Decentralized finance (DeFi) has been grabbing the headlines and capturing the imagination of traders in recent weeks and some of the biggest centralized cryptocurrency exchanges seem to be afraid they’re missing out.

That’s why they are now trying to reposition themselves as integral parts of this exploding sector, particularly as traders in China grow more interested in DeFi.

Huobi announced Tuesday it was adding 10 more members to its DeFi initiative, described as “a consortium of centralized and decentralized financial services providers.”

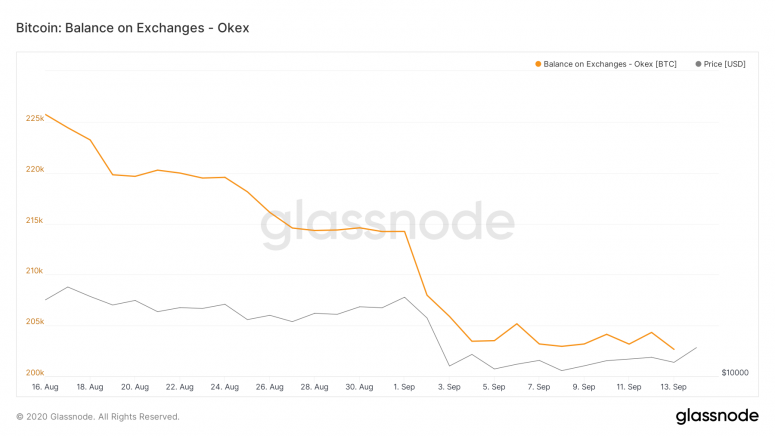

Archrival OKEx, which launched its OKxChain blockchain earlier this year, boasted Monday that with its latest upgrade the network is the most decentralized public chain powered by exchanges.

Binance, the world’s largest cryptocurrency exchange by trading volume, last week announced a new integration of its centralized platform, Binance.com, and its decentralized public blockchain, Binance Smart Chain (BSC). There’s a $100 million fund to encourage developers to build DeFi projects on BSC after the company’s last take on DeFi, Binance Dex – a decentralized exchange launched a year and a half ago – generated little traction.

Centralized exchanges’ aggressive moves into the rapidly growing DeFi space suggest decentralization may be their inevitable path for survival in a crypto trading landscape where decentralized exchanges (DEX) are stealing greater market share.

Centralized exchanges (CEX) are connected to blockchain networks but use their own computers to match cryptocurrency traders’ buy or sell orders. When one buys and holds a cryptocurrency on a CEX, the coin is often in a centralized address by the exchange. All that happens is a ledger balance change at the exchange itself. “Not your keys, not your coins” is a refrain often used to warn that anyone buying from an exchange isn’t in control so long as he or she doesn’t also have the private keys. Those who traded on Mt. Gox in 2014 learned that lesson the hard way when the exchange collapsed and hundreds of thousands of bitcoins went missing from its hot wallet.

Compared to a centralized exchange, a DEX, in theory, gives more freedom to its users. Decentralized exchanges are usually constructed atop blockchain networks. Automated market makers (AMMs) enable trades to be executed automatically through smart contracts without relying on a third party such as a centralized exchange. Traders also have the full control of their funds and their crypto. They are not required to go through any know-your-customer (KYC) verifications.

While both decentralized and centralized exchanges have been around since the early days of bitcoin itself, centralized exchanges dominated trading and mostly competed against each other. With the sudden boom in DeFi, DEXs are growing faster than their centralized counterparts.

The recent phenomenon of “yield farming” – where users get token rewards for participating in DeFi systems – has made it easier for traders to maximize returns, as CryptoX reported previously.

When Uniswap, a semi-automated platform where traders can buy and sell cryptocurrencies and other digital assets, surpassed CEX Coinbase Pro to become the largest U.S.-based cryptocurrency exchange by daily trading volume at the beginning of September, the DEX platform also saw a more than ten-fold gain on its trading volume over the previous month.

In August alone, DEXs represented 5% of total crypto exchange volumes, as AMMs like Uniswap, Curve and Balancer accounted for over 90% of total DEX volume, according to a Sept. 14 report by the cryptocurrency-analysis firm Messari.

China in play?

Binance, OKEx, and Huobi, the three centralized exchanges making some of the biggest splashes in DeFi, are also among the most popular exchanges with Chinese users, with deep roots in China, where interest in DeFi has been on an upswing.

The first steps of the Huobi-backed Global DeFi Alliance, according to a press statement by Sharlyn Wu, chief investment officer at Huobi, will be to host a series of events that will help “educate Asian users of various DeFi protocols.”

“These will be opportunities for Alliance members to collaborate with other branches within the Huobi ecosystem to bootstrap use interest in Asia,” Wu said.

Huobi’s DeFi initiative has included some of the biggest DeFi players including Compound, Curve, Aave, Balancer, and Maker Foundation.

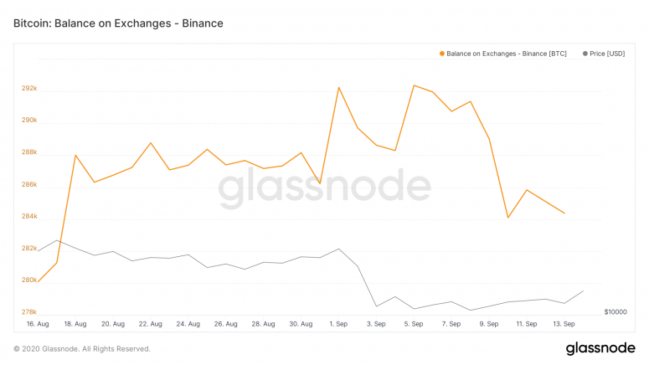

There is also a so-called “withdrawal movement” in China, according to a tweet by Dovey Wan, a partner at crypto asset investment fund Primitive Ventures and an adviser to CryptoX. She said users are withdrawing their crypto assets from centralized exchanges and transferring them to lucrative yield farming on DeFi.

According to Simons Chen, executive director of investment and trading crypto finance institution Babel Finance, based in Hong Kong, investors in China were cautious in the early boom of DeFi, during what he called its “first wave.” Many were burned in the initial coin offering (ICO) mania in 2017. But with the drama of SushiSwap ending DeFi’s first wave, investors recognize the potential of the space and are now rushing to join what they perceive as “the second wave” of DeFi, Chen told CryptoX in a phone interview.

Other than the high returns from yield farming, Chen said Chinese investors also enjoy another advantage of DeFi: having control of their own funds, which reduces the risks of exchanges’ exit scams.

“It’s a lot of pressure for centralized exchanges,” Chen said, recognizing the recent withdrawal trend among cryptocurrency holders in China.

Chen explained that centralized exchanges have huge exposure to margin trading, which allows traders to leverage their positions with borrowed funds. Should more assets leave for DeFi, the centralized exchanges could be left in the lurch.

CEX DeFi FOMO

DEXs have some advantages, even for the centralized exchanges trying to run one on the side.

“It’s always better to disrupt yourself than having somebody else disrupt you first,” said Changpeng Zhao, CEO of Binance, during his company’s recent World of DeFi summit.

He noted the cost of running a decentralized exchange is much cheaper for a company and, therefore, users usually pay less fee to trade on the decentralized platforms. He said he is anticipating Binance Smart Chain, the Ethereum-compatible DEX, will supplement the centralized exchange.

“On the Binance Smart Chain, there are already a number of really interesting projects leveraging automated market makers and DEXs. And on the smart chain, the DEXes, the AMMs will also provide liquidity for Binance’s orderbook,” he said.

While that may appear promising, some argue this is just Binance’s latest effort to keep up with DeFi after the exchange’s initial efforts failed to gain traction.

Jay Hao, CEO of OKEx, also acknowledged the success of DeFi and the eagerness of his exchange to be part of that success.

“One of OKEx’s core missions is to act as a bridge between high-quality DeFi products and the wider user group,” Jay Hao, CEO of OKEx said in an email response to CryptoX. “It’s impossible to ignore the compelling promise of DeFi and we are firm believers that it will succeed.”

The latest version of OKEx’s public chain is said to have higher transactions per second than the Ethereum network, according to the Malta-based exchange’s news release on Sept. 14. The chain is also designed to be compatible with Ethereum.

That could be a smart move, according to Three Arrows Capital CEO Su Zhu. With Ethereum’s soaring transaction fees and network congestion, potential demand for non-Ethereum DeFi could be the next big market trend, he said to CryptoX via a Telegram message.

What CEXs can get

Centralized exchanges face a dilemma growing their own DEXs and getting involved with DeFi: They can cannibalize their own businesses or they can indirectly prove these DEXs at their core are not truly decentralized. After all, the exchanges are for-profit businesses and not philanthropic foundations.

“As DeFi continues to grow, the centralized exchanges will end up acting like a white label,” Three Arrows Capital’s Zhu said. “Centralized exchanges (would be) a gateway to DeFi, but not where users ultimately spend their time.”

When asked to describe the relationship between OKEx and DeFi and how they could work together despite fundamental differences, OKEx’s Hao said that even if DEXs eventually prove they are the future, CEXs will also be part of that future.

“It is our belief at OKEx that DeFi will help us achieve the goal of ‘FinanceAll,’” Hao said. “As we believe there will always be room for traditional financial services, there will always be a need for centralized exchanges like ours.”

Binance’s Zhao, meanwhile, offered an answer of how his company can survive in a truly decentralized business model: its native token BNB.

“I will be really happy on the day when decentralized exchanges replace centralized exchanges and I think that will push our overall mission forward,” he said during his company’s recent virtual summit. “When that happens, our centralized entity may not be worth much less but BNB will be worth much more. So we don’t lose that much.”

Yet, that will require these centralized exchanges to give over control of their operations to the token holders, according to Zhu, in order for their native tokens to become “fully DeFi.”

Babel Finance’s Chen compared the CEXs’ take on DeFi with oil companies buying natural gas companies’ stocks when natural gas first challenged their dominance in the energy sector. The centralized exchanges are in the similar mindset as those oil giants: If DeFi and DEXes replace centralized exchanges, centralized exchanges would still be able to catch some part of that market share, Chen said.

Then again, that depends on whether DeFi survives the current high-risk and high-return craze. For the time being, if not longer, centralized exchanges will still likely dominate the crypto trading market.

“I know for sure most of the DeFi projects will fail. It’s just a matter of fact,” Zhao said. “(But) I don’t think DeFi will fail as an industry. A small number of projects will be hugely successful in the future.”