It takes two to tango in the world of crypto trading, where a dynamic relationship between buyers and sellers is always on display in something called an order book.

A tool that visualizes a real-time list of outstanding orders for a particular asset, order books represent the interests of buyers and sellers, offering a window into supply and demand.

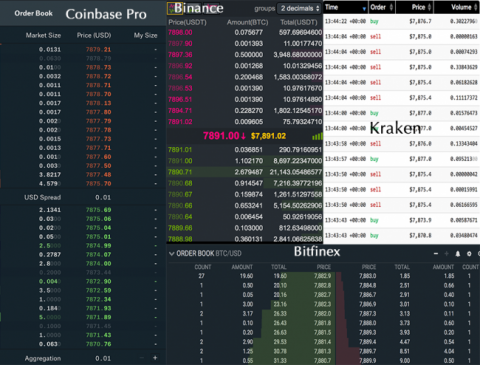

But while all order books serve the same purpose, their appearance can differ slightly among exchanges. That said, they are all built with the same features and functions.

Examples from Coinbase Pro, Binance, Bitfinex and Kraken are shown below:

To become comfortable reading order books, it is essential to understand four main concepts: bid, ask, amount and price. This information is displayed on two sides of the order book known as the buy-side and sell-side.

For the purposes of this explanation, we will be using the BTC/USD order book from one of the world’s largest cryptocurrency exchanges, Bitfinex.

Price and Amount

Although the two sides display opposing information, the concepts of amount (also referred to as size) and price are relevant to both. Simply put, the amount and price per order display the total units of the cryptocurrency looking to be traded and at what price each unit is valued.

In the example below there is an open buy order in the amount of 20.24 at a price of $8218.50.

This means the entity who opened this order would like to purchase 20.24 units of bitcoin at a price of $8,218.50 per unit.

In the Bitfinex order book, you will also see the terms “count” and “total.”

The count refers to how many orders are combined at this price level to create the amount, whereas the total is simply a running total of the combined amounts.

The Buy Side

The buy side represents all open buy orders above the last traded price.

This offer from the buyer is known as the “bid.” It effectively voices the trader’s interest, stating something like, “I am bidding on X units you own at a specific price in the hopes of purchasing them.”

Once the bid is matched with an appropriate sell order, the trade can be facilitated.

When there is an abundance of buy orders (demand) at a specific price level, something known as a buy wall is formed.

Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. The price will not be able to sink any further since the orders below the wall cannot be executed until the large order is fulfilled – in turn helping the wall act as a short-term support level.

In the example above, we can see a large order of 500.2 BTC units waiting to be filled with a bid of $6,263.

Since the order is rather large (high demand) compared to what is being offered (low supply), the orders at a lower bid cannot be filled until this order is satisfied – creating a buy wall.

In this case, the buy wall is helping the $6,263 price level of bitcoin act as short-term support.

The Sell Side

Conversely, the sell side contains all open sell orders below the last traded price.

This price is known as the “ask.” It states, “I am asking someone to buy X units I own at a certain price.”

The opposite of a buy wall is formed when there is an abundance of sell orders (supply) at a specific price level, known as a sell wall. If there is a very large sell order unlikely to be filled due to lack of demand at the specified price level, then sell orders at a higher price cannot be executed – therefore making the price level of the wall a short-term resistance.

Conclusion

All in all, the order book gives a trader an opportunity to make more informed decisions based on the buy and sell interest of a particular cryptocurrency.

Essentially, it provides a “behind the scenes” view into live-action supply and demand which may reveal order imbalances, market manipulation and support/resistance zones – all of which can be used to a savvy trader’s advantage.

Disclosure: The author holds BTC, AST, REQ, OMG, FUEL, 1st, and AMP at the time of writing.

Text on page image via Shutterstock; Charts by Trading View

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.