Historically, stimulus checks have been pumping the cryptocurrency market. Let us see if we see another round of bullish marathons this time. Today’s picks are AAVE, LINK and ETH.

There was a theory that whenever the US Stimulus bill was accepted, the cryptocurrency market will skyrocket and the signing of the Bill by President Biden will establish a new bullish cycle. Yesterday, March 6, the Senate approved the $1.9 trillion bill, on Tuesday the House Democrats are expected to pass the bill and President Biden is expected to sign the bill this coming week.

AAVE

As for the announcements and updates, Aave has partnered with a Lichtenstein-based crypto wallet and exchange Nash to integrate DeFi earning products by Aave and Aave token will be available to trade on Nash. As Nash currently supports Circle’s digital USD, it is assumed that the first tradeable pair will be AAVE/USDC, whereas adding other pairs such as AAVE/ETH is expected as well. The total value of AAVE locked in DeFi has significantly increased in the past 24 hour, adding 7.4% in USD, making $4.984B in total value locked.

Photo: TradingView

AAVE/USD shows strength by breaking out of the descending parallel channel. The best price action for the pair would be the test of the dynamic resistance (the upper edge of the channel) as support and continue upwards to test resistances at $495 and $594 above that.

LINK

Chainlink has partnered with yet another DeFi protocol Swingby. Swingby will use Chainlink to match prices in its inter-chain swaps. Chainlink is moving to FX now with expanding its oracle network to support price data of non-crypto currencies with the launch of EUR/USD. As the company declared on their blog, the FX EUR/USD pair is already used by derivatives protocol Synthetix. While exchanges pull data from FX liquidity providers to offer FX pairs on their trading terminal, Chainlink brings the most accurate FX data into DeFi and blockchain. The accuracy of the data is provided by the many oracles which aggregate the price and the network accepts the most accurate among all Oracles.

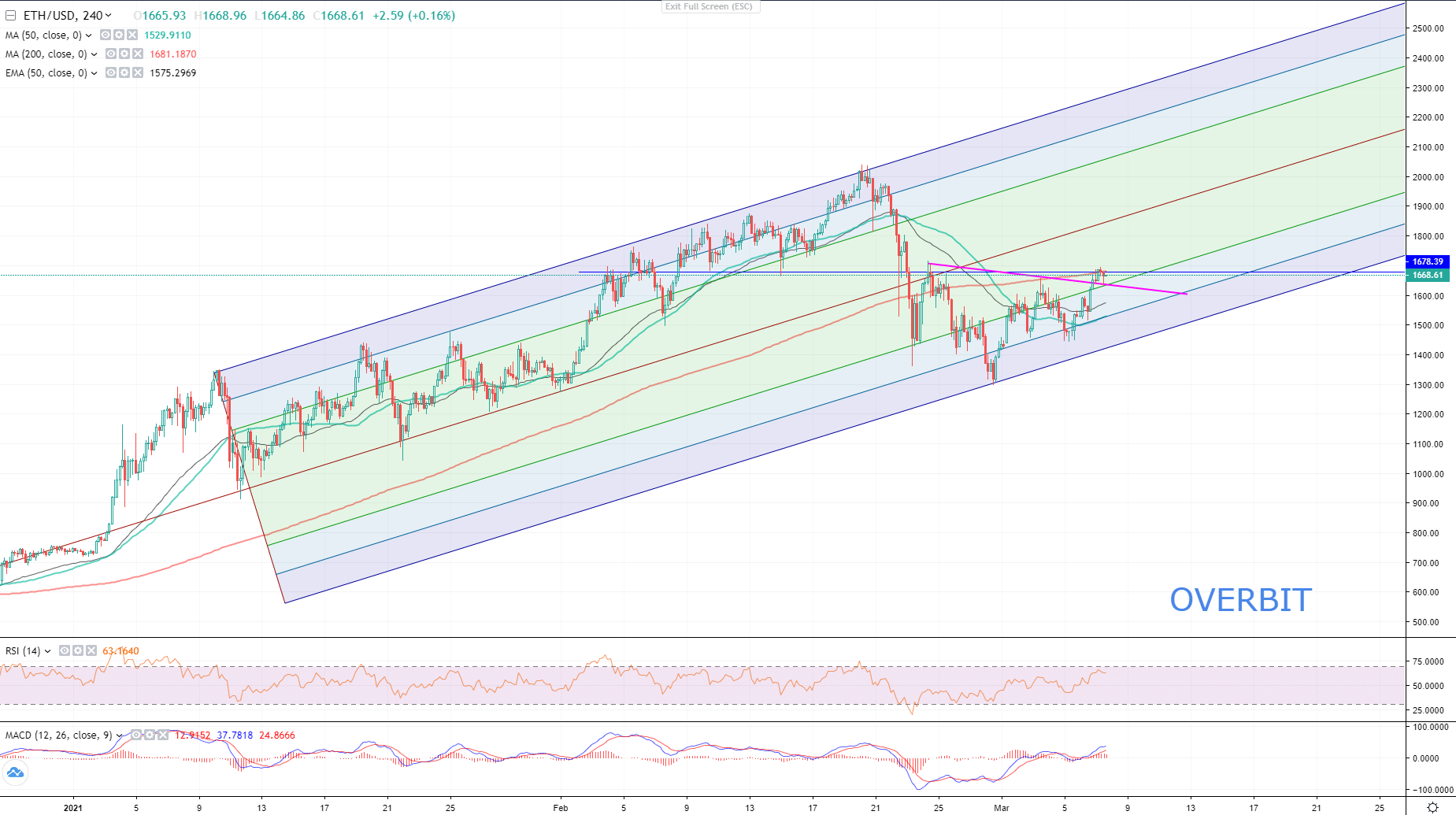

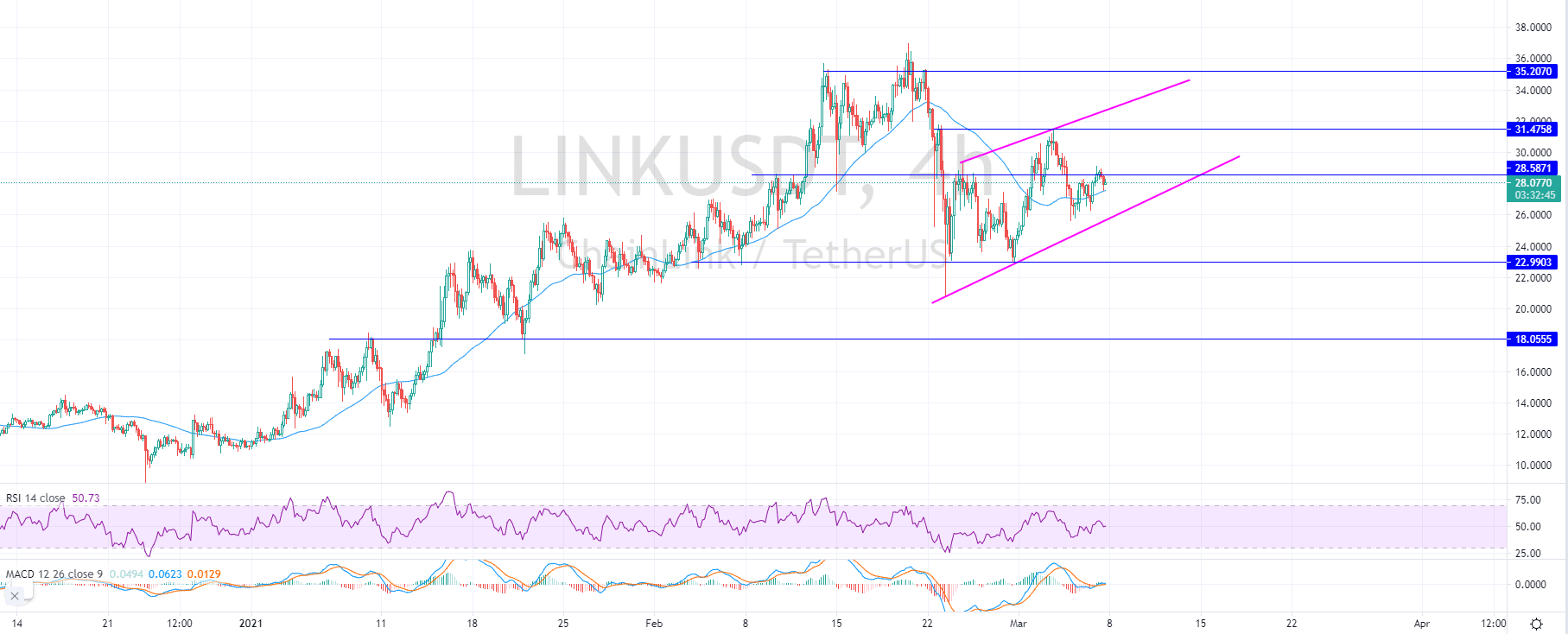

Photo: TradingView

LINK/USD stays above the dynamic support of the ascending channel and above the 50MA on a 4-Hour chart. The further advancement of the price was stopped by a strong resistance at $28.600, breaking of which will lead to a jump towards $31.4700 and $33.000. It is highly recommended to watch for the touching of the upper edge of the ascending channel by LINK/USD at any point, as there is a strong resistance.

ETH

Ethereum was one of the coins to highly cheer the Stimulus bill by adding 8.38% to its value yesterday. This week Ethereum hit another record with the total ETH locked in DeFi on March 5 reached $8.876B, helping ethereum price to jump after a decline of the price.

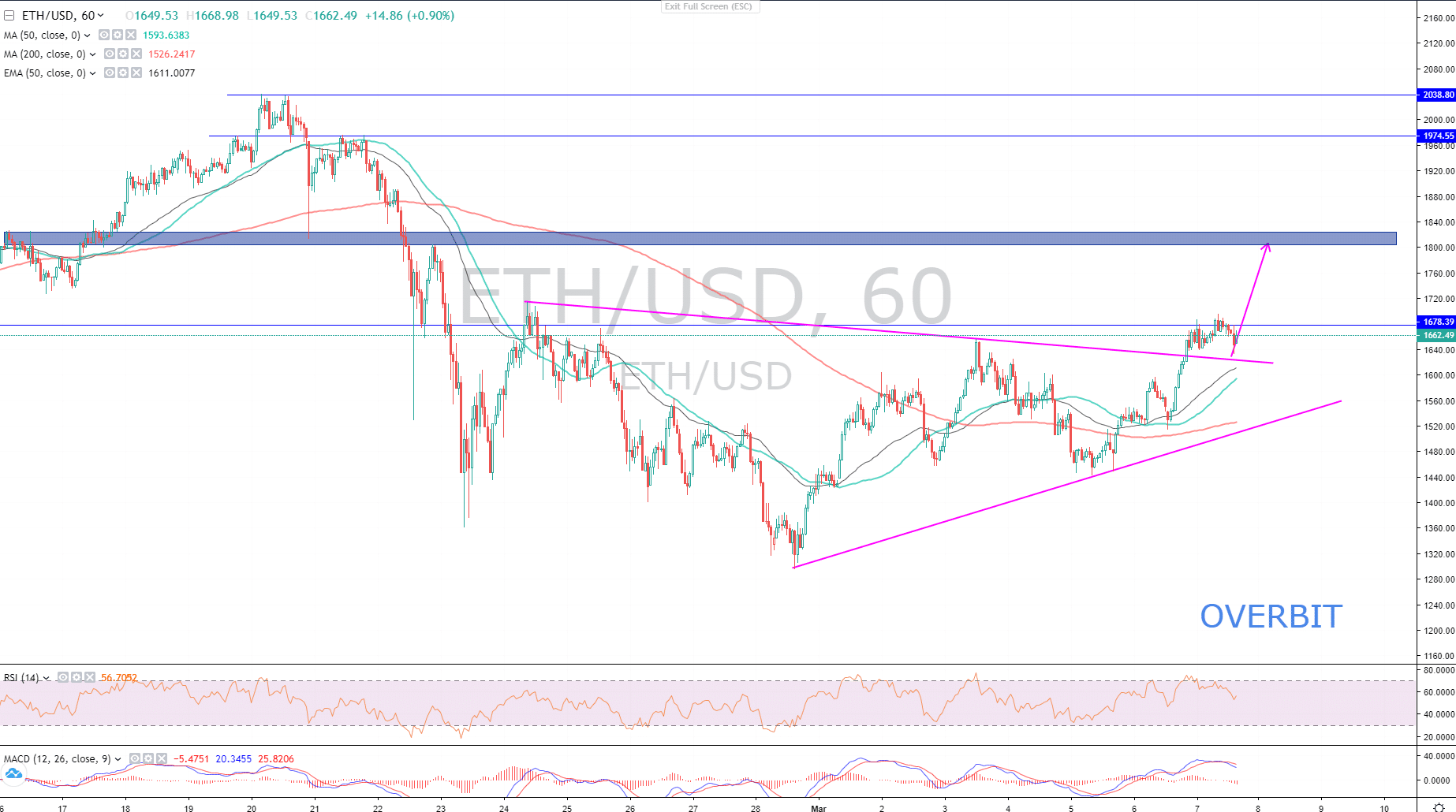

ETH/USD has made a significant advancement into turning it’s bearish sentiment to bullish by closing above the dynamic resistance of February 24. The same dynamic resistance also acts as a neckline of the inverted Head and Shoulders formation.

An hourly ETH/USD chart clearly demonstrates that Ethereum is on a bull phase. The pair has completed a breakout from the triangle, the move which supported the breakout is impulsive, the price retested the dynamic resistance as support. There is one obstacle to overleap at $1680 and Eth can advance upwards to test another strong resistance area laid at $1805 – $1825 area.

Senior Vice President at Overbit. Technical analyst, crypto-enthusiast, ex-VP at TradingView, medium and long-term trader, trades and analyses FX, Crypto and Commodities markets.