Bitcoin has proven itself to be a risk asset, not a safe haven, with “considerable” potential upside, according to a Friday note from JPMorgan’s Global Quantitative and Derivatives Strategy team obtained by CoinDesk. Writing to clients in “Flows & Liquidity,” one of JPMorgan’s flagship publications, the authors said that characterizing bitcoin as a “risk” asset rather than a “safe” asset is “more appropriate” based on the leading cryptocurrency’s increased positive correlation with the Standard & Poor’s 500 Index since March. Bitcoin’s function as a risk asset is “likely more of…

Day: October 24, 2020

Paul Tudor Jones: A Bet on Bitcoin Is a Bet on Human Ingenuity

A recap of an exceptionally bullish week for bitcoin and crypto as a whole. On this week’s Breakdown weekly recap, NLW looks at: The initial price action that started the week Debates about whether BTC was thriving at the expense of alts and DeFi The PayPal news News of more public companies putting treasury reserves into BTC Paul Tudor Jones’ optimistic take on the human ingenuity driving bitcoin’s success This week on The Breakdown: Original

Cybercrime task force monitoring the global digital financial system

The United States faces a growing threat of transnational cybercrime, particularly against its financial system. In what may be the largest prosecution of its kind in U.S. history, the U.S. Department of Justice has charged Texas tech billionaire Bob Brockman in a 39-count indictment with evading $2 billion in taxes. The businessman used encrypted devices and code words to conceal his wire fraud, tax fraud and money laundering within a network of offshore entities and bank accounts. As the CEO of Reynolds and Reynolds Co., Brockman contributed 6.4% to the…

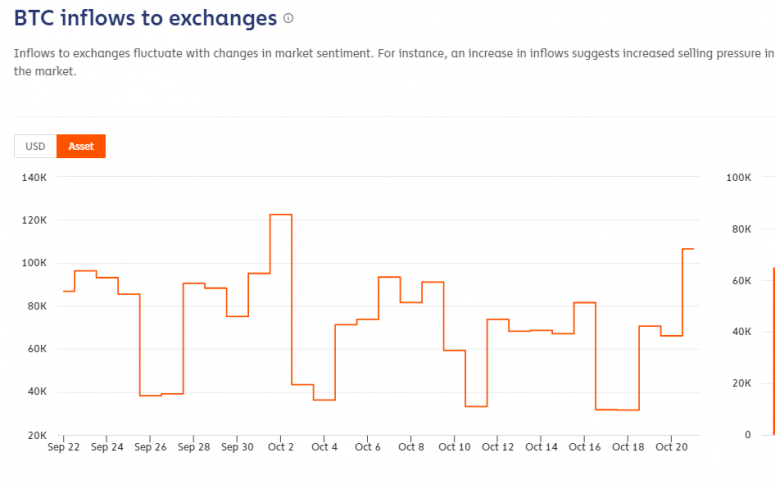

Five On-Chain Indicators Investors Should Follow: Chainalysis

Analyzing cryptocurrency markets may seem easier than traditional markets because blockchain technology has more built-in transparency, enabling anyone to analyze and audit on-chain data. Simultaneously, however, there are challenges to zeroing in on forward-looking numbers that give insights into current and future price trends. Philip Gradwell, chief economist at the blockchain intelligence firm Chainalysis, joined CryptoX earlier this week to discuss the five must-track on-chain indicators for all traders. Exchange inflows “The first indicator that I look at every day is exchange inflows,” Gradwell said. Investors typically transfer coins from their…

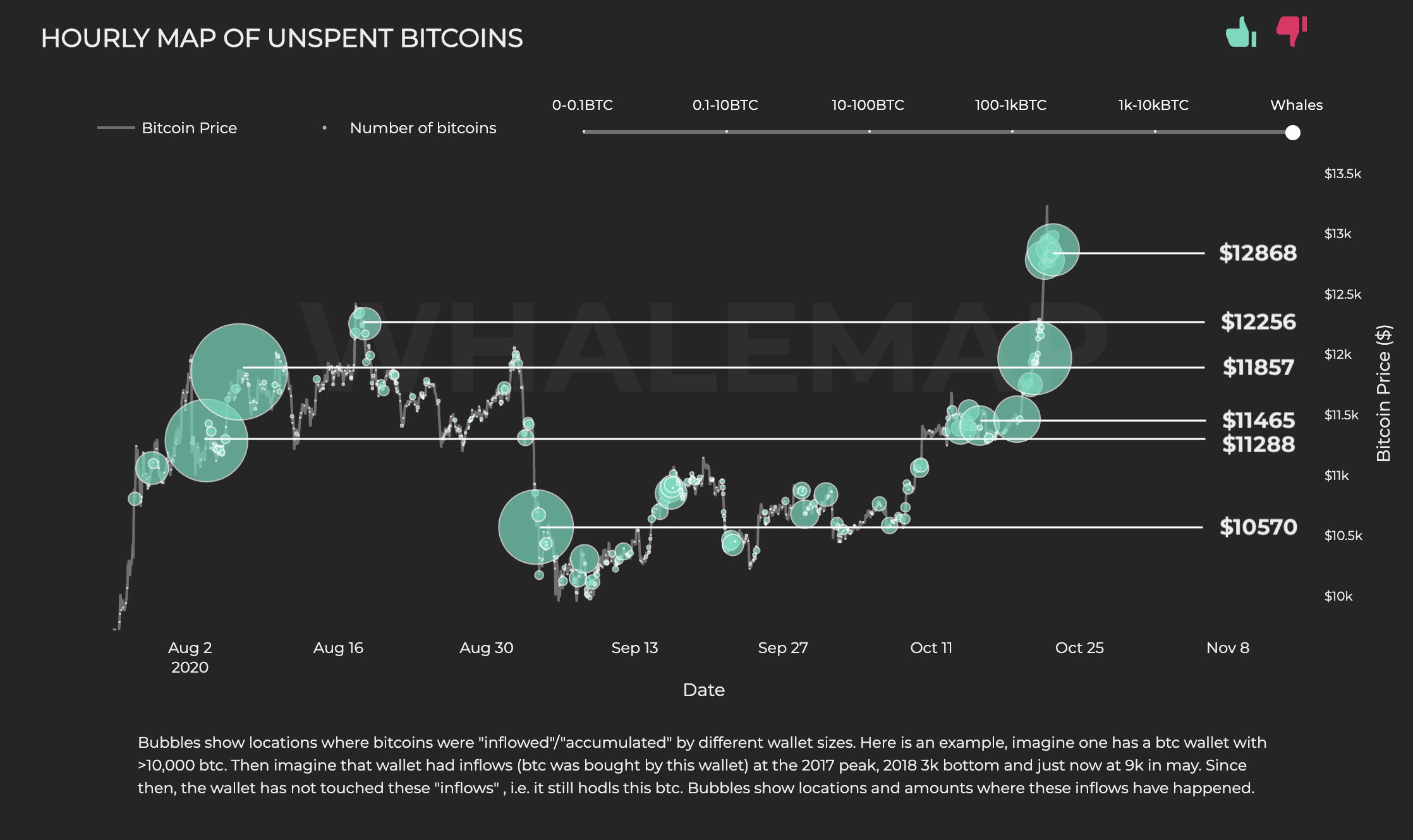

Bitcoin whale clusters pinpoint 3 key levels for BTC price rally to continue

According to Whalemap, there are three major Bitcoin (BTC) whale clusters in the near term that might serve as key technical levels. The $11,857, $12,256 and $12,868 levels would likely act as important support and resistance areas. In previous cycles, whale activity coincided with significant price movements at crucial technical levels. For instance, Cointelegraph reported that a whale sold at $12,000 after “HODLing” for years. In the next few weeks, BTC dropped to sub-$10,000. Bitcoin whale clusters. Source: Whalemap.io What are whale clusters and why are they important? Whale clusters…

Ultimate Online Trading Solution for Anyone

Tradelax offers a wide array of tools. Customers can access more than 200 financial instruments and trade stocks, commodities, currencies, and indices. Within the last 30 years, the financial industry has become the fundament of global economics. Trading futures and stocks assist organizations in creating additional sources of revenue for innovation and expansion. The development of the Internet allows anyone who has a computer to engage in trading without any limitations. However, it’s worth remembering that online trading is inevitably interconnected with certain risks, including scams, private data exposure, and…

Global Family Office Summit Takes Place Virtually With Key Highlights Including Education, Trust, and Responsibility

The Global Family Office Summit that took place via Zoom platform on October 20 brought together key players to discuss issues that high value investors are willing to address. Its primary outlined mission is to connect different disruptive tech leaders from all over the world, hence solve the world’s challenges using technology especially blockchain, cryptocurrency and artificial intelligence. Being the first time the event was held, and specifically virtually due to the ongoing coronavirus pandemic, GDA group is looking forward to many more successful events and fruitful opportunities. The GDA…

Money Reimagined: ‘They Starve’: The Ugly Side of the US’ KYC-AML Obsession

At a 2015 blockchain event, Nairobi-based bitcoin pioneer Elizabeth Rossiello answered an audience question about the impact on Somalians of a recent shutdown in remittance inflows after the U.S. government had labeled the country a “high-risk jurisdiction.” The AZA Group CEO’s answer was blunt: “They starve.” Ever since then I’ve come to see governments’ demands that banks use know-your-customer (KYC) identification models to meet anti-money laundering (AML) goals as mostly counterproductive. Listen to the Money Reimagined podcast that accompanies this newsletter. Western governments thought they were starving East African terrorist…

Voyager Digital Buys European Crypto Exchange Focused on Institutional Investors

Crypto-asset broker Voyager Digital Ltd is buying LGO Markets, a French cryptocurrency exchange focused on corporate investors. The two firms will merge under one brand, Voyager, and their two separate native tokens, VGX and LGO, will also merge. The deal grants Voyager, a Canadian Securities Exchange-listed (CSE) firm, access to the European retail market through LGO’s Virtual Asset Service Provider licence held with the French financial regulator, industry media reports. LGO will cease to concentrate on institutional investors on Oct. 31, as it simultaneously assumes the Voyager brand. To complete…

Two Strong Ethereum On-Chain Trends Suggest the Trend Is Bullish

Ethereum has undergone a strong rally over the past few days amid a Bitcoin push higher. In the past seven days, ETH has gained around 10%, pushing from the $370 region to $410 as of this article’s writing. ETH is expected to push higher as there are fundamental and on-chain trends that favor bull trends. Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Key Ethereum On-Chain Trends Bullish Ethereum is expected to move higher in the days and weeks ahead as on-chain trends remain bullish. Santiment,…