As 2022 begins, 13 different cryptocurrency exchange platforms have more than a billion dollars each in digital currencies held in reserves. Between all 13 trading platforms, the group of exchange platforms hold a whopping $165.25 billion worth of bitcoin, ethereum, and tether.

13 Crypto Exchanges Hold a Billion or More in Crypto Equalling Over $165 Billion in Assets Under Management

At the time of writing, the crypto economy is worth $2.3 trillion and 7.10% of the aggregate or $168 billion is made up of stablecoins. Furthermore, statistics on January 2, 2022, indicate that 13 crypto-asset trading platforms hold a billion dollars or more in cryptocurrencies.

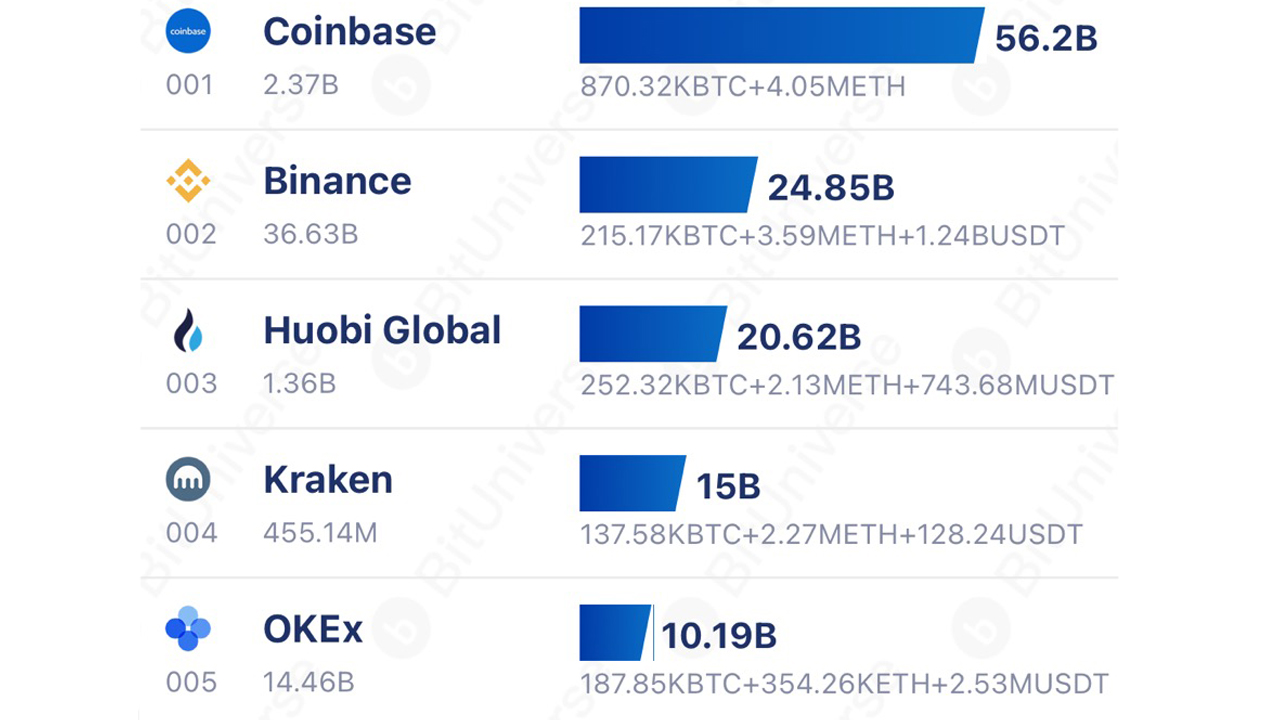

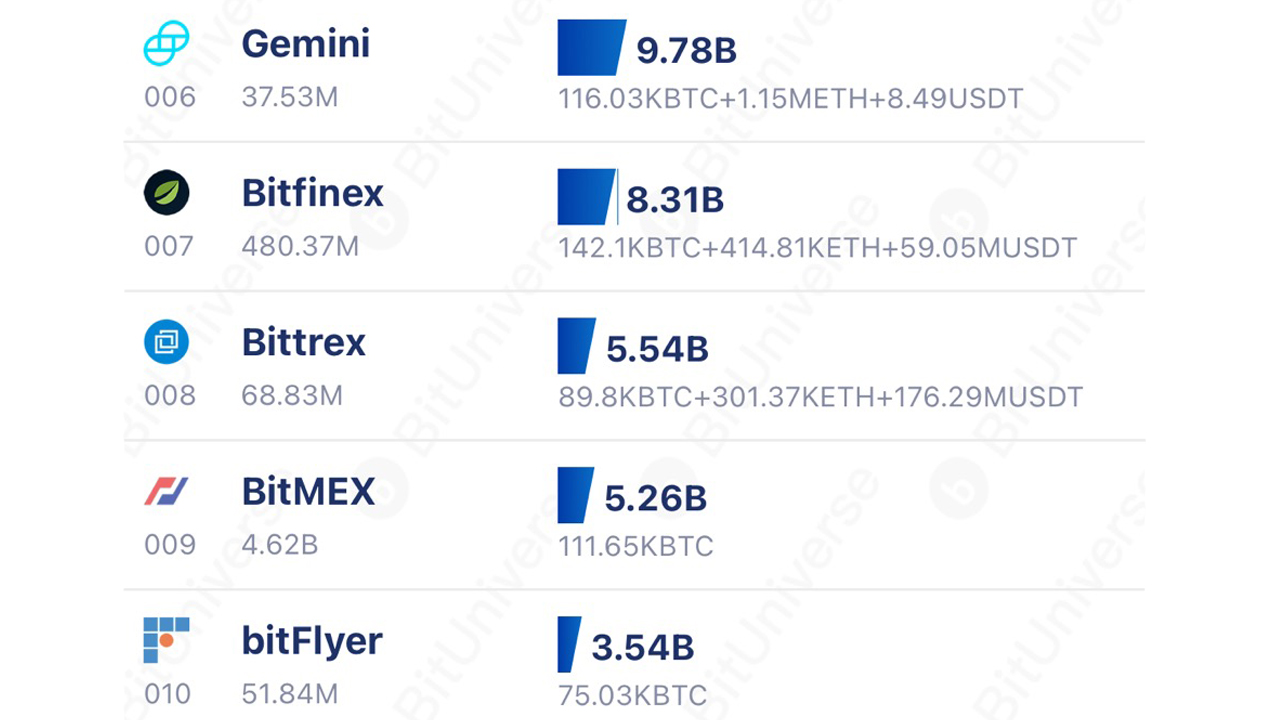

The 13 exchanges include Coinbase, Binance, Huobi Global, Kraken, Okex, Gemini, Bitfinex, Bittrex, Bitflyer, Coincheck, Bitstamp, and Bybit respectively. Coinbase is the leader, in terms of crypto reserves held on Sunday, with $56.2 billion in crypto assets under management (AUM).

$40.27 billion of Coinbase’s reserves is made up of bitcoin (BTC), with 853,530 BTC in custody. The second-largest exchange in terms of crypto AUM is Binance with $24.85 billion today. Binance has 370,390 BTC, 3.59 ETH, and 1.24 billion USDT under custody.

All 13 exchanges hold approximately 165.25 billion in crypto assets on January 2, 2022, which equates to 6.98% of the $2.3 trillion crypto economy. Bybit maintains the 13th position, in terms of crypto reserves, and holds $1.44 billion in digital assets.

10 Crypto Asset Trading Platforms Hold More Than $50 Million, 23 Exchanges Custody Over a Million in Crypto Reserves

Approximately ten crypto-asset exchanges command more than $50 million in crypto AUM. 23 exchanges hold a million dollars or more in crypto AUM and dozens of crypto exchanges have no available reserve data.

This report’s crypto exchange reserve data published on January 2, 2022, at 8:15 a.m. (EST) was recorded by Bituniverse, Peckshield, Chain.info, and Etherscan.

The only organization that surpasses the bitcoin (BTC) reserves Coinbase holds is Grayscale Investment’s Bitcoin Trust (GBTC), and the trust’s 648,069 BTC under custody. The Bitcoin Trust has 3.086% of the 21 million capped bitcoin supply.

Another entity that has more than 100K in BTC assets is Block.one with 140,000 BTC under management, while the publicly-listed company Microstrategy holds 124,391 BTC today. Grayscale, Block.one, and Microstrategy are the only non-exchange entities with 100K BTC or more.

What do you think about the 13 crypto exchanges with $165 billion under management? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bituniverse,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.