The company, granted a New York BitLicense in January 2023, had advertised free wallet storage on its website, but it charged fees that sometimes entirely emptied investors’ accounts, the investigation concluded. In an agreement with the state, Coin Cafe is paying back those harmed, including 340 investors in New York. Source

Day: May 18, 2023

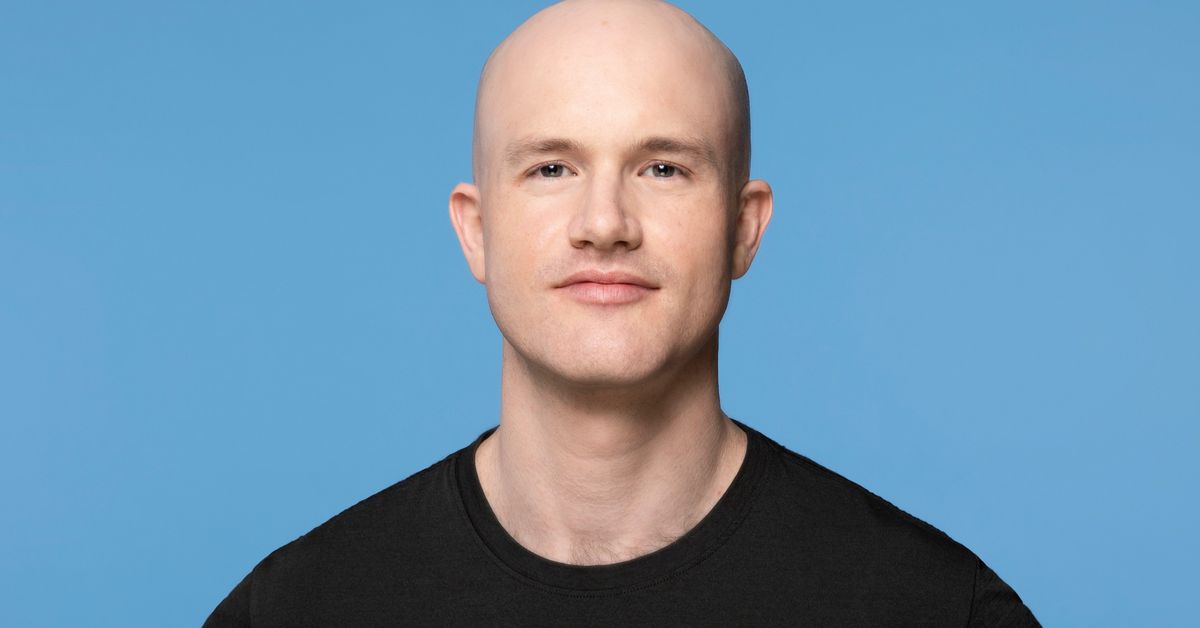

Coinbase launches zero trading fee subscription service

Cryptocurrency exchange Coinbase is set to launch its subscription service called “Coinbase One” across 35 countries. Initially, only customers in the United Kingdom, Germany and Ireland will have access to Coinbase One. According to the May 18 announcement, Coinbase One aims to provide features such as zero-fee trading, amplified staking rewards and exclusive benefits through partnerships with industry players such as Messari and CoinTracker for a monthly fee of $29.99. Furthermore, Coinbase plans to collaborate with other partners — such as Alto IRA (Individual Retirement Account), Blockworks’ Permissionless and Lemonade —…

Bitcoin Miami panel rejects ‘fight’ rhetoric against regulators

A trio of speakers in attendance at Industry Day, May 18, during the Bitcoin 2023 event in Miami held a discussion on government regulation and how the cryptocurrency industry should fight back against the “anti-crypto army.” Moderated by David Zell, cofounder of the Bitcoin Policy Institute, the panel featured Perianne Boring, Founder and CEO at Chamber of Digital Commerce, Mina Khattak, Senior director of crypto and web3 at Worldpay, and Dana Syracuse, a partner at law firm Perkins Coie. The discussion opened with Chamber of Digital Commerce’s Boring describing the…

Crypto Exchange Coinbase (COIN) Officially Opens Subscription Service, Expands Reach Outside U.S.

“In total, Coinbase One has a presence in 35 countries (predominantly in Europe) – in these other countries Coinbase One is rolling out to full availability in the coming months, and we plan to expand to additional markets internationally,” the email added. Source

Should We Worry About Tether’s Bitcoin-Buying Plan?

With the new bitcoin-buying plan, announced about a week after the attestation, Tether joins the ranks of a number of institutional behemoths hoovering up BTC. Notably, MicroStrategy, the publicly-traded tech firm that after nearly two years of dollar cost averaging now essentially trades as a backdoor bitcoin exchange-traded fund (ETF), is getting pretty close to owning about 1% of bitcoin’s total supply. Tether already holds a little over 52,000 BTC, making its bitcoin treasury among the largest among corporations, with plans to spend 15% of the “tangible gains from its…

BRC-20 tokens add triple-digit gains as PEPE, bitcoin slip

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied While PEPE is dominating headlines, the meme token is nowhere close to the performance of other BRC-20-compliant assets that have been tracking higher, posting impressive gains in the last week of trading. PEPE trails emerging BRC-20 tokens According to trackers on May 18, PEPE is down the performance leaderboard, sliding 24% in the last trading week and 15% on the previous day. At this level, the token has a market cap of $10,012,422 or 26.55 BTC and its…

Bitcoin, gold and the debt ceiling — Does something have to give?

Bitcoin (BTC) has been trying to break above the $27,500 resistance for the past week, but to no avail. One of the reasons limiting Bitcoin’s upside is the risk of an eventual U.S. default as the government struggles to get the debt limit increase approved in Congress. Still, some analysts and investors argue that the U.S. debt ceiling standoff is merely a “show” because, ultimately, additional money will hit the markets. The US Debt Ceiling talks are all show. They’re going to print the dollar into oblivion. You need to…

Senators Elizabeth Warren and Roger Marshall’s Digital Asset Anti-Money-Laundering Act Won’t Stop Money Laundering, But it Could Ban Crypto

If the Warren-Marshall legislation fails the necessary test, does it do more harm than good? After all, money laundering is terrible. Shouldn’t the legislation be passed even if it only helps on the margins? Here is where the harms of the legislation, namely requiring those that develop software and validate transactions on a blockchain to register as financial institutions, are so problematic. The problem is these individuals can’t practically register as a financial institution. The authors of this legislation know this and further know that requiring software developers and validators…

US House stablecoin hearing focuses on competing bills for regulation

State versus federal regulation was a key issue in the hearing on stablecoins in the United States House of Representatives on May 18. The House Committee on Financial Services’ new Subcommittee on Digital Assets, Financial Technology and Inclusion heard testimony from five experts as it considered two proposed bills to regulate stablecoins. There were two draft bills under consideration by the subcommittee. The Republican bill was published in April ahead of a hearing on stablecoin in the Financial Services Committee. Ranking member Maxine Waters later introduced a competing draft based…

Pakistan Announces Fresh Ban on Crypto, but Adoption as a Hedge Remains Popular

On April 30, 2023, Pakistan’s Dawn newspaper reported that banks have formally warned customers against using debit or credit cards for crypto trading. But Dawn also said that cryptocurrencies are gaining increasing popularity in the nation with the annual trading volume for Pakistan-based wallets going up to $25 billion, up from $18 billion to $20 billion a year ago, according to Zeeshan Ahmed, country general manager at Rain Financial, a Gulf-based trading platform for cryptocurrencies. Source