Bitcoin Price Now Pressing $9K Resistance, Tries to Leave Lateral Market Behind

June 17, 2019 by Ramiro Burgos

The bitcoin price is back above $9,000 USD! But will it stick this time? We could appreciate a degree of skepticism there, but our weekly technical analysis report hints that it might be back on the way up. As always there are many factors at play — read on to find out what they are, and what impact they could have.

Also read: Bitcoin Price Adrift in Volatility Confusion, Touring a Lateral $9000-6000 Market

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Bitcoin Price Analysis

Long-Term Analysis

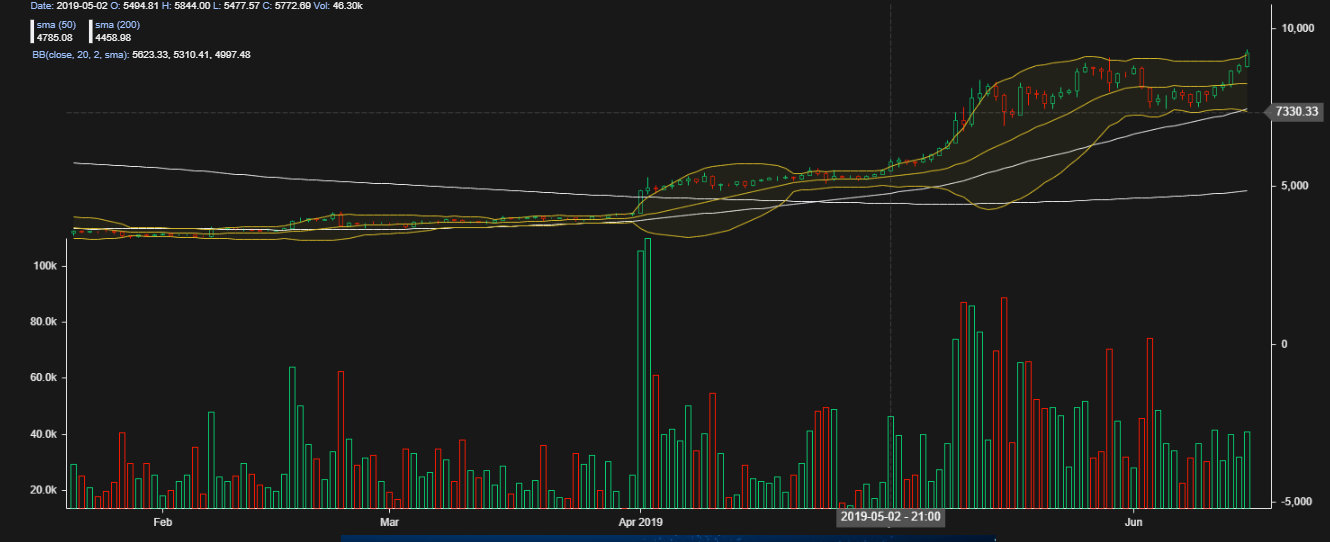

The bitcoin price is now challenging former peaks it reached a year ago. This time though, it is backed by news and traditional media, which seem to be the key to it overcoming the $9,000 level and finally leaving behind the sideways lateral movement between $9,000 and $7,000 it entered in May.

Upper resistances for this current upward movement are at $10,000 and $12,000, depending on external factors. According to Mass Psychology Analysis, the current Hope phase is still active, and would give way to Optimism if quotes keep the action over the $9,000 trigger.

Mid-Term Analysis

A wait and see attitude prevails among holder operators, due to quotes that increase volatility slipping below $8,000 and rising over $9,000 in the same week. Mathematical Indicators flipped up, backing another upward movement for the near-term, unless some external factor harms the general animus.

A formation analysis in progress canceled a reversal formation by surpassing former nearby highs, and the whole picture should be redefined considering a bullish trend.

Support remains at $6,000, allowing intermediate bouncing levels between the $7,800 and $8,000 level. This acts as a psychological stop-trigger for a bearish rally if values cross that range to the down side.

Short-Term Analysis

A lateral market around $8,000 that started in May 2019 seems to be ending with news and some fundamental opinions backing a Bullish Consensus to send quotes to higher levels.

Resistance is still at $10,000 and $12,000, reinforcing Hope phase while setting an intermediate support at $8,000. This should also turn into a big up rally because, with the recent rise, new formations and figures in progress consolidated stability inside the rising channel to leave the behind lateral market over the $8,000 level.

Japanese Candlestick Analysis gives an advantage to demand’s Soldiers structure over offer’s Crows disorder, and the next battlefield can be expected near the $10,000 level.

What do you think will happen to the bitcoin price? Share your predictions in the comments below.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book, the Manual de Análisis Técnico Aplicado a los Mercados Bursátiles. The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Image via Pixabay

This technical analysis is meant for informational purposes only. Bitsonline is not responsible for any gains or losses incurred while trading bitcoin.