The price of Bitcoin (BTC) fell below $13,000 on Oct. 28 shortly after hitting $13,850 at the day’s peak. Despite the 7% drop in 11 hours, however, the market sentiment remains positive for three key reasons.

First, Bitcoin is still at where it was on Oct. 27, merely 24 hours ago. Second, BTC rose to $13,850, right below a multi-year resistance area at $13,873. Third, a marketwide drop was expected due to declining stablecoin inflows into exchanges.

Bitcoin drops to where it was yesterday

In the last two days, the price of Bitcoin rallied 8.5% from $13,783 to $13,850 on Coinbase. The move came after a month-long uptrend during which BTC rose from around $10,200 to $13,850.

Now, on high time frame charts, like the daily chart, for example, BTC price is hovering above a key short-term moving average.

The recent pattern of Bitcoin following up each uptrend with a consolidation phase makes the ongoing rally sustainable.

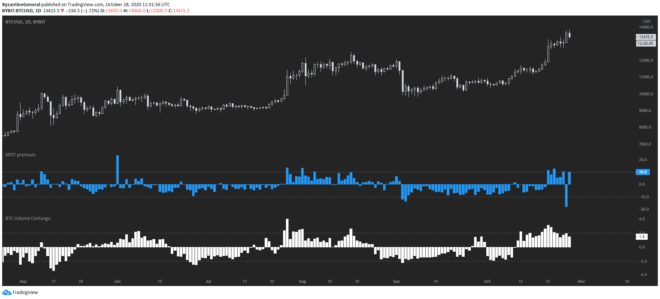

The strength of the spot market over the derivatives market also indicates that the uptrend is strong and healthy. A pseudonymous trader known as “Byzantine General” said:

“A higher spot price & higher spot volume (relatively speaking) is considered bullish because it means that the rally is based on actual buying instead of degenerates gambling on derivatives.”

The $13,873 level is a multi-year resistance area

Bitcoin peaked at around $13,900 in July 2019 across major exchanges. As Cointelegraph reported, many traders pinpointed the $13,875 level as the pivotal resistance area in the short term partially for this reason.

If BTC had continuously risen beyond $13,875 without any pullback, it would have caused the rally to become massively overheated. In the medium term, that would have raised the probability of deep pullback, or as some on-chain analysts call it, a “hell candle.”

BTC decline coincided with lack of stablecoin inflows

Prior to the short-term correction of Bitcoin, CryptoQuant CEO Ki-Young Ju warned that stablecoin inflows into exchanges were declining.

The inflow of stablecoins is an accurate metric to gauge buyer demand because stablecoins, like Tether, account for a large portion of the cryptocurrency market’s volume.

According to CoinMarketCap, the daily volume of Tether exceeds $59 billion across major exchanges. Purely in terms of daily volume, Tether is the most-traded cryptocurrency in the global market. A few hours before the BTC drop occurred, Ju tweeted:

“Fewer people are depositing #stablecoins to exchanges. BTC Buying power is weakening in the short-term(72h).”

The drop in stablecoin inflows might have triggered a sharp Bitcoin pullback because buyers and sellers were intensely battling over the past week. Some miners and whales were selling, while new inflows continuously offsetted the selling pressure.