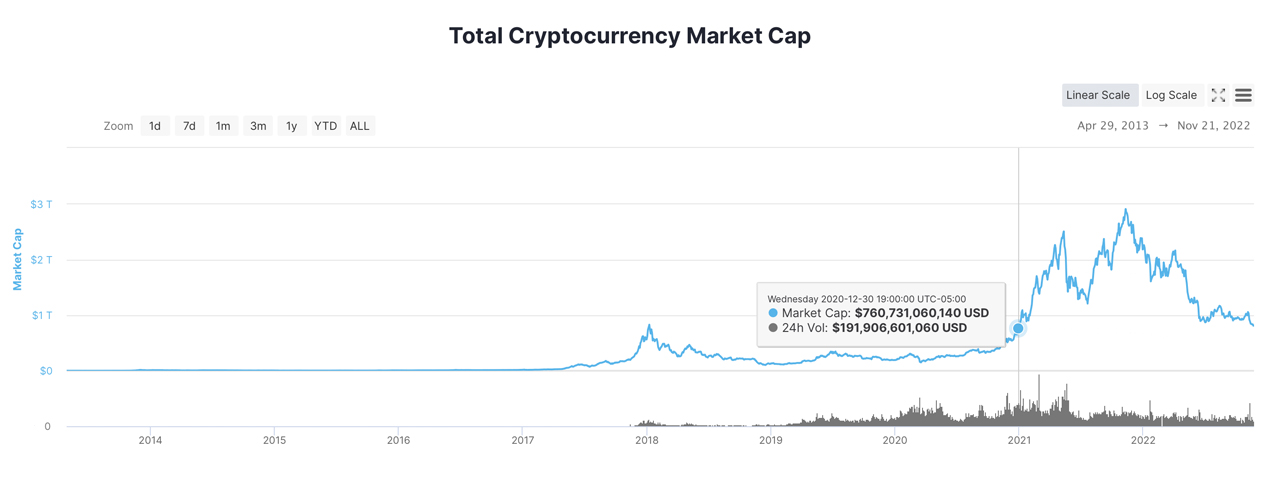

The global cryptocurrency market capitalization has dropped below the $800 billion region for the first time in 691 days or since December 30, 2020. Bitcoin has dipped below the $16K region dropping 5.12% over the past 24 hours, and the second leading crypto asset ethereum shed 7.61% on Monday, dropping below the $1,100 range.

Crypto Economy Sheds More Than 4% over the last day, Bitcoin Drops Below $16K, Ethereum Slips Below $1,100

Cryptocurrencies had a rough Monday as the entire digital asset market capitalization saw a 4.37% decrease over the last day. Furthermore, the U.S. dollar valuation of all the crypto assets in existence fell below the $800 billion zone, the lowest value seen since December 30, 2020.

While cryptocurrency trade volumes rose to $150 to $225 billion during the FTX market mayhem, global trade volumes dropped greatly down to $66.66 billion in 24-hour trade volume on November 21, 2022. Bitcoin (BTC) dropped to a low of $15,588 per unit on Monday under the $16K range and it’s currently coasting along at $15,721 per unit at 3:30 p.m. (ET).

Ethereum (ETH) is trading for $1,091.14 per unit after losing 7.61% in USD value during the last 24 hours. Some of the biggest losers on Monday include near protocol (NEAR) down 12.6%, terra luna classic (LUNC) lost 11.1%, and solana (SOL) shed 10.7% in 24 hours.

Coins like huobi (HT), ethereumpow (ETHW) and apecoin (APE) saw gains today between 1.7% to 7.3% with HT leading the pack. Presently, BTC’s dominance among the entire crypto economy’s digital assets is 38.7% on Monday, while ETH’s dominance is 17.1%.

Regarding the global trade volume on Monday, tether (USDT) dominates the books with $53.73 billion of the $66.66 billion in worldwide trade volume. Furthermore, as the crypto economy’s valuation shrank on Monday, USDT’s dominance increased to 8.102%.

Usd coin’s (USDC) market valuation equates to 5.485% of the $786.27 billion crypto economy value on Nov. 21, 2022. In addition to crypto assets, equity markets in the U.S. shuddered as all four major indexes (NYSE, Nasdaq, Dow, S&P 500) were down for most of Monday’s trading sessions.

Precious metals were down on Monday as well as gold slid 0.69% and silver dropped by 0.48%. Platinum happened to increase by 0.41% against the greenback, but palladium dropped by 3.74% during today’s New York spot prices note. By 4:15 p.m. (ET) on Monday, BTC’s price managed to climb to $15,900, while ETH’s value managed to jump back above the $1,100 zone.

What do you think about the crypto economy dropping below the $800 billion range? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.