Since its inception, the Uniswap Protocol (”Uniswap”) has served as trustless and highly decentralized financial infrastructure.

Inspired by Ethereum’s vision, we have long committed to the ideals of permissionless access, security, and immutability, all indespensable components for a future where anyone in the world can access financial services without fear of discrimination or counterparty risk.

Now rivaling centralized incumbents on daily volume, Uniswap’s success to date — achieved without involvement of the core development team since deployment — indicates that there is considerable demand for permissionless financial services.

In less than two years, the protocol has:

-

Supported over $20bn volume ($270k of which was socks!) traded by over 250,000 unique addresses across 8,484 unique assets

-

Secured over $1bn liquidity deposited by over 49,000 unique liquidity providers (LPs), earning $56m fees in the process

-

Emerged as foundational DeFi infrastructure, with integrations across hundreds of interfaces and applications

Having proven product-market fit for highly decentralized financial infrastructure with a platform that has thrived independently, Uniswap is now particularly well positioned for community-led growth, development, and self-sustainability. The introduction of UNI (ERC-20) serves this purpose, enabling shared community ownership and a vibrant, diverse, and dedicated governance system, which will actively guide the protocol towards the future.

Uniswap has always embraced the tenets of neutrality and trust minimization : it is crucial that governance is constrained to where it is strictly necessary. With this in mind, the Uniswap governance framework is limited to contributing to both protocol development and usage as well as development of the broader Uniswap ecosystem.

In doing so, UNI officially enshrines Uniswap as publicly-owned and self-sustainable infrastructure while continuing to carefully protect its indestructible and autonomous qualities.

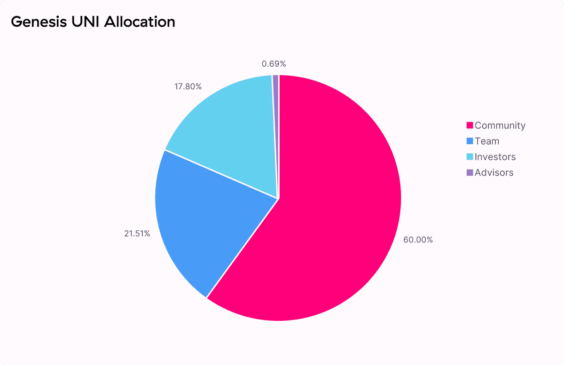

UNI Allocation

1 billion UNI have been minted at genesis and will become accessible over the course of 4 years. The initial four year allocation is as follows:

-

60.00% to Uniswap community members

600,000,000 UNI -

21.266% to team members and future employees with 4-year vesting

212,660,000 UNI -

18.044% to investors with 4-year vesting

180,440,000 UNI -

0.69% to advisors with 4-year vesting

6,900,000 UNI

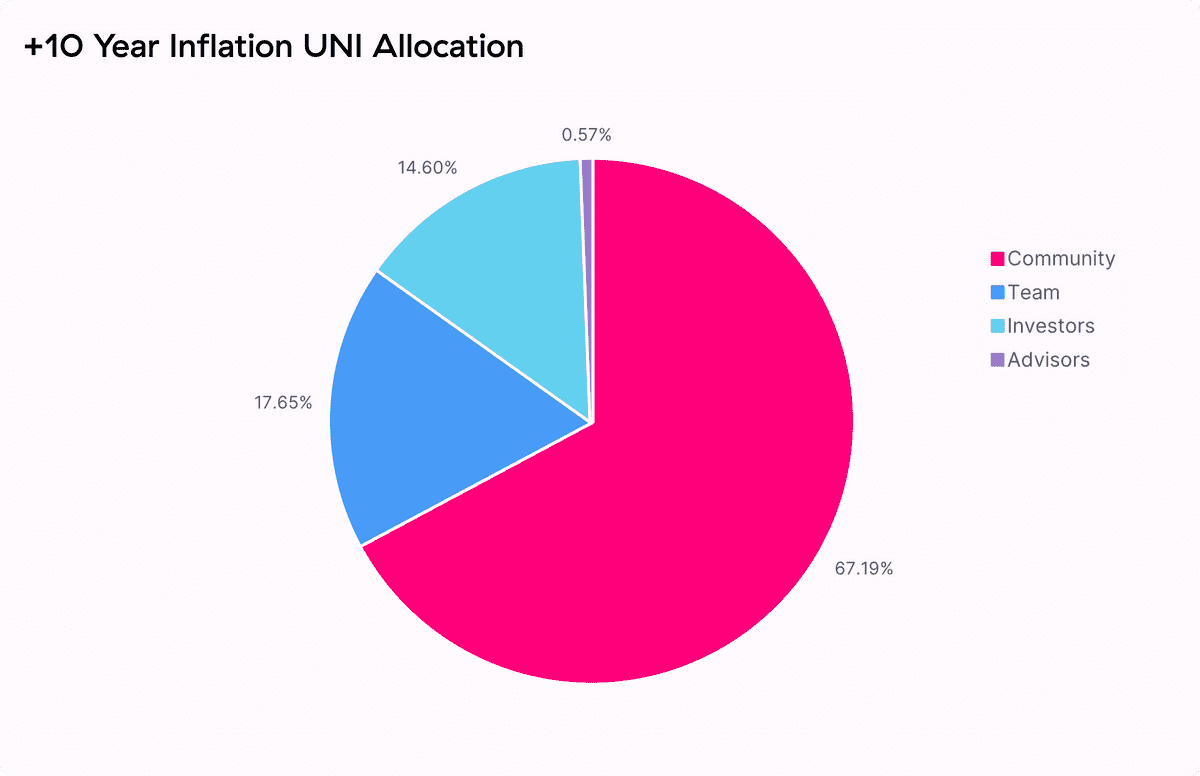

A perpetual inflation rate of 2% per year will start after 4 years, ensuring continued participation and contribution to Uniswap at the expense of passive UNI holders.

A Retrospective

Uniswap owes its success to the thousands of community members that have joined its journey over the past two years. These early community members will naturally serve as responsible stewards of Uniswap.

15% of UNI 150,000,000 UNI can immediately be claimed by historical liquidity providers, users, and SOCKS redeemers/holders based on a snapshot ending September 1, 2020, at 12:00 am UTC.

4.91664% pro-rata to all 49,192 historical LPs 49,166,400 UNI

~49 million UNI are claimable by historical liquidity providers. The formula accounts for LP liquidity on a per-second basis since the deployment of Uniswap v1, ensuring that rewards are weighted towards LPs that provided liquidity when total liquidity was low.

10.06136% split evenly across all 251,534 historical user addresses 100,613,600 UNI

400 UNI are claimable by each address that has ever called the Uniswap v1 or v2 contracts. This includes ~12,000 addresses that have only ever submitted failed transactions — love you guys.

0.022% to 220 SOCKS holders/redeemers 220,000 UNI

1000 UNI are claimable by each address that has either redeemed SOCKS tokens for physical socks or owned at least one SOCKS token at the snapshot date.

View the formula source code here

Community Treasury

With 15% of tokens already available to be claimed by historical users and liquidity providers, the governance treasury will retain 43% [430,000,000 UNI] of UNI supply to distribute on an ongoing basis through contributor grants, community initiatives, liquidity mining, and other programs.

UNI will vest to the governance treasury on a continuous basis according to the following schedule. Governance will have access to vested UNI starting October 18 2020 12:00am UTC.

| Year | Community Treasury | Distribution % |

|---|---|---|

| Year 1 | 172,000,000 UNI | 40% |

| Year 2 | 129,000,000 UNI | 30% |

| Year 3 | 86,000,000 UNI | 20% |

| Year 4 | 43,000,000 UNI | 10% |

Team, investor, and advisor UNI allocations will have tokens locked up on an identical schedule.

Liquidity Mining

An initial liquidity mining program will go live September 18 2020 12:00am UTC. The initial program will run until November 17 2020 12:00am UTC and target the following four pools on Uniswap v2:

-

ETH/USDT

-

ETH/USDC

-

ETH/DAI

-

ETH/WBTC

5,000,000 UNI will be allocated per pool to LPs proportional to liquidity, which roughly translates to:

-

83,333 UNI per pool per day

-

13.5 UNI per pool per block (14s blocktime)

These UNI are not subject to vesting or lock up.

After 30 days, governance will reach its vesting cliff and Uniswap governance will control all UNI vested to the Uniswap treasury. At this point, governance can vote to allocate UNI towards grants, strategic partnerships, governance initiatives, additional liquidity mining pools, and other programs.

Governance assets

A community-managed treasury opens up a world of infinite possibilities. We hope to see a variety of experimentation, including ecosystem grants and public goods funding, both of which can foster additional Uniswap ecosystem growth. Uniswap has set the standard for automated liquidity provision: it is now time to set the benchmark for responsible but radical, long-term aligned on-chain governance systems.

Uniswap governance will be live from day one, although control over the treasury will be delayed until October 17 2020 12:00am UTC. Control over the Uniswap fee switch is subject to a 180 day time lockdelay.

These grace periods provide the Uniswap community enough time to familiarize itself with the governance system, bring in a diverse and high-quality set of protocol delegates, and begin discussions and communications around potential governance proposals.

UNI holders are responsible for ensuring that governance decisions are made in compliance with applicable laws and regulations. To help facilitate this, the fee switch has been initialized to a contract UNI holders can use to vote on tokens for which they will collect fees. The community is encouraged to consult knowledgeable legal and regulatory professionals before implementing any specific proposal.

The Uniswap team will continue to have no involvement in v2 protocol development, auditing, and other matters. Similarly, team members will not participate directly in governance for the foreseeable future, although they may delegate votes to protocol delegates without seeking to influence their voting decisions.

In the meantime, UNI holders will have immediate ownership of:

Initial governance parameters are as follows:

-

1% of UNI total supply (delegated) to submit a governance proposal

-

4% of UNI supply required to vote ’yes’ to reach quorum

-

7 day voting period

-

2 day timelock delay on execution

Next steps

All historical users, liquidity providers, and SOCKS redeemers can claim their UNI now.

Liquidity providers in the preliminary set of targeted pools can deposit their liquidity tokens. Mining will begin on September 18th 2020 12am UTC.

UNI tokens can be delegated and used to vote through the governance portal.

Set up an account on gov.uniswap.org to start shaping and participating in protocol governance

Contracts

UNI Token:

https://etherscan.io/token/0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

Liquidity mining:

Governance:

https://etherscan.io/address/0x5e4be8Bc9637f0EAA1A755019e06A68ce081D58F

Timelock:

https://etherscan.io/address/0x1a9c8182c09f50c8318d769245bea52c32be35bc