Bitcoin (BTC) continued falling on Jan. 10 as gains from late last week fizzled and markets attempted to find support levels in the $7,000-$8,000 range.

Cryptocurrency market daily overview. Source: Coin360

BTC futures gap punctuates losses

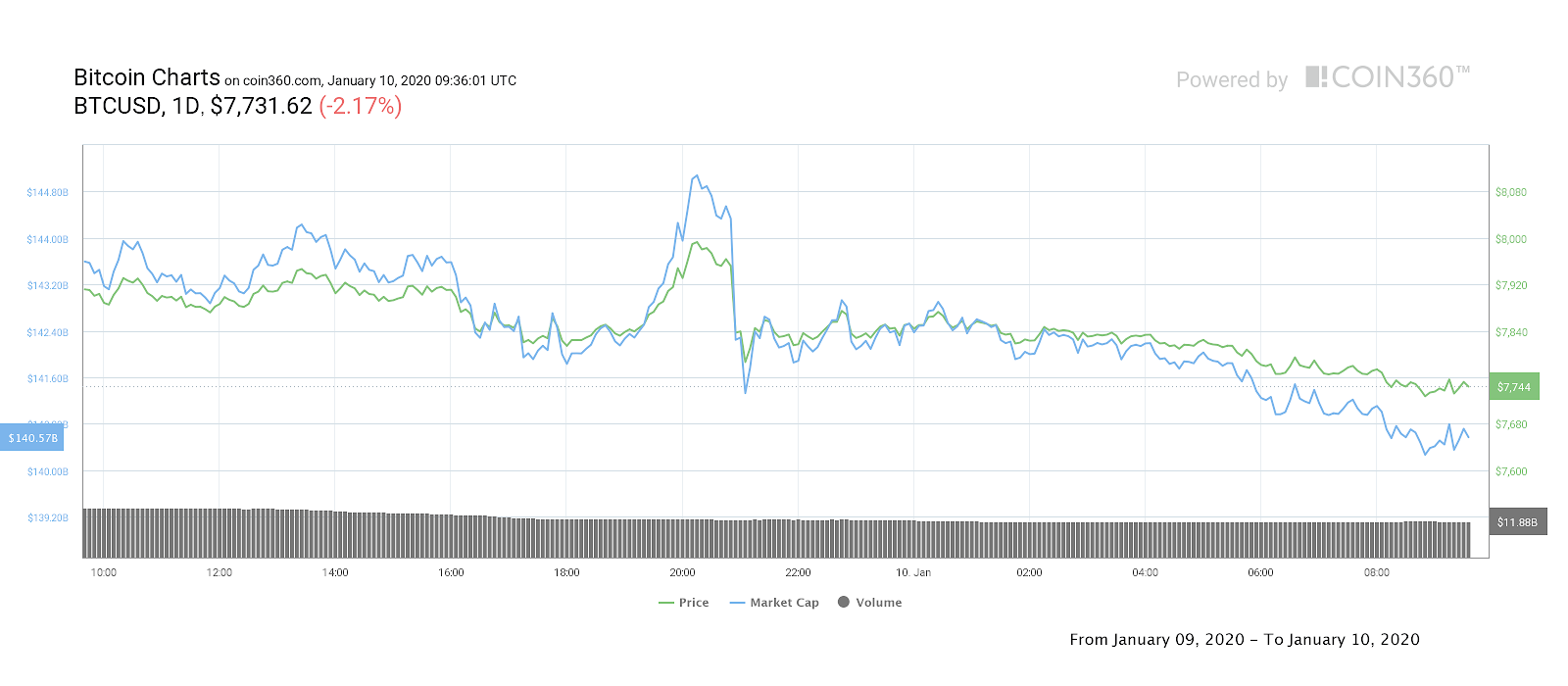

Data from Coin360 and Cointelegraph Markets showed BTC/USD shedding another 2% overnight on Thursday, having previously reached local highs above $8,400.

At press time, the pair circled just under $7,750 in volatile conditions, having paused its losses after hitting a “gap” in CME’s futures market between $7,676 and $7,716. CME’s price index itself just avoided entering the gap zone.

Bitcoin 1-day price chart. Source: Coin360

As Cointelegraph reported quoting regular contributor, Michaël van de Poppe, Bitcoin was likely to drop down to the gap, which represents the “empty space” between where one futures trading session closes and the next opens.

Historically, the price has sought to “fill” previous CME gaps with consistent regularity. The latest scenario is nonetheless rare, coming after 12 consecutive red candles on the 4-hour chart.

Bitcoin futures 4-hour chart. Source: CME/ TradingView

In a fresh update, Van de Poppe remained consistent about the short-term outlook, warning that downside action could take Bitcoin as low as the previous bottom at around $6,400. He summarized:

“Holding $7,500-7,600 on $BTC and we could look at $9,500. Losing $7,500-7,600 and I feel we’re accelerating towards $5,800 or $6,400.”

Others appeared taken aback by last week’s sudden improvement. Among them was Peter Brandt, the veteran trader well known for previously calling some of Bitcoin’s biggest moves.

Having warned BTC/USD could slip to $5,500 by July 2020, an apparent nuance saw Brandt give credence to the idea a Bitcoin bull market may have begun. In addition to technical signs, however, this depended on the absence of investors he called “cryptocultists.”

Altcoins avoid major sell-off

Altcoins meanwhile broadly copied Bitcoin’s slow descent, the majority of major tokens nonetheless staving off heavier losses.

Ether (ETH), the largest altcoin by market cap, shed 1.6% to trade at $136. Van de Poppe had warned that a close below $133 would put ETH in danger of dropping all the way to $100.

Ether 7-day price chart. Source: Coin360

A noticeable exception to the downtrend was Cosmos (ATOM), which gained 5.1% on the news of its impending listing on cryptocurrency exchange Coinbase Pro.

The overall cryptocurrency market cap was $205.5 billion, with Bitcoin’s share at 68.5%.