Bitcoin (BTC) is displaying fresh bull run signals as BTC price strength produces 7% daily gains.

BTC price bounces after snap sell-off

Data from Cointelegraph Markets Pro and TradingView hints that upside momentum may continue as on-chain metrics reset.

Bitcoin “needed to cool off” after hitting $44,000 this month, analysis believes, and after a trip to near $40,000, conditions are improving.

In a post on X (formerly Twitter) on Dec. 13, Philip Swift, creator of statistics resource Look Into Bitcoin, showed profit-taking surging as BTC/USD hit its latest 19-month highs.

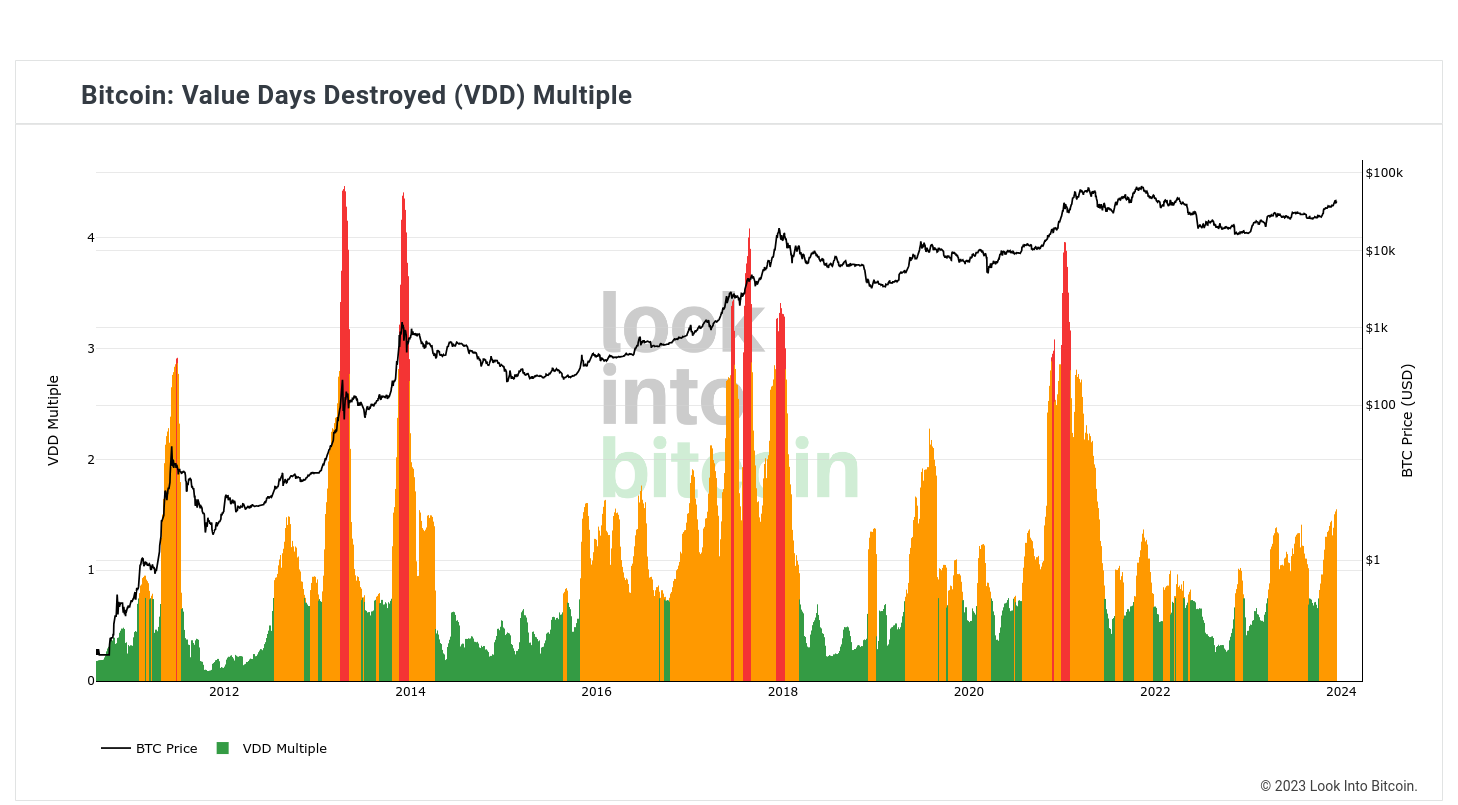

He flagged the Value Days Destroyed (VDD) Multiple metric, which multiplies Coin Days Destroyed by the current BTC price and tha on Dec. 11 hit its highest level since May 2021.

“Value Days Destroyed has now reached levels seen at previous Early Bull local highs as some HODL’ers take profit,” part of commentary stated.

VDD seeks to quantify Bitcoin selling activity at a given price point based on the length of time at which the newly-reactivated supply was previously dormant.

As Cointelegraph reported, recent selling has been driven by short-term holders, or STHs — the more speculative cohorts among the Bitcoin investor base.

Bitcoin, Ethereum see inflow boost

Looking at short-term BTC price action, meanwhile, others see the potential for further progress toward key resistance nearer $50,000.

Related: ‘Take some rest and GO’ — Bitcoin price copies 2020 bull run fractal

For analyst Matthew Hyland, this comes in the form of the relative strength index (RSI), which on daily timeframes has printed a bullish divergence with price.

“BTC close confirmed it,” he told X subscribers on Dec. 14.

Just as optimistic is popular social media commentator Ali, who spied a return of significant inflows into both Bitcoin and largest altcoin Ether (ETH).

These, he noted, mimic conditions from late 2020, when BTC/USD first broke beyond $20,000 to enter price discovery.

Over $19.7 billion are flowing into #Bitcoin and #Ethereum today! This is around the same capital inflow we saw back in December 2020 before $BTC surged from $18,000 to $65,000! pic.twitter.com/pBALVN0C2c

— Ali (@ali_charts) December 14, 2023

“We have a plan. We know where we’re going, why we’re going, and when we’re going. The rest is just noise,” fellow commentator BitQuant added in the latest series of bullish BTC price prognoses.

“Bitcoin should overcome the $42K-$45K channel by the end of the coming week, and then there are no more strong resistances until $63K.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.