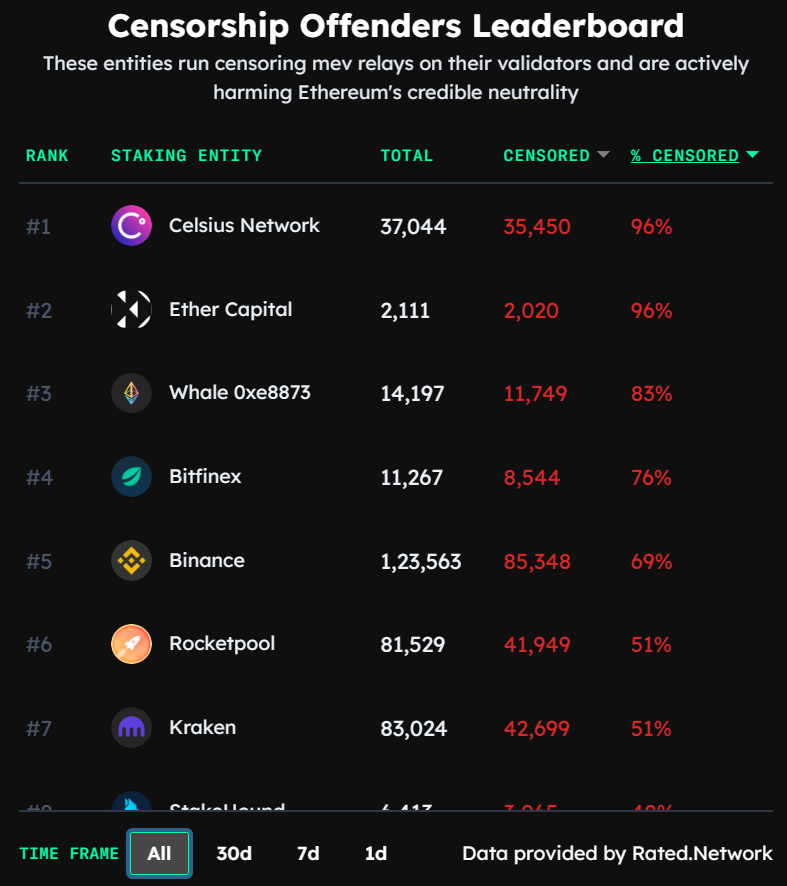

The historic Merge upgrade from Sept. 2022 — which marked Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) — resulted in the overall decline in compliance with standards laid down by the Office of Foreign Assets Control (OFAC). Ethereum blocks adhering to OFAC compliance censor certain transactions, which has a negative impact on the neutrality of the Ethereum ecosystem. In early August 2022, OFAC sanctioned Tornado Cash and several Ethereum (ETH) addresses associated with it due to its ability to mask and anonymize transactions. Prior to the Merge upgrade, Ethereum’s…

Month: September 2023

Bitcoin's Implied Volatility Gauge Tops Ether for Record 20 Straight Days

The spread between dominant crypto options exchange Deribit’s forward-looking 30-day implied volatility index for ether (ETH DVOL) and bitcoin (BTC DVOL) has been consistently negative since Sept. 7. Original

Early Rejection Of 21Shares Spot Bitcoin ETF Sparks Concerns

The US Securities and Exchange Commission’s (SEC) early delay of the ARK 21Shares Spot Bitcoin ETF application has raised concerns in the crypto community about what this move might mean for the potential launch of any Spot Bitcoin ETF this year. No Spot Bitcoin ETF This Year? In a tweet shared on his X (formerly Twitter) platform, Bloomberg Analyst James Seyffart questioned the SEC’s latest decision and whether or not it “may put the hammer down for any hopes of an ETF approval this year.” He further quizzed whether this…

Circle and SDF Launch EURC on Stellar Network to Enhance European Remittance Network

As with USDC, the EURC on the Stellar network is redeemable at a ratio of 1:1 to the backing fiat currency at any time of the day and week. Leading stablecoin issuer, Circle Internet Financial LLC, and the Stellar Development Foundation (SDF) announced the launch of EURC on the Stellar network. The EURC stablecoins now run on three layer one (L1) blockchains including Ethereum (ETH), Avalanche (AVAX), and now Stellar (XLM) network. As a result, DeFi and Dapps developers on the three chains can build financial ecosystems that tap into…

Hollywood Studios Can Use Writers’ Creations to Train AI Models Under New Tentative Deal

Last month, the AMPTP published a proposal containing guidelines for AI use. Among other things, the proposal sought to address actors’ and writers’ concerns about data transparency and the use of artificial intelligence. Hollywood studios may be able to legally train artificial intelligence (AI) models using works from human writers, according to a tentative labor deal reported by the Wall Street Journal (WSJ). Citing people familiar with the case, the WSJ reports that the deal includes a victory for writers as they must be paid and credited for any work done whether or not…

Ramp partners with MetaMask to enhance web3

Ramp, a fintech company focused on connecting crypto with traditional finance, has partnered with MetaMask, a popular non-custodial wallet, to integrate its on-ramp services on the wallet’s mobile application. ConsenSys, a Ethereum-focused technology company, is the developer of MetaMask. Ramp join forces with MetaMask Ramp is designed to bridge the gap between traditional fiat and crypto spaces, allowing users to transition between the two. Ramp’s partnership with MetaMask aims to give over 100 million MetaMask users across 150 countries full access to Ramp’s utility. During the initial integration, Ramp’s services…

US SEC Postpones Decision on ARK 21Shares Spot Bitcoin ETF to January 2024

The SEC has now postponed decisions on several spot BTC ETF applications, including ARK 21Shares, Valkyrie, WisdomTree, VanEck, and Bitwise. The United States Securities and Exchange Commission (SEC) has officially delayed making a decision on a spot Bitcoin exchange-traded fund (ETF) proposal from ARK 21Shares. The Commission seems to be exploiting the maximum time required to make a decision and had given itself an additional 60 days. The SEC published a notice stating that it needed more time to either approve or reject the ARK 21Shares application proposed for listing on the…

6th Swiss bank joins SDX crypto exchange

Hypothekarbank Lenzburg, a regional Swiss bank with over $7 billion in assets, has become the sixth Swiss bank to join Six Digital Exchange (SDX). According to the press release from Sept. 27, Hypothekarbank Lenzburg joins Berner Kantonalbank, Credit Suisse, Kaiser Partner Privatbank, UBS and Zürcher Kantonalbank. All the companies are from Switzerland, and SDX’s company, Six Group, is headquartered in Zurich. Related: How big is Bitcoin in Lugano? Decentralize with Cointelegraph goes to BTC school As specified in the release, by joining the SDX’s central securities depository, Hypothekarbank Lenzburg will…

Will Bitcoin price hold $26K ahead of monthly $3B BTC options expiry?

The upcoming $3 billion in Bitcoin (BTC) monthly options expiration on Sept. 29 could prove pivotal for the $26,000 support level. BTC price faces serious headwinds On one side, Bitcoin’s recognition in China appears to be strengthening, following a judicial report from a Shanghai Court that acknowledged digital currencies as unique and non-replicable. Conversely, Bitcoin’s spot exchange trading volumes have dwindled to a five-year low, according to on-chain analytics firm CryptoQuant. Analyst Cauê Oliveira pointed out that a significant factor behind this decline in trading activity is the growing fear surrounding the…

BONE Prices Surges as Developers Beef up Security

In crypto circles, renouncing a smart contract means that the contract’s creator will no longer have control over it – giving investors a sense of security as the contract can no longer be changed or updated, and is hence saved from possible manipulation by the contract creator. Source