In a tumultuous turn of events, the cryptocurrency market has been rattled by a sharp decline in Bitcoin prices. After a sustained period of remarkable gains and record highs, Bitcoin has plunged to a weekly low of $65,000, marking a significant setback for investors.

At the time of writing, Bitcoin numbers were all painted in red, and trading at $65,710, losing value in the 24-hour and weekly timeframes by 5.6% and 4.5%, respectively, according to data from Coingecko.

A few days after its previous low of $68,000, Bitcoin plummeted to its present level, a figure not seen in a week, as bears persisted in their downward pressure.

Bitcoin plunging in the last 24 hours. Source: Coingecko.

Altcoins Also Take A Beating

While Bitcoin bears the brunt of the downturn, altcoins are not spared from the fallout. Ethereum (ETH) and Binance Coin (BNB) have also witnessed substantial losses, shedding 10% of their value or more.

Dogecoin and Shiba Inu, two popular meme coins, have experienced even steeper declines, plunging by 20% and nearly 30%, respectively. The broader altcoin market mirrors Bitcoin’s downward trajectory, amplifying the sense of unease among investors.

BTC market cap currently at $1.29 trillion. Chart: TradingView.com

Bitcoin: Impact On Market Dynamics

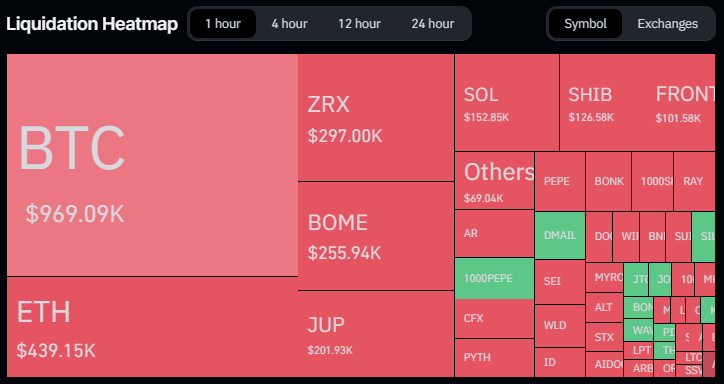

The recent price correction in Bitcoin has reverberated across the cryptocurrency landscape, reshaping market dynamics and investor sentiment. The surge in liquidations, with over 151,000 traders facing margin calls in the past 24 hours, underscores the magnitude of the market upheaval. Bitcoin’s dominance in the market is evident as it accounts for the lion’s share of the total liquidations, highlighting its pivotal role in shaping overall market trends.

As a result of the decline in value, the total market liquidations have reached $426 million, with Bitcoin taking the worst hit.

Liquidation Spree

The amount that the price of Bitcoin has liquidated over the last 24 hours has exceeded $104 million, with long traders losing the most money—they lost $86 million compared to $18 million for short sellers. Ethereum saw a $48 million overall liquidation, with $33 million going to long traders and $15 million going to short traders, as a result of the losing run.

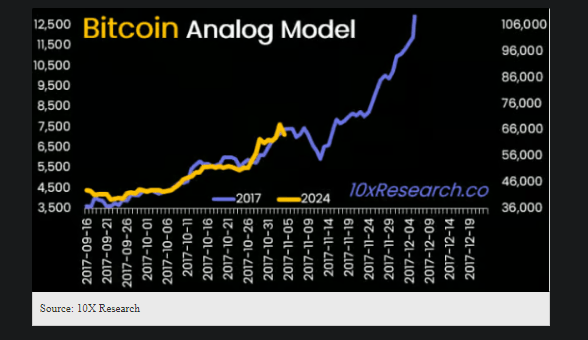

Analyst Sounds Alarm Siren

Meanwhile, market analysts such as Markus Thielen, CEO of 10x Research, have sounded the alarm bells, warning of further downside risks for Bitcoin. Thielen’s prediction of a potential drop to $63,000 sends a sobering message to investors, urging caution and prudence in navigating the current market environment.

His insights shed light on underlying concerns about Bitcoin’s market structure, including low trading volumes and liquidity, which exacerbate the risk of sharp price corrections.

Amidst the market turbulence, investors are grappling with the implications of Thielen’s analysis and adjusting their strategies accordingly. The era of meme coin mania appears to be waning, prompting investors to reassess their positions and secure profits while they still can.

Featured image from Kinesis Money, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.