In the past 24 hours, the price of ether, the native crypto asset of the Ethereum blockchain protocol, has increased by five percent against the U.S. dollar.

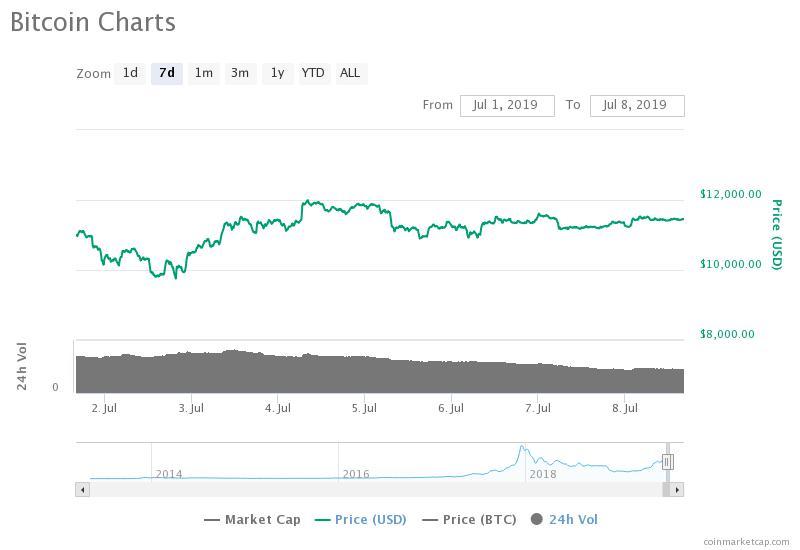

e bitcoin price recovered by two percent.

The valuation of the crypto market has remained relatively stable in the past seven days, hovering at around $320 billion.

More institutional development, will bitcoin benefit from it?

According to Zerohedge, JPMorgan has said that the emergence of a new bond asset class denominated in crypto assets like bitcoin has become a possibility following the approval of two European companies.

“The approval to two European companies to launch the world’s first institutional grade bitcoin-denominated bond that contains no fiat exposure for investors leads the way for the emergence of a new bond asset class denominated in cryptocurrencies: JPM,” the publication reported.

Bitcoin’s large year-to-date gain, which is estimated to be at around 210 percent even after its 30 percent plunge from its yearly high at $14,000, has primarily been attributed to the consistent increase in the inflow of institutional capital throughout 2018 and the past six months.

Analysts do not necessarily believe that the growth of institutional capital directly led the bitcoin price to increase by large margins in recent months. Rather, some have said that institutions prefer to invest with a long term strategy and are less likely to liquidate their holdings in the short to medium term.

The inflow of institutional capital may have established a strong fundamental layer in the global market for bitcoin and other major crypto assets to recover despite the lack of retail interest at the level of 2017.

“The 2013 bubble was driven by technocrats and dark web trawlers and the 2017 rally was led by the whims of speculative retail traders, 2019’s growth belongs to financial institutions who are diversifying stale portfolios and finally have the professional machinery to do so,” BCB CEO Oliver von Landsberg-Sadie told CoinDesk.

As institutional infrastructure improves and the inflow of institutional capital is sustained throughout the upcoming months, bitcoin is likely to be the main beneficiary of the shift in trend.

But, several companies like CME Group, the operator of the biggest bitcoin futures market which recently surpassed $1 billion in daily volume, are said to be preparing to establish a futures market for Ethereum in the future.

A Bitwise report in March indicated that the CME bitcoin futures market accounted for a large portion of the global bitcoin volume when fake volumes from the market are removed.

The report read:

“And, when you remove fake volume, CME and CBOE futures volume is significant ($91M), especially compared to the real spot volume (35% for Feb 2019). This is good news because it means CME— a regulated, surveilled market— is of material size, which important for an ETF.”

If a futures market for Ethereum by CME Group opens in the near term, it is a possibility that the global volume of the asset increases and opens up the asset to a broader market of investors in the U.S.

Other alternative crypto assets struggling

Although Ethereum has shown some momentum in the past 24 hours, other alternative crypto assets, which often recover in tandem with bitcoin and leading cryptocurrencies, have struggled against the U.S. dollar.

Unlike previous bull markets, the crypto market has recently shown decoupling and independent price movements.

Click here for a real-time ethereum price chart.