Developers of THORChain have unveiled a community proposal to burn around $300 million worth of RUNE tokens to boost lending activity. In a community proposal published on Jan. 30, the THORChain developers suggested burning 60 million RUNE tokens (worth around $300 million as of press time) from the Standby Reserve fund, representing a 12% of the max supply of RUNE. The move, according to the initiative’s description, is set to make room for more loans on THORChain. “By burning ~$300 million in RUNE from standby, it means THORChain can onboard…

Day: January 31, 2024

UK Opposition Party Wants Country to Be a Securities Tokenization Hub and Advance Work on CBDC

“Labour recognises the growing case for a state-backed digital pound to protect the integrity and sovereignty of the Bank of England, and the U.K.’s financial and monetary system,” the party said. “Labour fully supports the Bank of England’s work in this area, and wants to ensure that issues such as threats to privacy, financial inclusion and stability are effectively mitigated in the design of a central bank digital currency.” Source

UK Police Seize Nearly $1.8B of Bitcoin (BTC) From Investment Fraud in China: FT

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

New York Community Bancorp Shares Tumble After Earnings Miss, 71% Dividend Cut

The bank took over defunct Signature Bank’s non crypto-related deposits last year. Source

Analyst Compared Solana To Ethereum ICO Boom, What Does This Mean For SOL Price?

Crypto analyst Santiago Santos recently drew parallels between the Solana and Ethereum networks. As part of his analysis, Santos suggested that Solana had an advantage over Ethereum, something which he believes could cause the former to catch up with the latter soon enough. Solana’s Recent Run Similar To Ethereum’s ICO Boom Santos mentioned in an X (formerly Twitter) post that Solana is “going through what Ethereum did during the ICO boom.” However, unlike then, when it was only whitepapers, Solana has applications seeing meaningful usage and growth, the analyst further…

Inside the 'Private Mempools' Where Ethereum Traders Hide From Front-Running Bots

These private mempools – where blockchain transactions avoid the eyes of front-running bots – promise to offer better settlement and lower fees to Ethereum users, but experts are sounding the alarm bell on some big risks. Source

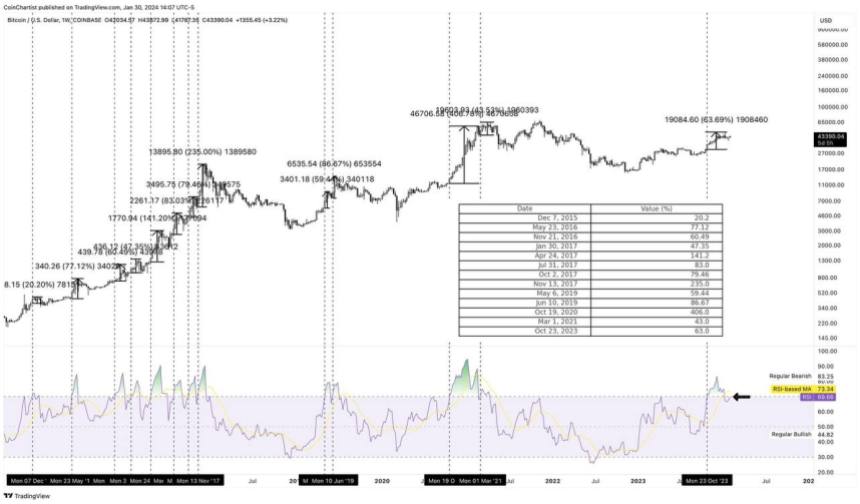

Why “Overbought” Bitcoin Could Trigger A 107% Rally

Bitcoin price had previously been showing extreme strength leading up until the debut of the first spot ETFs. That strength has since subsided, leading to a 20% correction in BTCUSD. A popular technical indicator that measures momentum, however, could point to powerful continuation to the upside, but only if a certain level is breached. Keep reading to learn more about the Relative Strength Index and how the top cryptocurrency behaves once the market reaches an “overbought” level. Bitcoin Approaches “Overbought” And Why This Isn’t A Bad Thing The Relative Strength…

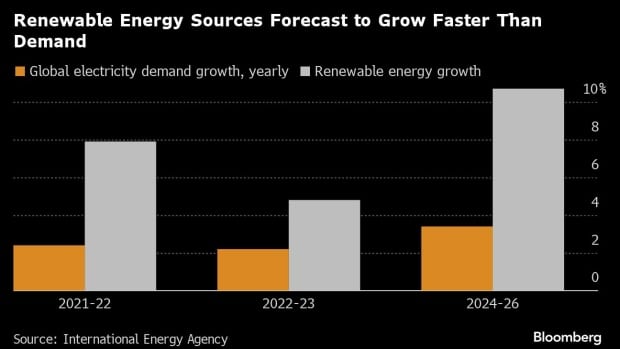

Electricity demand to double in 3 years. How AI and mining play a part

Electricity demand worldwide could double over the next three years, mainly due to cryptocurrency mining and artificial intelligence. How will crypto keep up? AI and cryptocurrencies accounted for almost 2% of global electricity demand in 2022, which illustrates the scale of their energy impact. This increase is mainly due to the growing complexity and volume of computing operations for artificial intelligence and the ever-increasing number of cryptographic transactions. According to a recent report from Bloomberg, which cites the International Energy Agency, global demand for electricity from data centers, cryptocurrencies, and…

Ripple's XRP Drops 5% After Executive Is Hacked, Sparking Rumors of Network Breach

Blockchain analyst ZachXBT claims 213 million XRP tokens were stolen before being laundered across multiple exchanges. Source

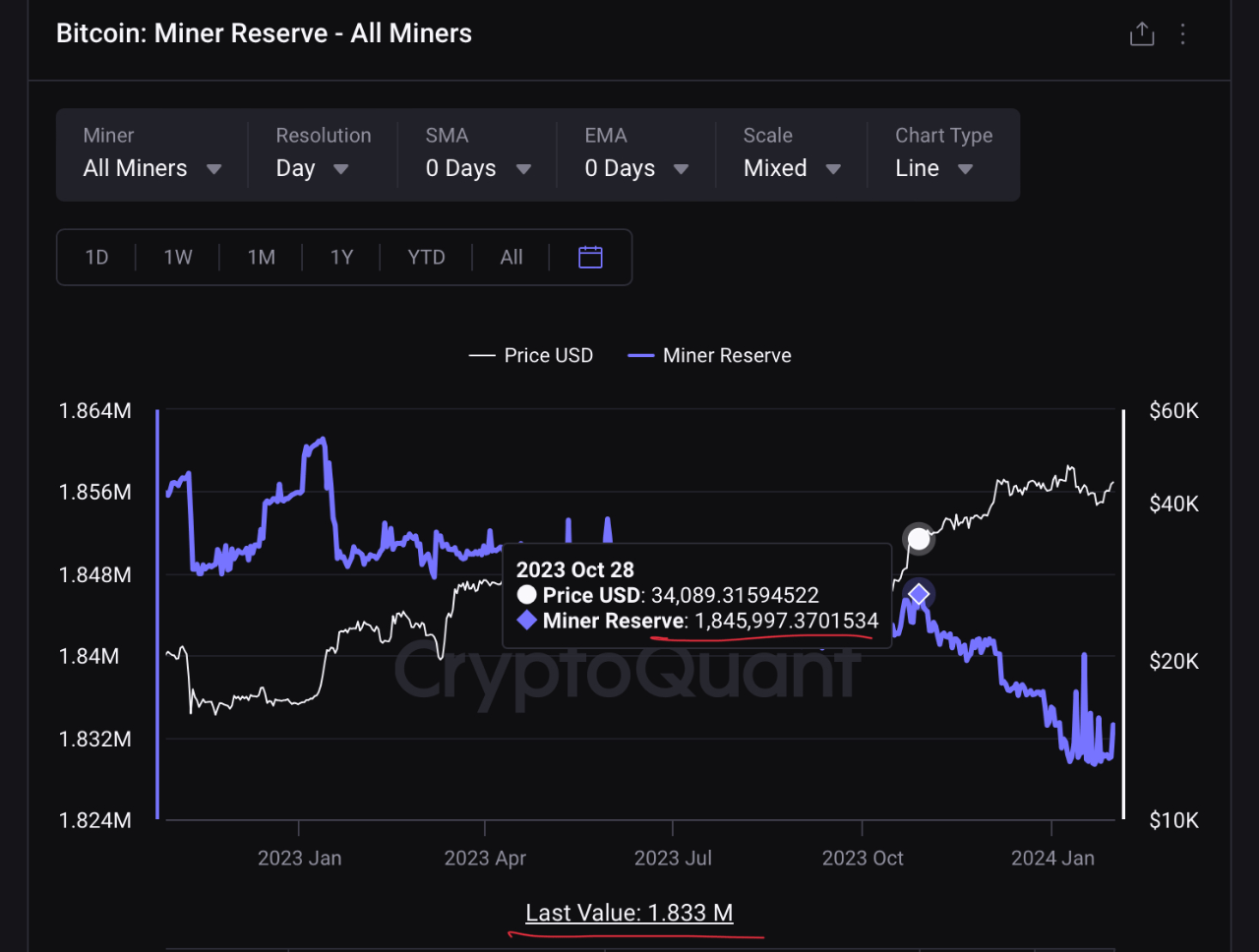

Bitcoin Miner Selloff Poses “Negligible Impact”, Quant Argues

On-chain data shows the Bitcoin miners have been selling recently, but this quant has argued that this selloff shouldn’t have much impact on the market. Bitcoin Miner Reserve Has Registered A Decline Recently In a CryptoQuant Quicktake post, an analyst discussed the latest selling pressure that the miners have been putting on the market. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin that the miners combined hold in their wallets right now. This metric can naturally provide information about the…