Crypto hedge fund executive, Murad Mahmudov this morning added his voice to the growing song of experts calling for $100k a bitcoin.

The CIO of Adaptive Capital weighed in on the technical debate observing that the current choppy price action is most likely just a “steady accumulation” phase.

At first glance this looks like a weak chop for the next week or so, but my intuition tells me there is steady accumulation happening at these levels.

Don’t try to outsmart yourself on short timeframes, zoom out & think big. In my view, BTC is going to $100K per orangecoin. pic.twitter.com/uccAgZdcXo

— Murad Mahmudov 🚀 (@MustStopMurad) August 12, 2019

Earlier this month, Bitcoin evangelist Anthony Pompliano also extolled the flagship cryptocurrency’s values hinting that we could see Bitcoin at $100k in a mere 30 months.

When it comes to trading, humans love round numbers. And in crypto, adding a zero to those numbers carries with it visions of parabolic riches. Experienced bitcoin traders know all too well that if you take a vacation at the wrong time you might just miss out on 10x returns.

Historically speaking $100, $1,000, and $10,000 were all key levels. It only stands to reason then that the next psychological barrier squares firmly at the $100k mark.

As Mahmudov points out, every pullback is another opportunity to add to your long-term holdings:

“A number of confluences pointing to that level on the Daily as well. Goes without saying that this is not financial advice, but If I were a betting man, I would be patiently and slowly adding at every key support.”

Taking In the Bigger Picture | $100k Bitcoin

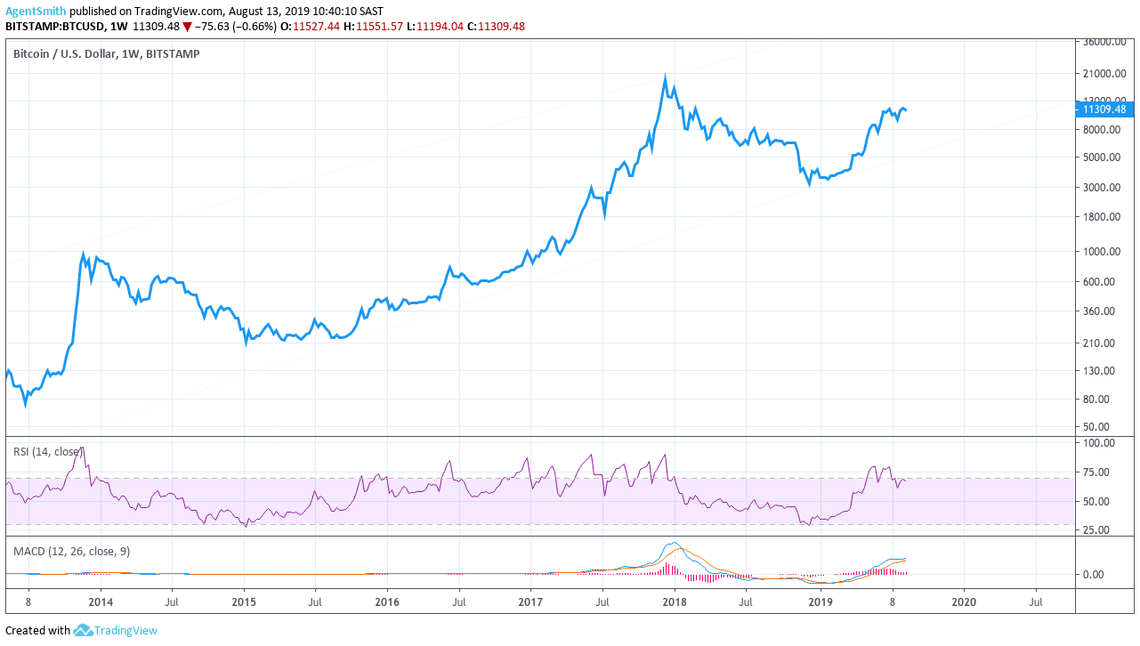

Ok, so July and August have not been particularly favorable compared to the first half of the year. But let’s zoom out and get some perspective, as Mahmudov suggests. From a weekly standpoint, cyclical indicators still have plenty of room to run.

2016 and 2017 provided ample opportunities to BTFD. It remains to be seen whether 2019 will offer the same.

As long as the current chop continues you may be able to squeeze out some healthy gains on both sides of this market. Maybe. Mahmudov’s words are cautious but poignant – don’t outsmart yourself for the small wins by avoiding the larger trend.