- Warren Buffett’s investment in Snowflake has so far netted a 100% gain.

- Although Snowflake has bright prospects, its pricey valuation could create the temptation to lock in gains.

- Though he has earned a reputation for long-term investing, Buffett’s 1966 investment in Walt Disney remains a stain on his career.

One of the most famous pieces of advice offered by Warren Buffett is to only invest in what you know. This philosophy has tended to result in the Oracle of Omaha favoring asset-heavy firms and eschewing tech stocks.

Additionally, Buffett’s Berkshire Hathaway has tended to avoid participating in initial public offerings.

It came as a surprise earlier this month when reports said Berkshire would participate in the tech IPO of cloud data-warehousing startup Snowflake. Berkshire ended up acquiring $250 million worth of Snowflake shares. The investing conglomerate bought another 4.04 million shares at the debut price of $120. The total amount Berkshire spent on the IPO amounted to slightly over $730 million.

The stock closed Friday at $240 per share, a 100% gain.

Tech Correction Coming?

In an era where tech stocks are considered to be overpriced, and a severe market correction expected, it would be tempting to exit when the going is still good.

The Oracle of Omaha has severally emphasized the importance of patience in investing. One of his favorite quotes says:

The stock market is a device for transferring money from the impatient to the patient.

While Buffett’s long-term investing credentials are not in doubt, it would not be out of character to exit the investment prematurely. He did this over five decades ago with Walt Disney.

Warren Buffett Leaves the House of Mouse Too Soon

Selling Walt Disney stock too soon is considered one of Warren Buffett’s biggest mistakes. In 1966, Berkshire Hathaway bought a 5% stake in Disney at $4 million. Buffett sold the stake a year later for about $6.2 million.

If Buffett were still holding the Disney stake today, it would now be worth $11.6 billion. This would give the investing conglomerate a paper profit of over $11 billion on top of dividends.

While there is no guarantee that Snowflake will be a better investment than Walt Disney over the long run, its performance so far suggests bright prospects.

What Attracted Buffett to Snowflake

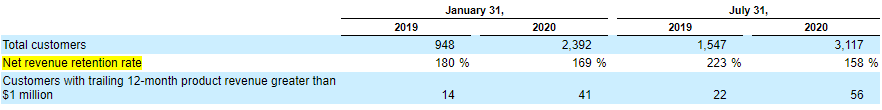

One of the reasons Snowflake soared after listing publicly is its fast revenue growth. During the fiscal year that ended in January, Snowflake registered year-over-year revenue growth of 133%. Revenue growth over the previous fiscal year was 174%. Over the past 12 months, Snowflake has more than doubled the number of customers to 3,117 from 1,547.

With the value of the addressable market expected to grow by 50% between 2020 and 2023, Snowflake’s revenue growth should continue, especially as it expands its global footprint.

Still in the Loss-Making Territory, but…

Even though Snowflake is still making losses, those declines are narrowing as revenues continue to balloon.

Another plus for Snowflake is that its cloud data-warehousing services appear to be sticky. In the fiscal year ending in January, the net revenue retention rate was 169%.

In the previous fiscal year, the net revenue retention rate was 180%. During the most recent six-month period that ended in July, the net revenue retention rate was equally impressive, rising by over 150%.

All these factors suggest a bright future for Snowflake, which boosts the stock’s upward potential.

While Warren Buffett has not always followed his advice, with Snowflake, he cannot afford to repeat the Walt Disney mistake.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.