By CCN: The Fear of Missing Out (FOMO) that recently drove bitcoin’s price above $9,000 has run out of gas, according to a new report published by crypto analytics firm SFOX.

While the BTC price was on a steady incline since the beginning of April when bitcoin traded for $4,100, the coin has hit a ‘tipping point’ in overall sentiment.

Bitcoin began to rally in April. | Source: CoinMarketCap

Bitcoin Rally Driven by FOMO

SFOX relies upon price momentum, market sentiment, and industry advancement for its price outlook. In May, BTC registered a ‘mildly bullish’ rating but has since been downgraded to ‘uncertain.’ FOMO has clouded overall crypto sentiment and the fundamentals driving bitcoin’s price.

“It’s not clear in times of rapid growth how much of the growth is due to underlying fundamentals and how much is due to “fear of missing out,” or “FOMO.”

Emotion-driven investment has resulted in massive price volatility for bitcoin, such as when the cryptocurrency fell more than $500 in the span of minutes on June 3. Whale sellers have controlled the market, capitalizing on shaky BTC investors and adding to the growing dumpster fire.

Bitcoin Negatively Correlated to the S&P 500 in May

Considering the price of BTC fell more than 80% percent in 2018, investors were hoping to pile in at the bottom when the price suddenly took off. It appeared that bitcoin was set to renew its bullish trend from 2017, but now analysts are pointing to stock market woes and the looming trade war as the primary catalyst.

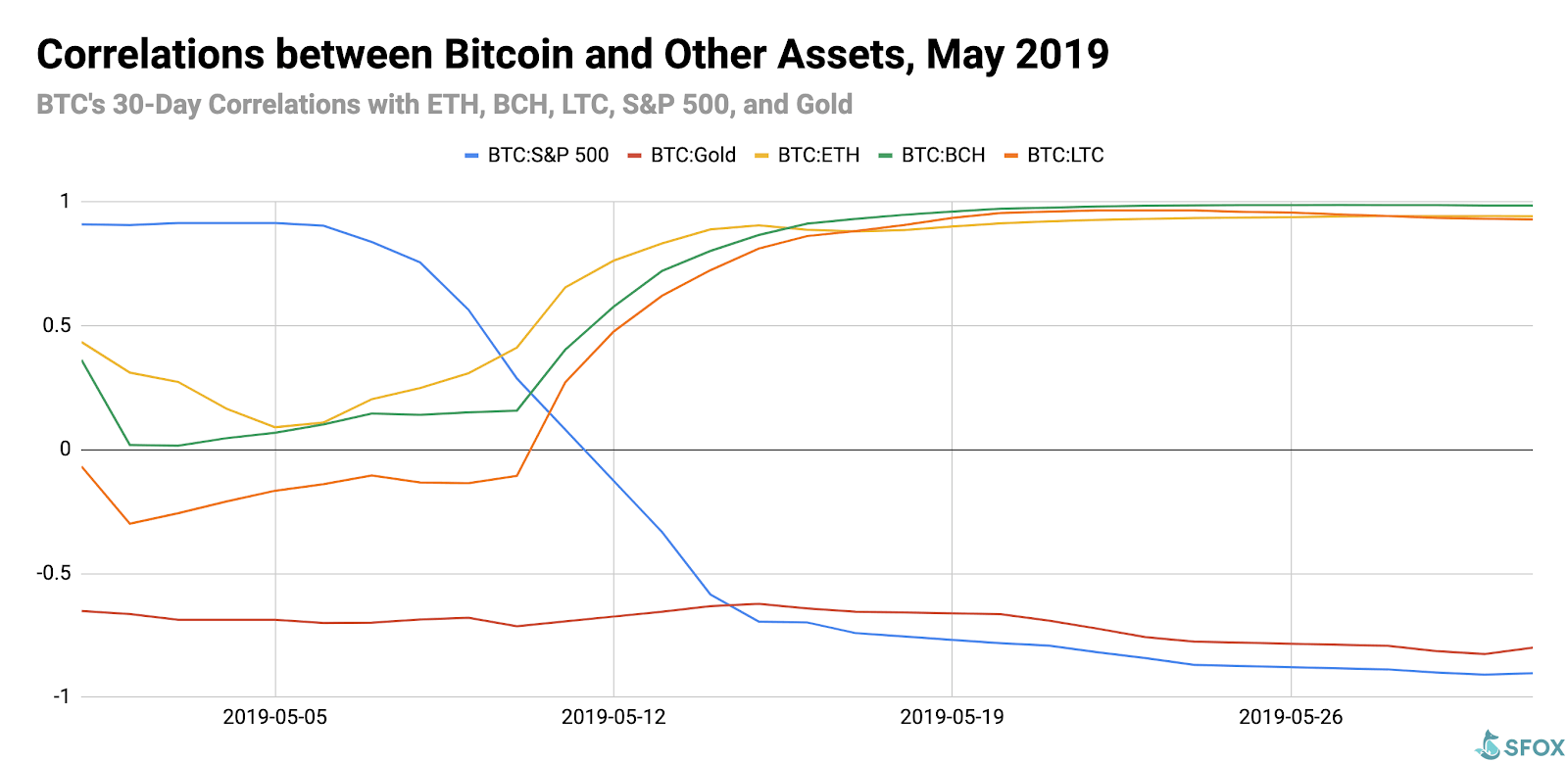

SFOX found that bitcoin held a near-perfect negative correlation with the S&P 500 throughout May. Investors were using bitcoin as a way to hedge their bets against the falling stock market. Chinese investors contributed their share to the buying frenzy, fleeing the falling yuan in the wake of President Trump’s trade threats.

Crypto a Haven For Stock Market Investors

Bitcoin typically has a low correlation with most markets. However, in May the currency tracked with top altcoins such as ethereum and litecoin, in addition to its negative correlation with the S&P 500.

BTC ETH LTC Gold S&P 500 Price Correlation for May. Source: SFOX

The growing exposure for bitcoin has created a demand for crypto in times of stock market uncertainty. Despite claims that bitcoin is devoid of value, the cryptocurrency competed with gold as an alternative asset class for investors fleeing the S&P 500, a trend likely to continue if the DOW takes a hit.

Click here for a real-time bitcoin price chart.