Today’s investors face many options beyond stocks and bonds, with crypto vs. traditional finance becoming an increasingly common discourse.

Both public and private players are constantly searching for opportunities to deploy capital into investment vehicles that yield substantial returns while posing minimal risk. However, the nature of risk appetite has evolved in the last decade with the emergence of a new asset class accessible from anywhere in the world.

Before committing resources to any industry, whether it’s decentralized finance (defi) or traditional markets, investors need to understand what separates the two. This article explores crypto vs. traditional finance: the differences, similarities, and whether now is a good time to get into them.

Сryptocurrency or traditional finance

In the debate of cryptocurrency vs. traditional finance, the key differences lie in their operational models and accessibility. Traditional finance (tradfi) relies on centralized entities like banks, governed by regulations often set by a few officials, and is limited by geographical and operational constraints. While trusted due to its long history, this system often excludes those in remote areas from accessing financial services.

On the other hand, decentralized finance (defi) operates without traditional banking infrastructure, offering transparency and community involvement through auditable codes and smart contracts. Crypto vs. finance highlights the flexibility of defi, allowing 24/7 trading globally without geographical barriers, unlike the limited trading hours of traditional markets like the U.S. stock exchange.

What is traditional finance? It’s a system where innovation can be slow due to strict regulatory compliance, whereas cryptocurrencies encourage the rapid development of new financial products. Additionally, traditional finance often incurs higher transaction costs and slower cross-border settlements than crypto’s quick and cost-effective transactions.

Investment analysis also differs between these sectors. Traditional finance investors focus on metrics like price-to-book ratios, while crypto investors consider project whitepapers, tokenomics, and community engagement. This comparison between crypto vs. finance underscores the evolving landscape of financial services and the growing appeal of cryptocurrencies.

Crypto vs. traditional finance in 2023

Markets experienced significant price movements throughout 2023. Inflation in the U.S. and countries around the globe seemingly incentivized cash injections into numerous tradfi and defi sectors to hedge against economic downturns.

According to official data, the S&P 500 recorded a 24.87% year-to-date (YTD) increase.

Gold, one of the most popular assets in tradfi, achieved its all-time high (ATH) price in 2023. Prices of the yellow metal peaked in December, trading as high as $2,150 per ounce. This represented a 13.3% growth in 12 months.

Bitcoin (BTC), crypto’s leading blockchain and token, saw a 158% YTD growth, eclipsing both the S&P 500 and gold. The cryptocurrency, often called digital gold, exchanged hands at just $43,000 as the year ended, around 36% below its ATH achieved in November 2021.

Another major cryptocurrency, Ethereum (ETH), registered 100% YTD gains, also surpassing gold and the S&P 500 in profitability. Currently, the coin is trading at $2,404, remaining the main blockchain for building crypto infrastructure and launching tokens and dapps.

However, crypto typically experiences massive volatility and price fluctuation compared to TradFi.

Why do people prefer crypto

The crypto industry is notably still in its nascent stage, although institutional interest is growing, as indicated by spot exchange-traded fund (ETF) hype, and mass adoption is also on the rise, with multiple jurisdictions developing clear rules to oversee digital assets.

Billions of dollars have been poured into cryptocurrencies as investors seek new markets with sizable returns. While crypto does feature inherent risks ranging from security concerns to bad actors, it also offers transparency since anyone can view blockchain transactions with tools like Etherscan.

This transparency allows for anonymity, as on-chain transactions show under an alphanumeric wallet address rather than a bank account associated with private information like your name and address.

On-chain transfers are immutable, which means they cannot be altered or tampered with, adding an extra layer of trust from users. Many defi protocols are also open-source; anyone can view the underlying code, reinforcing transparency within the crypto community.

Therefore, users can manage their risk while earning high returns on their initial capital investments. Additionally, crypto is controlled by the collective and encourages peer-to-peer financial interaction in a neutral environment where demand and supply exist.

Importantly, cryptocurrencies and defi are open to all, regardless of geography. You do not need government approval or bank authorization to participate in crypto. Crypto trading is, however, banned in select countries like China.

Is now a good time to invest in crypto?

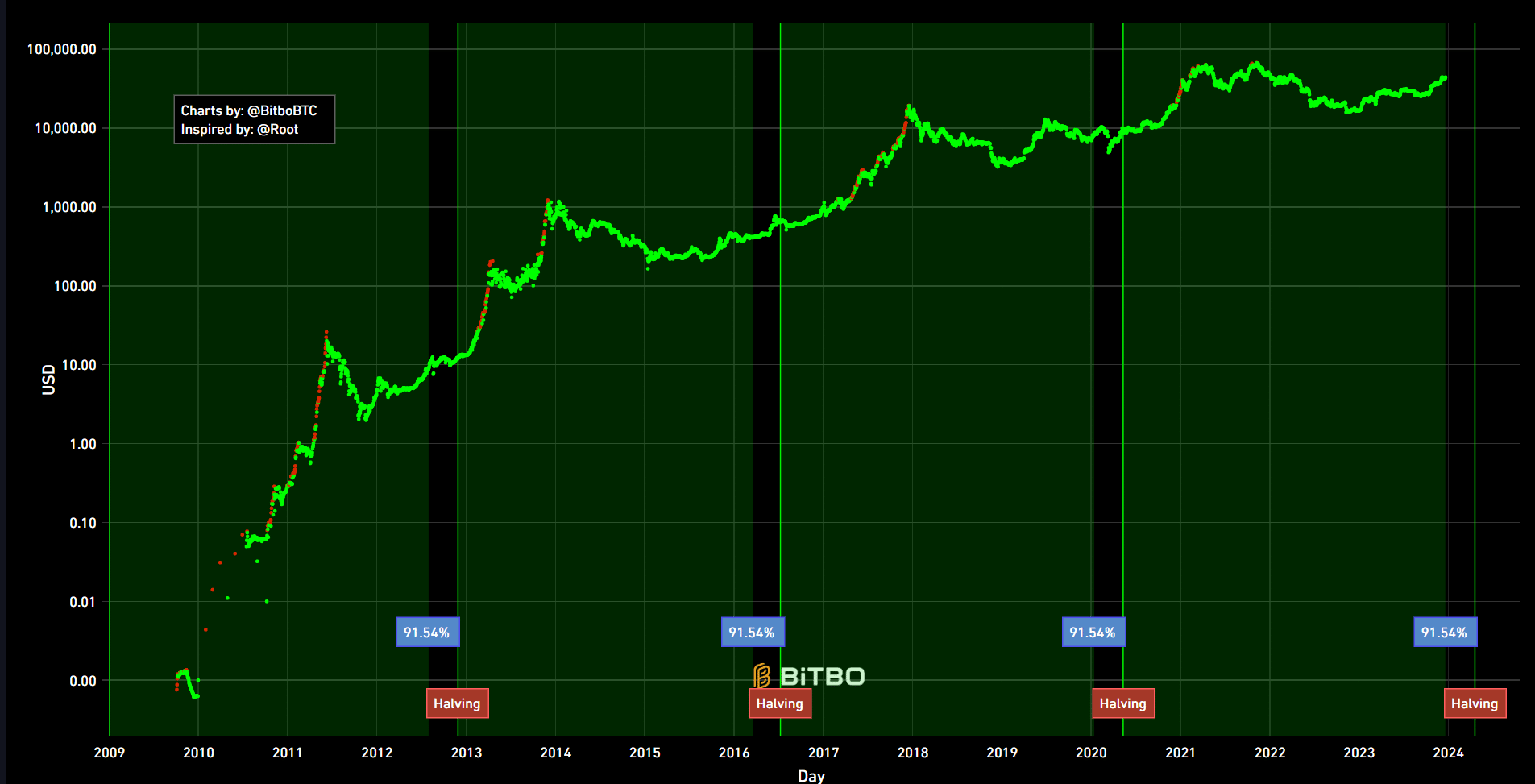

Crypto, like any financial sector, has its bear and bull cycles where the market is either up or down. Digital asset markets historically work in one to two-year intervals with anywhere from 12-34 months between cycles.

Considering that the last confirmed bull run ended in 2021, followed by a crash in 2022 marked by several crypto bankruptcies, and a resurgence in 2023 fueled by institutional interest, it might be a good time to evaluate crypto asset investments.

Wall Street titans like BlacRock have filed for exchange-traded products to invest in Bitcoin and Ethereum at spot prices. These are the world’s two largest blockchains and cryptocurrencies, with a combined market cap of over $1 trillion.

Legacy banks like JP Morgan Chase, America’s largest bank, have moved to commercialize blockchains and propel tokenization of real-world assets (RWAs) like real estate. RWAs on blockchains are already a billion-dollar industry, per Coingecko.

Furthermore, the Bitcoin halving is expected to occur by April 2024. This will effectively halve Bitcoin’s supply and create a situation that could trigger increased demand. There’s division among proponents on whether this development is already priced in. Still, data shows that Bitcoin has never returned to its pre-halving price.

A mix of cyclical patterns, institutional attention in crypto spot ETFs, BTC’s halving, and general bullish sentiment means this may be a good time to invest in crypto. However, when investing in speculative markets and risk assets like digital currencies, caution is advised.

Conclusion

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cryptocurrencies and traditional finance have both had watershed moments in 2023. Assets like gold hit an ATH, and the world’s largest asset managers were interested in BTC and ETH, an indicator that billions of dollars in retail money may soon flood into cryptos.

Overall, top cryptocurrencies outperformed traditional markets and ultimately came out on top in the crypto vs. traditional finance match-up in 2023. However, it’s important to keep in mind that both markets can be volatile, and thus, investors should be sure to do their due diligence before making any investment decision in 2024 or further in the future.