By CCN Markets: The bitcoin price could break above its all-time high by year-end 2019, according to Oliver Isaacs.

The millionaire cryptocurrency analyst and trader told The Independent that more investors are viewing bitcoin as a safe-haven asset in the wake of growing macroeconomic tensions. Isaacs referred to the ongoing trade conflicts between the U.S. and China that last month sent the global equity market on a downward trend. The negative sentiment prompted investors to hedge in cryptocurrencies. He stated:

“I believe bitcoin has the potential to hit $25,000 by the end of 2019 or early 2020. There are multiple drivers behind the recent resurgence. There are geopolitical, technological, and regulatory drivers. The net effect of the trade war between the U.S. and China has led to a sudden interest in bitcoin as a hedge on investments.”

The statement followed bitcoin’s dramatic correction in the recent market cycle. The cryptocurrency dropped by more than 18% after establishing its 2019 high near $9,090 on San Francisco-based exchange, Coinbase. Nevertheless, bitcoin remains in a positive trend from a broader outlook, with its year-to-date performance showing as much as 146% gains.

Isaacs noted that the bitcoin adoption rate is heading in the direction of the cryptocurrency’s price. He cited significant organization like Amazon, Starbucks, Whole Foods, and Microsoft that recently started accepting BTC payments, indicating that the cryptocurrency ecosystem has turned more positive since crashing more than 85% in 2018.

The Bearish Take on Bitcoin

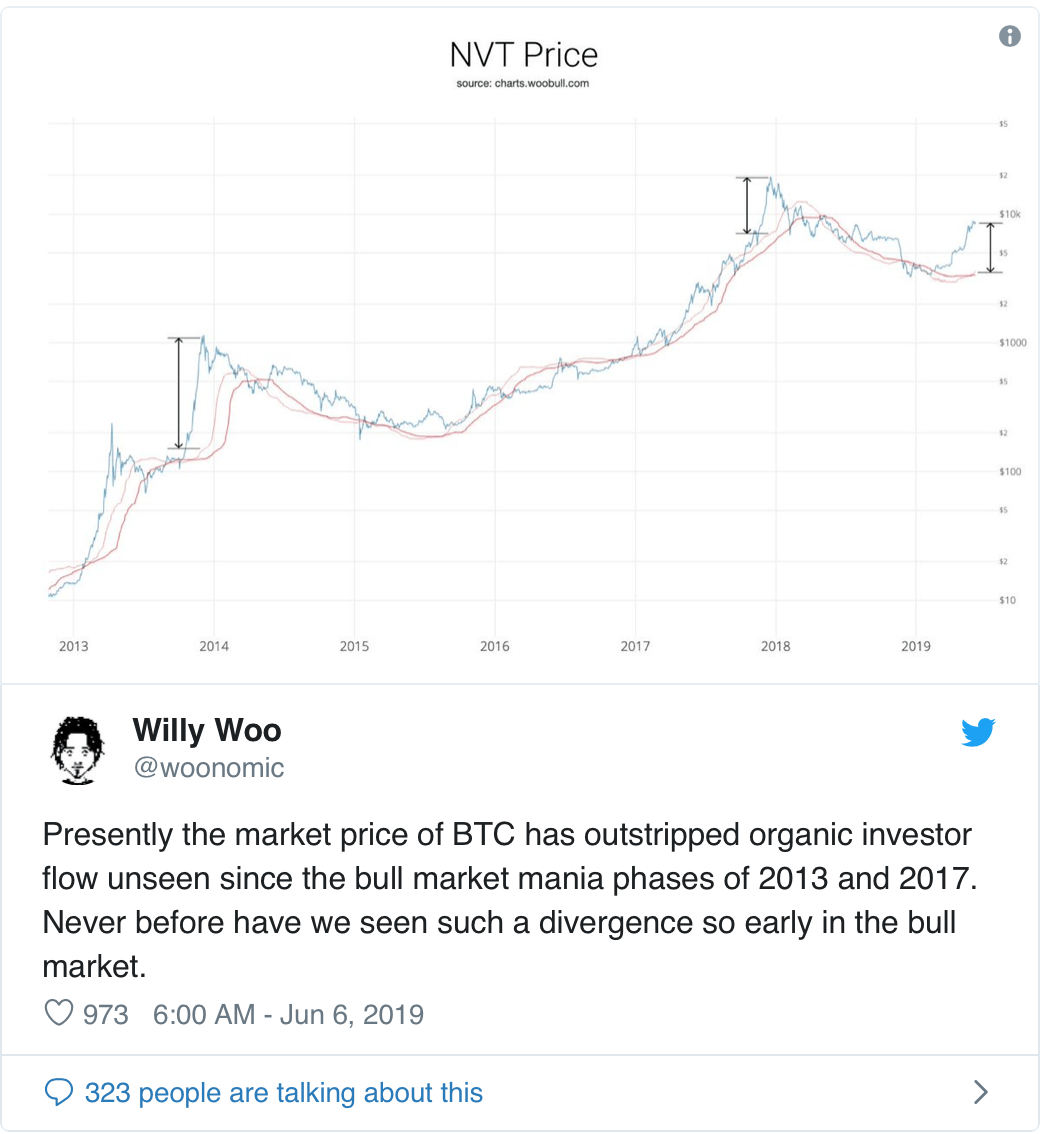

Meanwhile, other notably analysts believe bitcoin is due for a considerable drop. Willy Woo, the founder of Woobull.com, said the cryptocurrency has become overvalued following the latest upside movements. The analyst put bitcoin against his popular NVT metric, which represents the ratio of bitcoin’s market capitalization to the volume transmitted by its blockchain. He noted a considerable divergence between the current bitcoin price and the NVT Ratio (explained here), which is bearish:

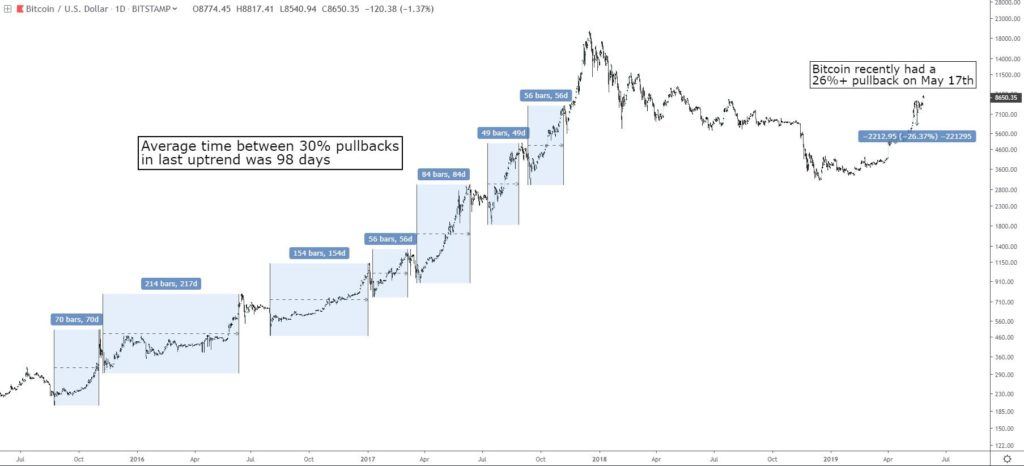

Josh Rager, another prominent analyst, provided a less harsh bitcoin price outlook, stating that a sharp downside correction would attract more investors to purchase it at cheaper rates. He noted that the BTC-to-dollar exchange rate dropped by at least 30% after every significant bullish move on a broader timeframe, as shown in the graph below.

If Rager is correct, BTC could go as low as $6,000 before attempting a sharp pullback to reclaim the session top of $9,090.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN Markets.