The price of Bitcoin (BTC) has seen a destructive week, as the price crashed 52% on one single day this week. One of the most massive crashes witnessed since the existence of Bitcoin.

Not only has Bitcoin been hitting hard during the week, but equity markets have also seen their worst week since 2008, and other safe havens gold & silver have seen a selloff. Cash is king, is the idea. However, are we continuing dropdowns, or are we temporarily done?

Crypto market daily performance. Source: Coin360

Bitcoin drops to $3,750 and bounces with $2,000 since

The volatility of all markets has been skyrocketing during the week, as the VIX (Volatility Index in the USA) is reaching levels not seen since Bitcoin was invented. Similarly, Bitcoin has seen a drop from $7,500 to $3,750, after which the price jumped up with $2,000 to $5,750 in the 24 hours after.

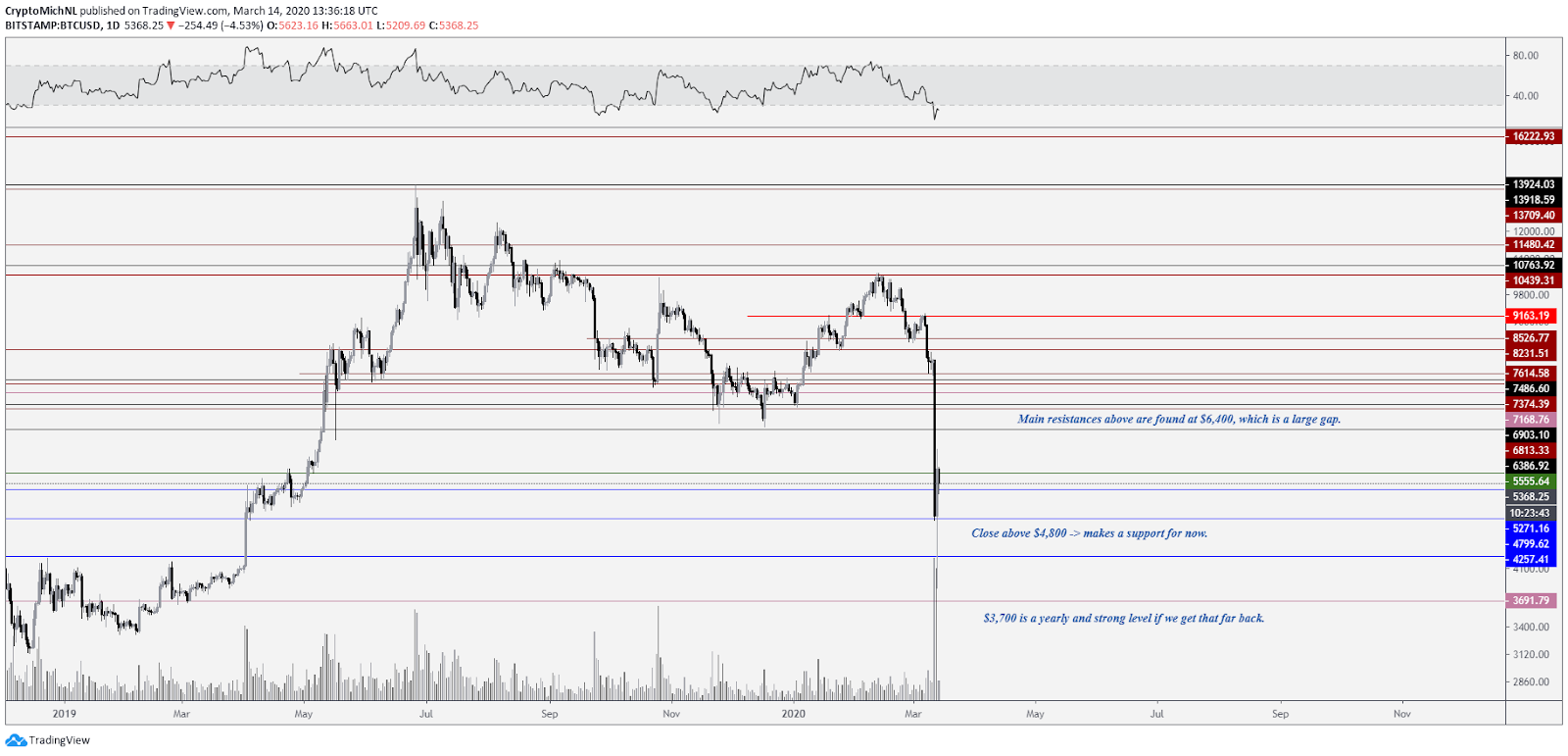

BTC USDT 1-day chart. Source: TradingView

The daily time frame is showing the selloff from last week. It’s also showing which levels the market should keep in mind for the coming period. The primary resistances above us are found at $6,400 and $6,800-6,900.

That’s quite far from here. Massive drops usually occur in a short period, through which support levels are found far away from each other. The other way around, during upwards rallies, the same occurs with levels there. An example is a rally from $3,100 to $14,000. This whole rally had movements of $1,000 in one hour, which makes gaps in the chart.

However, the main resistances are $6,400 and $6,800-6,900. Similarly, the support levels to be watched are $4,800 (as the price of Bitcoin has bounced on that weekly level), $4,250, and $3,700 as further support levels.

Currently, the price of Bitcoin tries to flip the $5,250 level as support. Making that level support gives the market space to test levels above us, which are $6,400 for instance.

Crypto fear & greed index hits extreme fear

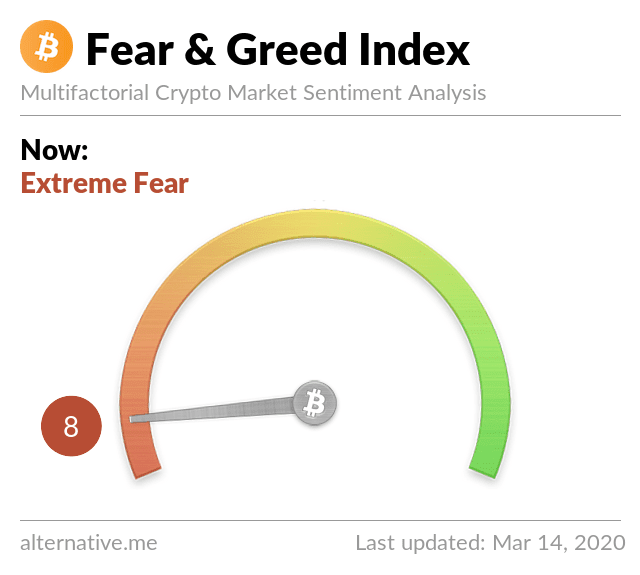

Crypto fear & greed index. Source: Alternative.me

The crypto fear & greed index gives a proper perspective on the current sentiment of the market. It shows the level of 8 out of 100, which is named extreme fear. The number is significant, as the last time these levels were hit, the price of Bitcoin was $3,100 (November 2018) or $6,000 (February 2018 crash).

Remarkably, the level of fear on the equities fear & greed index is showing the level of 1, which means that there’s no belief anymore. However, the equities markets have seen a selloff of 30% in ten days. Dropdowns not seen before, unlike 2008 and 1929.

Does that mean we’re going to see further dropdowns? Well, it seems natural to expect further dropdowns the moment many countries decide to go in lockdown for the coronavirus.

But institutions and governments are already announcing solution packages for the economy. One of them was President Trump yesterday. This resulted in U.S. equity markets bounced by 8% in 30 minutes, while Bitcoin jumped from $4,800 to $5,600 in these hours.

Nevertheless, a further dropdown is likely to occur, as the whole global economy is coming to grips with the coronavirus. However, the effects of that will usually come after some time, which will be later this year. In the short term, the fear and panic may hit peak levels as people anticipate more lockdowns.

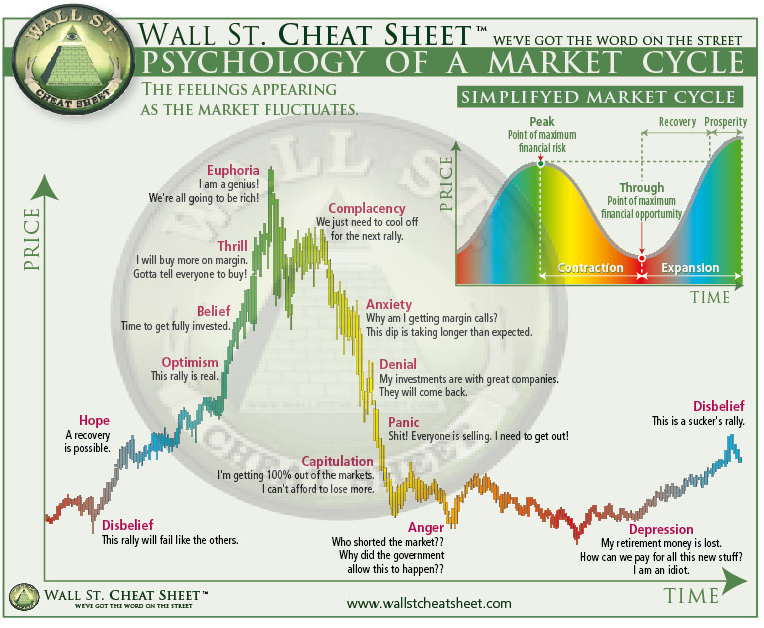

Where does that leave us in the equity markets? Probably the so-called “bull trap” as shown in the Wall Street Cheat Sheet.

Wall street bubble pattern

The bubble pattern is pretty well-known around the crypto investors, as these have experienced one during the past years. After the first massive selloff, there’s a period of calm upwards movements in which people expect things to be healthy and calm down.

Such a period could also occur in the equity markets in the coming months, as Western countries are going to take measures to contain the virus, which may stop the panic. However, the real economic impact will only show up later this year, which then would trigger a further downwards drop as is shown in the chart.

What’s next for Bitcoin?

It’s not unreasonable to expect further downwards momentum for Bitcoin, as BTC is massively seen as a risky asset and the first one to be sold. People need cash on hand rather than a volatile digital token.

However, the majority of the fear and panic could be priced in. The history of Bitcoin shows many 80%+ dropdowns, after which the price stabilized and slowly started to grind upwards. A similar case could occur here. From a technical point of view, it’s important to keep an eye on the 200-Week moving average, as it’s the key indicator for bullish/bearish markets on equity markets and Bitcoin.

BTC USD 1-week chart. Source: TradingView

The 1-week chart is showing the 200-Week MA. During 2015, a giant drop below the 200-week MA occurred as well, after which the price bounced back up and held the level.

It’s essential to keep an eye on this indicator and to see how the price will close during the coming weeks. As long as the 200-Week MA holds, the market could have seen a capitulation bottom.

Short term relief rally to $6,100 possible

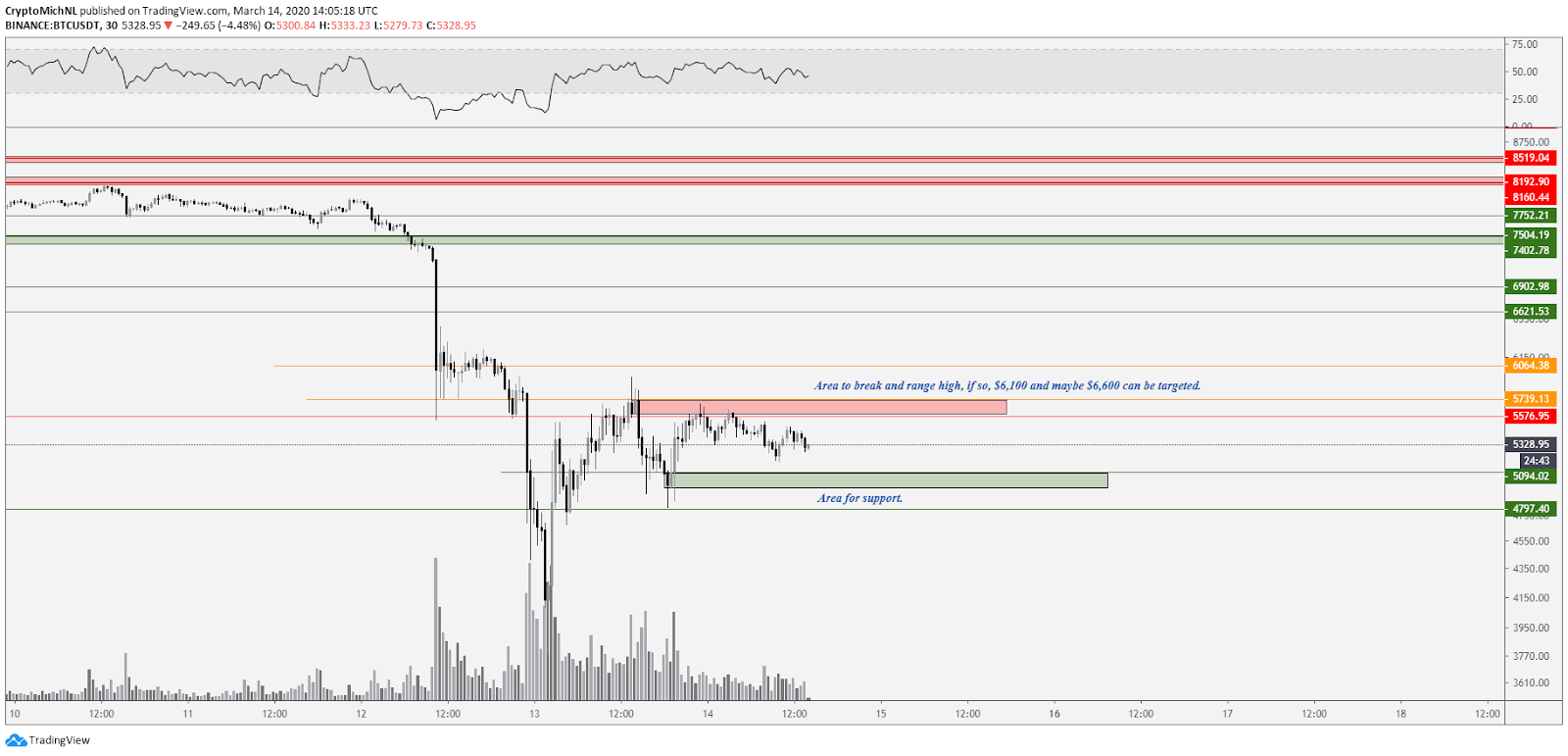

BTC USD 30-min chart. Source: TradingView

The short-term view is showing a clear range through which Bitcoin is moving with resistances lying at $5,600-5,750. The support levels are found at $4,900-5,100.

As long as the lower support remains to support, a continuation upwards and tests there are on the tables. Such a push upwards makes levels of $6,100 possible as a relief rally and bearish retest.

However, in conclusion, Bitcoin is not out of the woods. It might have already made a capitulation bottom, but breaking below $4,800 may result in a further dropdown and test of the lows around $3,750.

If you’re trading in these markets, be aware of the high risks involved in these volatile times, and use proper risk management.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.