- Gold’s price posted its biggest single-day slide since 2013. The yellow metal bottomed at $1,564.00/oz., wiping out more than two weeks’ worth of gains.

- The selloff was triggered by fears that coronavirus will impact demand for raw materials as economic growth grinds to a halt.

- Steep declines in stocks and other assets may have also forced traders to give up their gold positions to cover losses elsewhere.

The price of gold plunged on Friday, selling off in lockstep with equities as the impact of coronavirus quickly spread to the commodities sector.

As Bloomberg reports, returns from commodities have dropped to the lowest level since 1987 over fears that coronavirus will impact demand for raw materials.

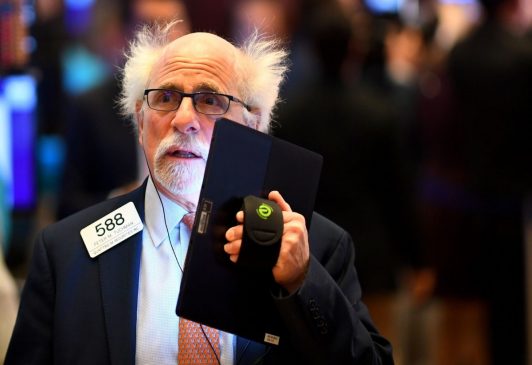

Market Selloff Hits Gold, Precious Metals

Gold’s April futures contract crashed $78.00, or 4.7%, to $1,564.00 a troy ounce on Friday, marking the worst selloff in roughly seven years. The yellow metal has erased most of its gains for the year and is currently trading at its lowest level in two-and-a-half weeks.

The rout in precious metals extended far beyond gold. Silver futures crashed $1.34, or 7.6%, to $15.40 a troy ounce. Spot platinum was off by as much as $54.79, or 6.1%, to $848.25 an ounce.

Why Is Safe-Haven Gold Suddenly Crashing?

Gold’s biggest selloff in years caught many traders by surprise on Friday. The most-trusted safe haven had been rallying for weeks over fears that the coronavirus outbreak would disrupt global trade flows and economic growth.

The slide in precious metals on Friday came against a backdrop of uncertainty over raw material demand. Hopes for an oil-price recovery have been quickly dashed amid infighting among OPEC and its allies.

The spread of coronavirus is expected to knock out 435,000 barrels per day in oil demand in the first quarter alone, according to the International Energy Agency.

Since gold is an industrial commodity as well as a consumer good, it’s not immune to the broader economy. Falling demand as a result of coronavirus will likely impact gold’s other use cases.

Massive selloffs in other assets may have also forced traders to give up their gold positions to cover losses elsewhere. This process has been ongoing for a few days now, as gold backtracked from seven-year highs.

Gold Remains Bullish Long-Term

If gold’s selloff was largely triggered by traders covering margin calls, a swift recovery is possible in the near term. Beyond the immediate, bullion is still benefiting from the same value drivers that pushed it to seven-year highs just a few weeks ago.

Slowing global growth, a reduced exposure to risk among investors and highly accommodative monetary policy are likely to keep gold prices elevated.

Futures traders now expect the Federal Reserve to cut interest rates in back-to-back meetings in March and April. The decline in real interest rates remains the biggest catalyst for bullion over the long term.

Disclaimer: The above should not be considered trading advice from CCN.com.

This article was edited by Josiah Wilmoth.

Last modified: February 28, 2020 7:26 PM UTC