The $900 Bitcoin (BTC) price drop over the past two days might have been scary for novice traders, but those trading futures and options don’t seem bothered.

Cryptocurrency daily market performance snapshot. Source: Coin360

As Bitcoin price rallied to $11,000 on Sept. 19, investors may have become overly excited as the price briefly broke an important resistance level.

The steady rally lasted ten days and saw Bitcoin’s dominance rate rebound for a 15-month low and this had some traders calling for a return to the $12,000 level.

This sentiment began to shift once it was clear BTC would not be able to hold the $11K mark and the correction to $10,300 had some analysts calling for a sub-$10K CME gap fill.

While retail investors may have been spooked by the slight correction, professional investors gauge market conditions and sentiment by using different tools than those used by day traders and the retail crowd.

Indicators such as basis, options skew, and futures open interest price provide real-time data on how professional traders adapted after the drop to $10,300, along with BTC’s brief rebound to $10,500.

Contracts and liquidations provide insight

The first step pro traders use is to look at futures open interest data to measure the total value of active contracts. Whenever traders have their positions liquidated due to insufficient margin, the exchange automatically closes their positions.

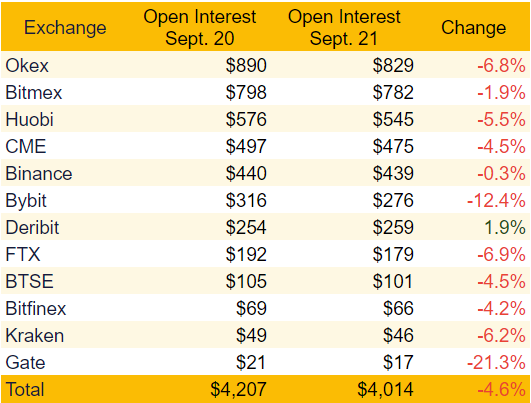

As shown below, BTC total futures open interest dropped less than 5%, remaining at a healthy $4 billion level. The current figure is stable compared to a week ago, and indicates that liquidations due to insufficient margin were not that significant.

Total BTC futures open interest. Source: Bybt.com

The underwater leveraged longs could undoubtedly have added more funding to prevent their positions from being forcefully closed. To assess whether this is the case preventing yesterday’s sharp price drop from impacting liquidations, we need to analyze future contracts basis.

Is there contango or backwardation?

Basis is also frequently referred to as the futures premium, and it measures the premium of longer-term futures contracts to the current spot (regular markets) levels. Professional traders tend to be more active than retail on such instruments due to the hassle of handling expiry dates.

These fixed-month contracts usually trade at a slight premium, indicating that sellers request more money to withhold settlement longer. On healthy markets, futures should trade at a 5% or more annualized premium, otherwise known as contango.

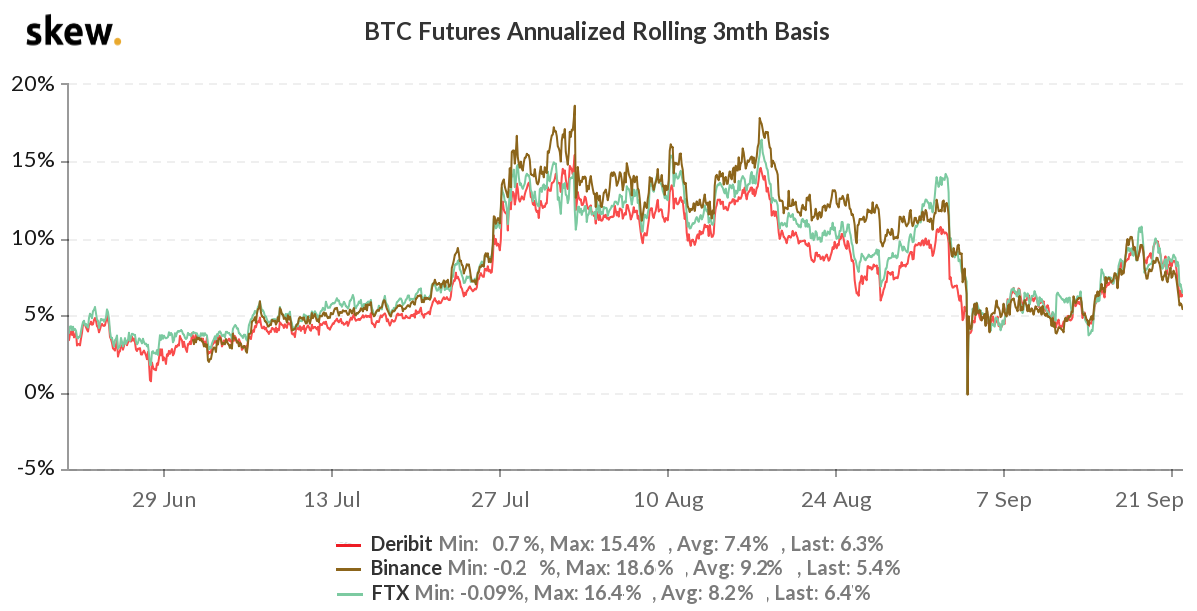

BTC 3-month futures annualized basis. Source: Skew.com

The above chart clearly states that the futures premium (basis) did not abandon its bullish stance, holding a near 6% annualized level. Apart from a brief moment on September 3, when Bitcoin faced a $2,000 drop over two days, the basis indicator has held above 5%.

Nevertheless, this premium could have been caused by factors not directly related to traders’ bullishness. If competing products in decentralized finance (DeFi) pay high incentives for cryptocurrencies deposits, sellers will demand a higher premium on future contracts.

To clarify such uncertainty, one should turn to Bitcoin options markets. Call options allow the buyer to acquire BTC at a fixed price on contract expiry. On the other hand, put options provide insurance for buyers and protect against BTC price drops. For this privilege, the buyer pays an upfront premium to the contract seller.

Whenever market makers and professional traders are tending bullish, they will demand a higher premium on call (buy) options. This trend will cause a negative 25% delta skew indicator.

The opposite will hold true whenever large investors are worried about a short-to-medium term price correction. The put (sell) options that protect from downside should trade at a larger premium than call (buy) options during bearish markets. This situation will result in a positive 25% delta skew indicator.

BTC 3-month options 25% delta skew. Source: Skew.com

Although there is no set rule, a 25% delta skew indicator ranging from 10% negative to a positive 10% level could be deemed neutral. Numbers below that range are almost certainly an indicator of bullishness, and that is currently the case.

Currently, there is no indication of desperation, bearishness, or unusual activity regarding BTC futures and options markets. Instead, the primary metrics show resilience and a slight bullish stance, a scenario which is opposed to what one might expect after the price failed to break through the $11K resistance.

Traditional markets continue to impact Bitcoin price

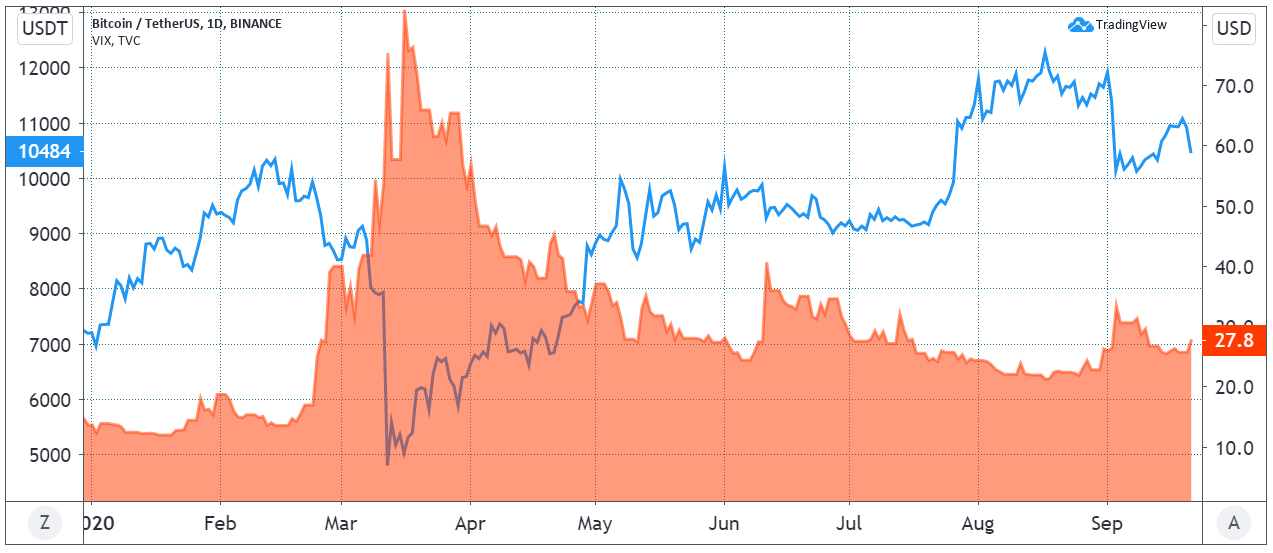

Yesterday’s move happened in tandem with a 7.5% increase in the S&P 500’s volatility (VIX) indicator.

The VIX has long been considered the traditional markets primary fear indicator. This movement can partially explain why derivatives traders were not particularly bothered by yesterday’s negative price swing.

BTC (blue) versus S&P 500 VIX (red). Source: TradingView

The above chart shows the inverse correlation between the S&P 500 VIX index and Bitcoin price. Throughout 2020 most periods of uncertainty in traditional stock markets have reflected negatively on Bitcoin’s performance.

As a word of caution, there’s no guarantee that this correlation will continue for the remainder of the year. Therefore, one shouldn’t alter their BTC positions exclusively based on the moves mentioned in this article.

However, professional traders will continue to keep a close eye on the VIX indicator in order to decide whether a BTC drop seems strictly stock-market related.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.