By CCN: The parabolic bitcoin price explosion, which saw BTC surge 136 percent in 2019, is a trap, according to on-chain analyst and Adaptive Fund partner Willy Woo.

The price explosion is simply a short-squeeze driven by hedge funds. Organic buyers are waiting for a healthy retracement before buying in again.

“This a quant fund driven short squeeze devoid of any true investor volume… I’m awaiting this exchange driven pump to blow off, a proper retrace, and only then do I think real investor flows will come in and drive the true organic bull market.”

Bitcoin rally driven by short squeeze

A short squeeze takes place when a majority of traders are betting against the bitcoin price, known as short-selling. Eager to slaughter all the short-sellers, whales start buying in huge volume, pushing up the price, and forcing the short-sellers to close their positions.

When the majority of shorts are liquidated, the squeeze is complete. It’s no longer profitable to keep buying. That’s where we are right now, according to Willy Woo:

“At the $8k-9k mark the market switched from short to majority long. This put a cap on the profitability of short squeezing.”

A natural pullback is imminent

The BTC rally is already losing steam, falling 19 percent in a matter of days. It’s a sign that short-squeezing is no longer profitable. Whales are selling. The price will naturally return to organic levels.

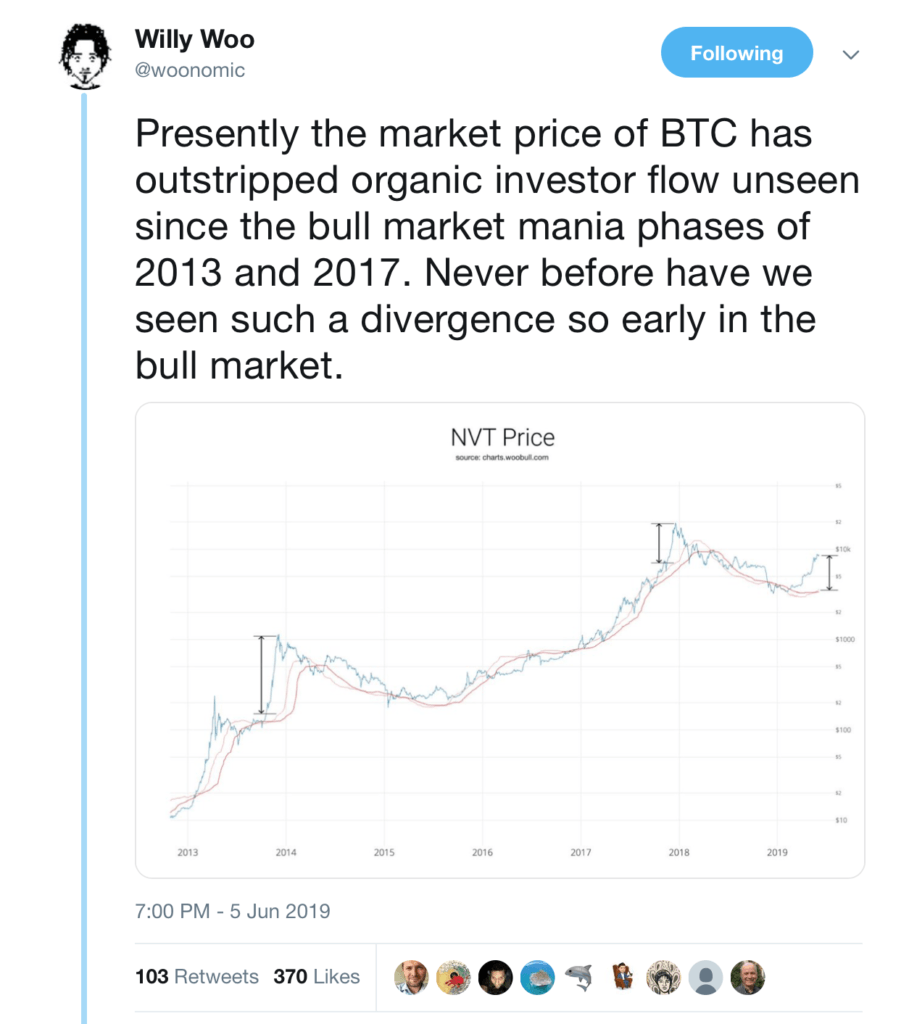

Another flashing warning is the NVT indicator which measures bitcoin’s network value against transactions. NVT is often used to predict overbought levels. As Woo explains, the divergence is currently at levels previously only seen at the top of fierce selloffs.

“Presently the market price of BTC has outstripped organic investor flow unseen since the bull market mania phases of 2013 and 2017. Never before have we seen such a divergence so early in the bull market.”

Bitcoin price back to $3,000?

As to how far the bitcoin price will retrace, Willy Woo doesn’t elaborate. Among the most bearish calls is a fall to $3,000, predicted by one trader on TradingView who uses the same NVT indicator to form their analysis.

The broader consensus among traders is a ~30 percent retracement, which would take bitcoin to $6,400. As CCN reported, trader Josh Rager said there is plenty of precedent for a 30 percent pullback.

“BTC 30% pullback coming? Yes, eventually. If history repeats, there should be plenty of strong pullback on the way to next peak all-time high. There were at least nine 30%+ pullbacks from last cycle accumulation and uptrend. Plenty of buying opportunities ahead, don’t let it shake you.”

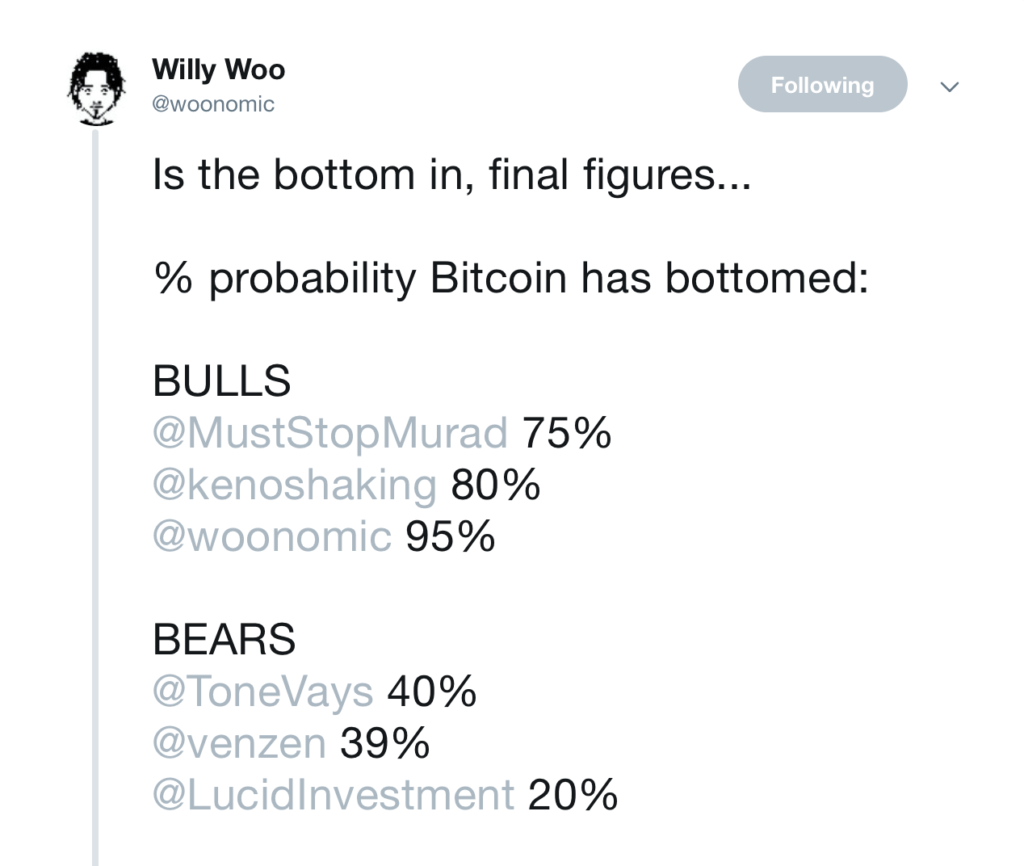

95% chance bitcoin bottom is in

It’s worth pointing out that Willy Woo’s analysis is not hyper-bearish. It’s simply a cautious approach to a phenomenal price run-up. He previously calculated a 95 percent chance the bitcoin bottom has been formed, based on polling active BTC traders.

“I’m swimming in data and you kind of get an intuition about things. I’d say a one-in-20 to one-in-40 chance that this floor falls through. So that’s 95%-97.5% that the bottom is in.”

In other words, don’t panic. Be cautious. Be realistic. There will be plenty of pullbacks and better buying opportunities ahead.

Click here for real-time bitcoin price chart.