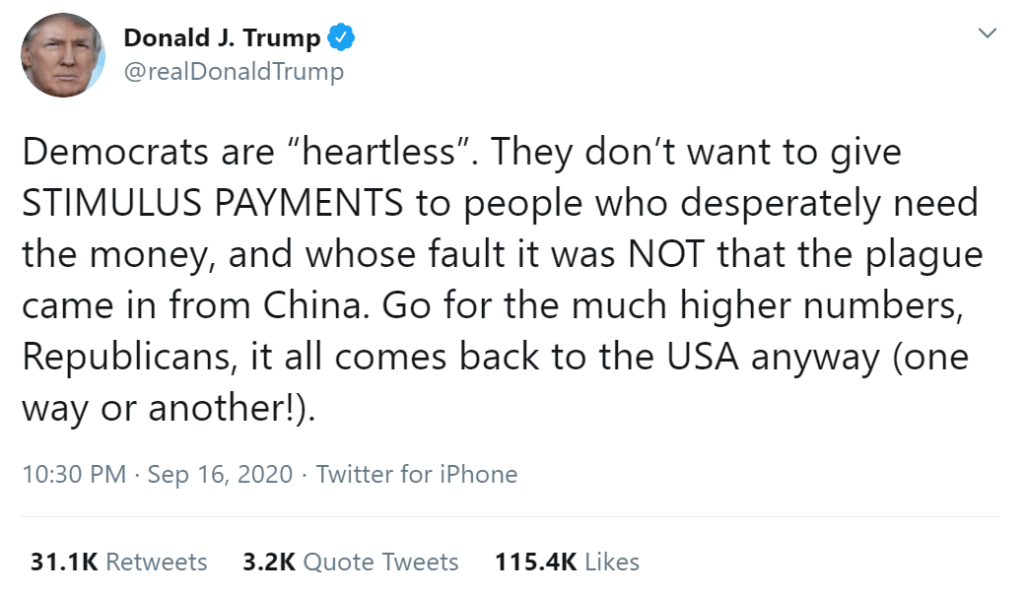

Washington is battling a stimulus stalemate, but U.S. President Donald Trump urged the Republicans to “go for the higher numbers.”

The reluctance of portfolio managers to predict massive inflation and the prospect of a stimulus package raises the probability of a newfound stock market rally.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.