Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Rob from the poor and give to the rich? Robinhood prompts furious backlash after restricting trades

The volatility seen on the stock markets this week made some of Bitcoin’s recent price swings look tame. And it’s all down to a dramatic face-off between a Reddit group called r/Wallstreetbets and the short-selling hedge funds that Reddit took on at their own game.

Day traders have helped GameStop stock surge from $17.25 on Jan. 4 to highs of $483 this week — a 2,700% rise for a retailer struggling to survive in an online world. This inflicted billions of dollars of pain on established investors caught up in the short squeeze.

But Robinhood caused controversy when it restricted trades on GME stock, as well as other r/Wallstreetbets targets, including AMC Entertainment, BlackBerry and Nokia. The investing app, which has proven popular with millennials, was accused of preventing average investors from fighting back against hedge funds manipulating the market.

The SEC is now looking into Robinhood’s handling of GameStop trading, with Congress announcing hearings into the practice of short selling.

All of this drama could bring crypto assets into sharper focus. Industry executives have described the fiasco as a “clear indication of how broken and fundamentally rigged the traditional financial system is.”

Bitcoin soars by $5,000 in minutes — BTC hits $38,000 after Elon Musk’s ‘Dogecoin treatment’

The GameStop saga can be linked to several of the other top stories this week. Tesla CEO Elon Musk has been among those cheering on r/Wallstreetbets, and this week, he offered a ringing endorsement of crypto as an alternative.

The world’s richest man quietly added “#bitcoin” to his Twitter bio… with BTC surging by more than $5,000 within minutes as a result. This helped turn the fortunes of the world’s biggest cryptocurrency around, as it had been at peril of losing support at $30,000.

Alas, the price boost was short-lived. In the 24 hours that followed, BTC headed back toward $33,000 — leaving $34,500 as a significant resistance zone that needs to be broken if there’s any chance of sustaining bullish momentum.

Cointelegraph Markets analyst Michaël van de Poppe says the critical level to watch now is the $30,000 region. “If that fails to sustain support (after numerous tests already), I expect a drop toward $25,000 and the 21-Week MA,” he wrote.

Dogecoin ranks among top 10 crypto assets for first time since 2015

And another symptom of this week’s mayhem saw Dogecoin surge 900% in less than two days. The meme coin was well and truly unleashed, sprinting from $0.0078 to $0.078 and quadrupling its previous all-time high.

DOGE’s sudden parabola was attributed to an organized pump carried out by r/Wallstreetbets, and Robinhood also ended up suspending instant deposits for crypto purchases because of the “extraordinary market conditions.”

At one point, DOGE briefly surpassed Bitcoin in daily trading volumes on Binance — with its market cap leapfrogging ahead of Litecoin, Bitcoin Cash and Stellar. Tweets about Dogecoin also surged by 1,787%, with 89,991 posts about DOGE in just 24 hours.

Unfortunately, dogs bite — and traders were left licking their wounds after a vicious dump. Prices fell by 45.82% in a single day, leaving many with buyer’s remorse. On Twitter, RyanJK captured the mood by writing: “Doge doing what it does best, welcoming people into crypto with a huge slap in the face.”

Ripple demands to know why Ether isn’t a security as XRP defense gets desperate

Ripple Labs has filed its response to the Securities and Exchange Commission over allegations that XRP is a security — and the company seems prepared to drag the rest of the industry into its legal fight.

The embattled firm has filed a Freedom of Information Act request that demands information “about how the SEC determined the status of Ether as a non-security.”

Representatives at the SEC have said that, while Ether’s presale may have been a securities offering at the time, ETH is now sufficiently decentralized and qualifies as a commodity.

Ripple has been throwing the kitchen sink at efforts to stave off the SEC’s case, which has caused the price of XRP to collapse, with many U.S. exchanges delisting the token. But curiously, the altcoin has had something of a weekend boost, with prices up 30%.

Coinbase unveils plans for direct stock listing

Coinbase has announced plans to pursue a direct listing of its Class A common stock, instead of plumping for an initial public offering.

This means that the major crypto exchange won’t be offering new shares to investors and, instead, will sell existing equities to the public.

Some advantages of the format for those holding stock in the company can include the ability to sell without lockups, creating “instant billionaires.”

When Coinbase first announced its intent to go public on Dec. 17, figures from Messari suggested the exchange could be worth $28 billion after going public.

Coinbase Pro has a history of experiencing outages and other issues at high-traffic times, and once again, users reported suffering difficulties at one point this week.

As Ryan Broderick wrote on Twitter: “The GameStop effect has completely upended the crypto market now. There’s a big Twitter-led $btc pump happening today and Coinbase — basically the Robinhood for entry-level crypto trading — has frozen USD purchases. Just tested it myself.”

Winners and Losers

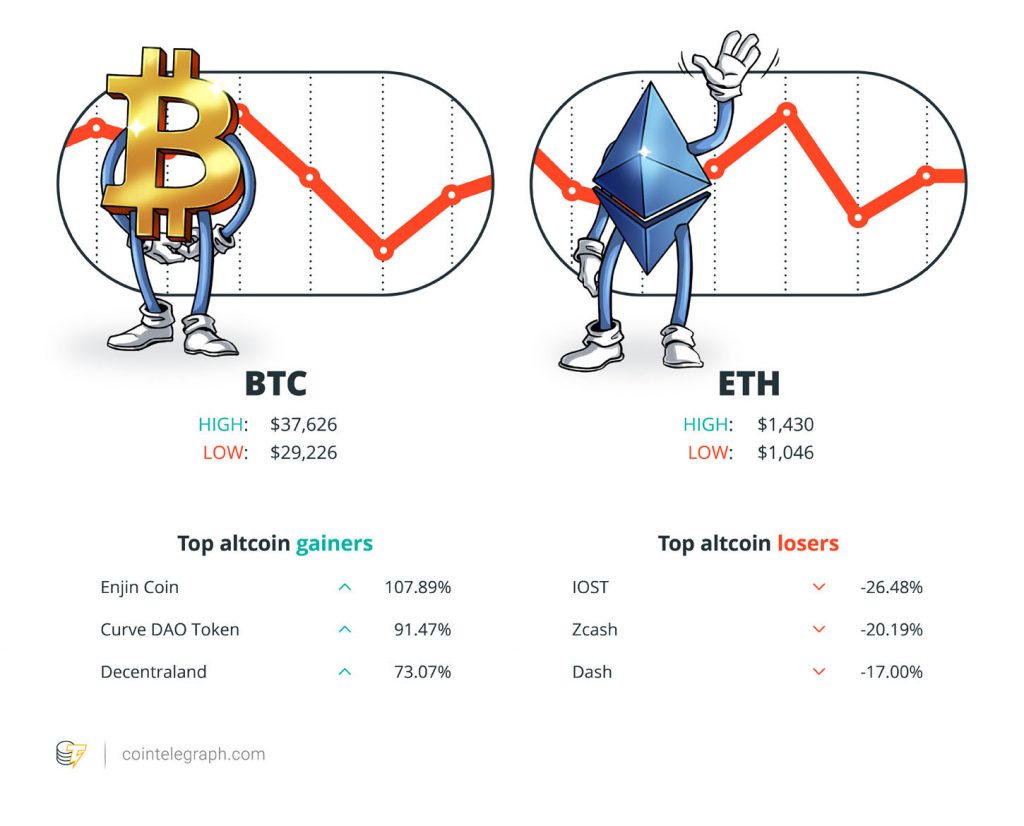

At the end of the week, Bitcoin is at $34,293.71, Ether at $1,365.72 and XRP at $0.38. The total market cap is at $1,012,676,711,938.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Fantom, Dogecoin and Voyager Token. The top three altcoin losers of the week are Enjin Coin, Decentraland and NXM.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“With upcoming Chinese New Year holidays, we expect this [Bitcoin] selling pressure to continue in the short-term, providing good entry opportunities for market participants.”

Lennard Neo, Stack Funds head of research

“Has Doge ever been to a dollar?”

MSB Chairman, parody Twitter account

“Right now, the reality of the institutional demand that would support a $35,000 price or even a $30,000 price is just not there. I don’t think the investor base is big enough and deep enough right now to support this kind of valuation.”

Scott Minerd, Guggenheim CIO

“If you are using a mobile crypto wallet on an iOS device, be sure to update iOS as soon as possible!”

Pete Kim, Coinbase head engineer

“If you don’t like suits, buy $GME and $AMC. If you don’t like the bankers, buy #Bitcoin.”

Cameron Winklevoss, Gemini co-founder

“People have maximum interest at $40,000 per #Bitcoin, but almost zero interest at $30,000 per #Bitcoin. Interesting.”

Michaël van de Poppe, Cointelegraph Markets analyst

“Gamestonk!!”

Elon Musk, Tesla CEO

“Are cryptocurrencies here to stay? Digital innovation in payments – yes. Have we landed on what I would call the design, governance and arrangements for a lasting digital currency? No, I don’t think we’re there yet.”

Andrew Bailey, Bank of England governor

“If I were a regulator, I would be kind of hyperventilating at the success of [Bitcoin] at the moment, and I would be arming myself to deal with it.”

Lloyd Blankfein, Goldman Sachs senior chairman

Prediction of the Week

Guggenheim says institutional demand not enough to keep BTC above $30,000

Guggenheim’s Scott Minerd has come out with another gloomy price outlook for Bitcoin, stating there’s not enough institutional demand to keep the asset over $30,000.

Speaking to Bloomberg, the chief investment officer said: “Right now, the reality of the institutional demand that would support a $35,000 price or even a $30,000 price is just not there. I don’t think the investor base is big enough and deep enough right now to support this kind of valuation.”

Minerd also believes that the downward pressure has a lot further to go, explaining that it is “not uncommon to see squeezes like this.”

On Jan. 20, Minerd told CNBC that he expects prices to retrace back to $20,000. The last time BTC fell by over half was in March 2020, when it dropped from just over $10,000 to below $5,000 in just three weeks.

FUD of the Week

Apple updates iOS to fix crypto wallet security vulnerabilities

Apple has issued new security updates for its mobile operating system after the iPhone maker discovered vulnerabilities that could compromise crypto wallets.

The security updates, which were released Tuesday, affect iOS 14.4 and iPadOS 14.4. The vulnerabilities reportedly allowed hackers to gain remote access to a target system, thereby exposing the user’s cryptocurrency wallet.

Pete Kim, Coinbase’s head engineer, issued this warning: “If you are using a mobile crypto wallet on an iOS device, be sure to update iOS as soon as possible!”

Crypto crime dropped 57% in 2020, but DeFi hacks surged, CipherTrace says

Crimes targeting the virtual currency sector decreased by more than half in 2020, according to blockchain security firm CipherTrace.

Overall losses from crypto theft, hacks and fraud fell 57% in 2020 to $1.9 billion, due mainly to improved security systems — but it wasn’t all good news.

Last year also saw a surge in crime related to decentralized finance, and the majority of incidents were “rug pulls.” This is where a token is artificially hyped and inflated, with the creators and early investors pulling the plug after the pump, leaving the latecomers out of pocket.

CipherTrace’s report warned that 50% of all crypto hacks were linked to DeFi protocols, with 99% of major fraud volume in the second half of 2020 stemming from rug pulls.

BoE Governor: Cryptocurrencies of today are destined to fail long term

The current generation of crypto assets lacks the design and structure needed to ensure long-term survival, Bank of England Governor Andrew Bailey has warned.

Speaking during a World Economic Forum panel, he said: “Are cryptocurrencies here to stay? Digital innovation in payments — yes. Have we landed on what I would call the design, governance and arrangements for a lasting digital currency? No, I don’t think we’re there yet.”

Bailey also indicated that the levels of transactional privacy afforded by crypto assets are a source of concern among regulators.

Best Cointelegraph Features

Risk it for the Bitcoin: Has BTC matured to be a safe investment play?

Institutional investors have arrived at the cryptocurrency table, but does that mean that Bitcoin has now become a safe investment?

DOGE price surge: The power of memes and social media on full display

Dogecoin, the quintessential meme crypto, is being pulled on a leash by yet another social media-driven hype.

Zombies not welcome: Original altcoins lose ground to DeFi newcomers

As DeFi takes over the cryptosphere, will the zombie projects remain dead after the great repricing?