- Tesla has recovered by as much as 7% in pre-market trading, after it suffered a 21% fall yesterday.

- The rally is likely a dead cat bounce, as day traders seek to profit and short-sellers close positions.

- With the wider market struggling, and Tesla still being overpriced, the company’s stock will fall further.

Tesla stock has climbed by 7% in early trading, after recording its biggest ever one-day loss on Tuesday. The company’s stock declined by 21.06% at close yesterday, as market fallout from its non-listing on the S&P 500 gained momentum.

Tesla bulls may be comforted by today’s pre-market rally, but it’s just as likely a dead cat bounce as a sign of a sustained recovery. The same issues that have dragged Tesla down since August 31 persist today, and with the wider stock market entering a bearish period, Tesla is likely to be pulled down further.

Tesla Stock Climbs 7% After Falling 21%

Tesla closed yesterday at $330, capping a 33.7% dive from a peak of $498 on August 31.

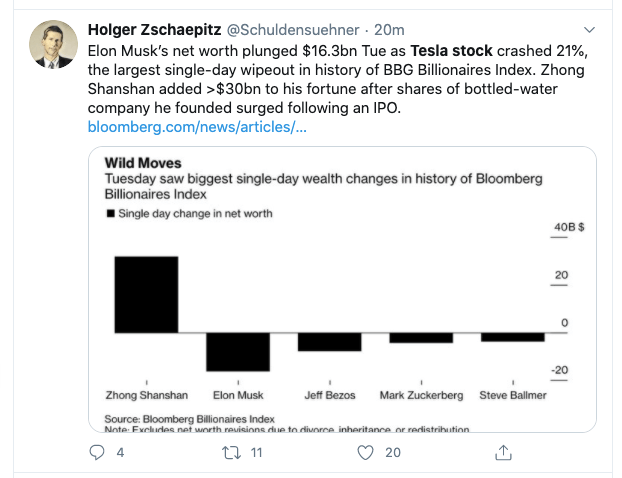

This was a disaster for a company that had enjoyed a 495% surge between January and the end of August. It was also a disaster for Elon Musk, whose net worth fell by $16.3 billion, the biggest one-day loss in the history of BBG Billionaires Index.

Believers in carmaker may be heartened by the fact that it’s currently 7% up in pre-market trading, at $353.

This is most likely a dead cat bounce, with Tesla likely to fall further amid a general decline in the U.S. stock market.

The first indicator of this is that the 7% upswing falls far short of matching yesterday’s 21% downswing. This bears all the hallmarks of a dead cat bounce: short-term traders may be attempting to create and benefit from a brief rally, which will end as soon as they take their profits.

It’s also likely that the 7% jump is partly the result of traders closing out short positions. Recall that Tesla is one of the most shorted stocks in the market, so yesterday’s 21% plunge may have prompted many short sellers to close. This means they effectively buy Tesla stock, which can obviously pump prices.

Worst Yet To Come

While such factors are enough to push Tesla up by 7% in early trading, they aren’t enough to prevent the stock from continuing its downward spiral.

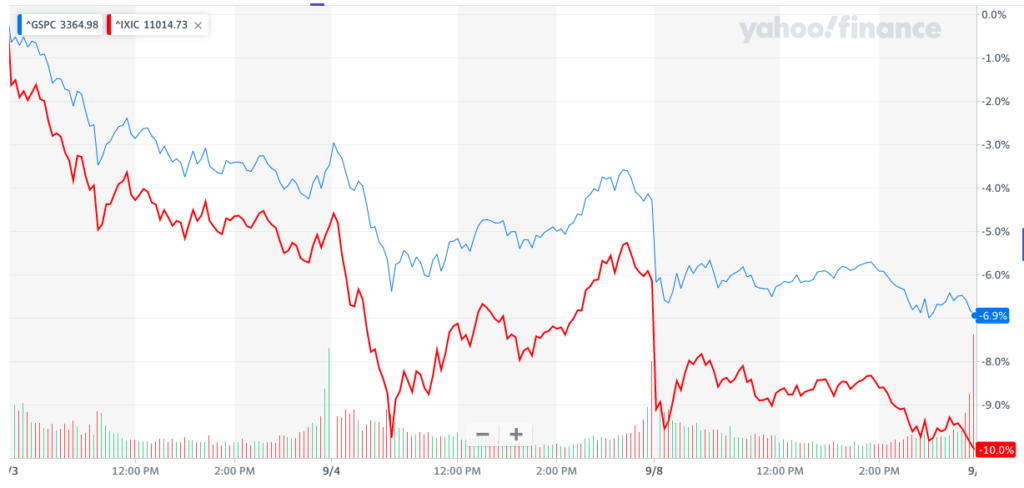

The NASDAQ and S&P 500 have declined by 10% and 6.9% over the past five days. Investors are losing confidence, and with coronavirus vaccine trials being suspended due to possible adverse reactions, they may be spooked even further in coming days. There’s also the ongoing negative economic data, which suggests that the U.S. “recovery” is going to be slow and painful.

Then there’s the simple fact that Tesla was (and still is) overpriced under any estimation of how successful it will be in the future. It can’t justify its price, particularly when other car manufacturers are catching up with its EV game.

This is all indicates that today’s small rally is a dead cat bounce. And as with every other bouncing dead cat, Tesla will fall again.

Disclaimer: The author holds no positions in the securities mentioned in this article.