Saturday, Dec. 22: most of the top 20 cryptocurrencies are seeing moderate losses, with Bitcoin (BTC) struggling to stay near $3,900.

Market visualization from Coin360

At press time, Bitcoin is down almost 5 percent over the last 24 hours, trading at $3,879. On its weekly chart, current prices are below the highest value on the week of near $4,200, but still significantly higher than $3,217, the value at which BTC started the week.

Bitcoin 7-day price chart. Source: CoinMarketCap

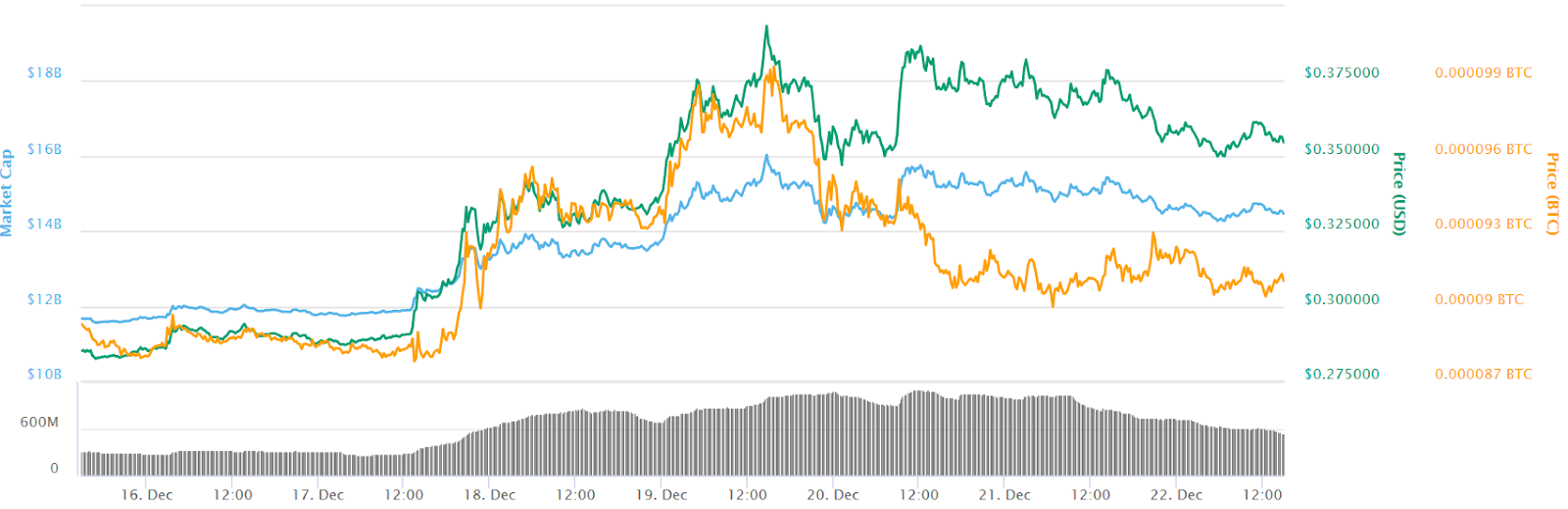

Ripple (XRP), the second largest cryptocurrency by market capitalization, has lost just over 5 percent on the day to press time. It started the day at $0.373 and is now trading at $0.353, near its lowest point of $0.349 over the last 24 hours.

On the weekly charts, the current price is significantly higher than $0.285, the price at which the leading altcoin started the week. The current price is also notable lower than the intra-week high of $0.393.

Ripple 7-day price chart. Source: CoinMarketCap

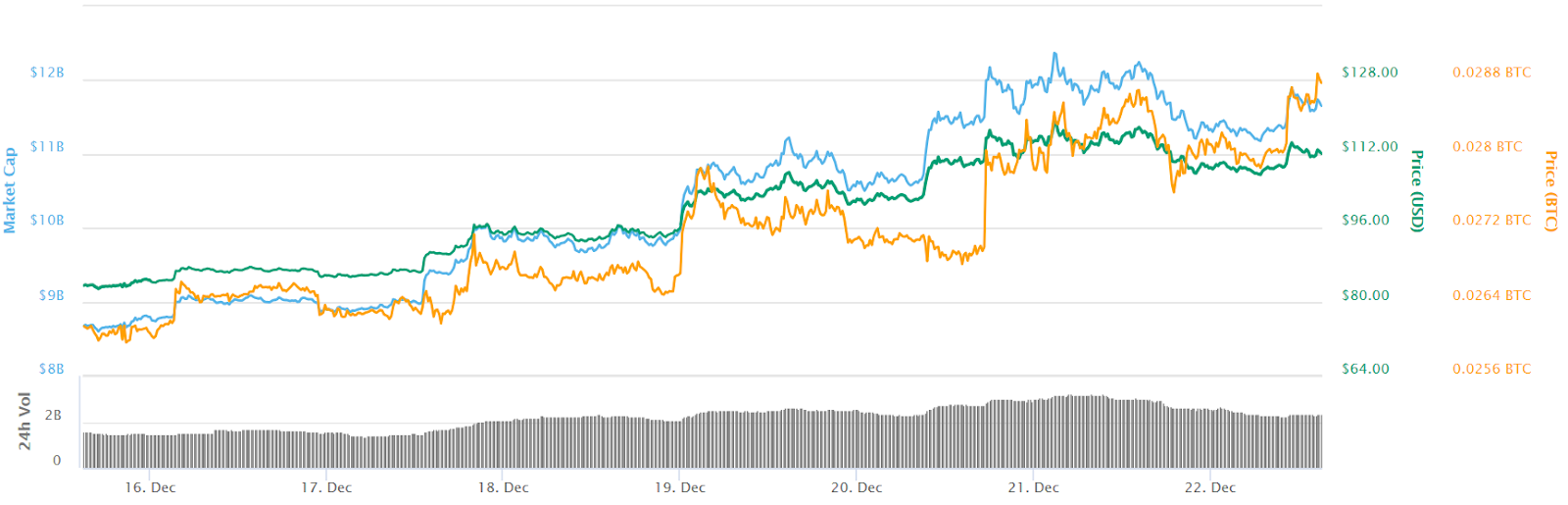

Ethereum (ETH) remains the third largest cryptocurrency by market cap, losing about 3 percent of its value in the last 24 hours. At press time, ETH is trading around $112, starting the 24-hour period at $116.40 and reporting an intra-day low of about $107.50.

On the weekly chart, the current price is notably higher than the starting point of $83.60, but below the intra-week high of $119.

Ethereum 7-day chart. Source: CoinMarketCap

Among the top 20 cryptocurrencies, some are reporting more notable losses. Namely, Bitcoin SV (BSV) is down nearly 10 percent, and Bitcoin Cash (BCH) is down over 8 percent on the day to press time. The only top 20 cryptocurrency breaking the red trend is Waves (WAVES), up almost 3 percent on the day.

Total market capitalization of all cryptocurrencies has dipped below $130 billion, at $127.5 billion by press time. Total market cap has still seen huge gains on the week, up from $101 billion, and peaking at $137.5 on Dec. 20.

As Cointelegraph reported Friday, the recent decrease in mining profitability has hit Graphics Processing Unit (GPU) producer Nvidia, cutting the company’s stock price by 54 percent in Q4 2018. Major mining ASIC hardware producer Ebang also recently reported “significant decreases” in revenue in the second half of this year.

As per a Cointelegraph report earlier this month, the recent crypto market crash made the operation of even the newest mining machines unprofitable in many cases.

This week, two United States congressmen introduced a bill in the House of Representatives that would exclude digital assets from being defined as securities.