By CCN Markets: The Italian government is mulling the decision to issue a “parallel currency” in a move that could plunge the eurozone into crisis – and provide the best case yet for mass bitcoin adoption.

In the same week, the Italian deputy prime minister proposed a tax grab on cash and valuables stored in safety deposit boxes.

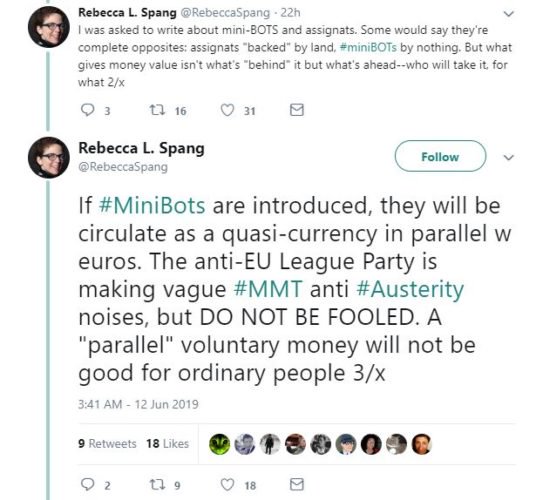

These crisis policies expose deep cracks in the fiat monetary system. The move prompted money historian Rebecca L. Spang to call for a new foundation of money.

“The time has come for a new, more equitable, version of money.”

While she doesn’t refer to cryptocurrency directly, the Italian crisis does build a compelling argument for bitcoin.

Explaining Italy’s “parallel currency” crisis

The proposed currency bills, known as mini-BOTs, are basically treasury bonds (buono ordinario del tesoro). But in a twist of economic rules, they’d be issued and accepted as a form of payment by the Italian government, circulating alongside the euro.

Mini-BOTs were initially conceived to pay back Italy’s insurmountable debt mountain (yes, paying debt with more debt). But the government would also accept the mini-BOTs back as payment for taxes, train tickets, and gasoline.

Many euro-skeptics may also adopt the new currency as an act of rebellion against the euro.

Credit rating agency Moody’s called it:

“A first step towards the creation of a parallel currency and preparation for Italy’s exit from the eurozone.”

The flaws of fiat

The trouble with circulating new money in a time of crisis is that it debases the existing currency value. As Spang explains:

“As a member of the euro, Italy cannot legally issue its own currency. But if the government paid its creditors in mini-BOTs – and if they agreed to take them back again as payment for taxes or train tickets – then total liquidity could increase without expansion of the official money supply.”

In other words, Italy would flood the market with the new currency, devalue the euro, drive up debt, and potentially spark runaway inflation.

In a worst-case scenario, whereby Italy prepares to leave the eurozone, a euro issued in Italy may hold less value than a euro issued in France. If the euro loses fungibility, it loses credibility as “good money.” Crisis ensues.

Bitcoin matters in Italy’s economic crisis

The Italian crisis builds a compelling argument for bitcoin.

Contrary to fiat money, bitcoin is deflationary, non-political, open and equitable. It can’t be manipulated, printed, or controlled by a single government.

While nation-states recklessly conjure new money from debt, bitcoin maintains a hard, fixed supply.

The argument for storing wealth in bitcoin grows even stronger when you consider Italy’s proposed tax on safety deposit holdings. If the Italian government goes ahead with this policy, expect depositors to shift their money into an asset that isn’t beholden to geographical borders.

Bitcoin or not, “the time has come for a new form of money”

Bitcoin may not be the right answer, but Spang argues that some form of depoliticized money is the future.

“We need a new, more equitable model for money and money production. But that money should be indefinitely politicized is, I think, truly an awful thing to contemplate.”

The analysis above only scratches the surface of the crisis in Italy and its impact on the monetary system. Read Spang’s full tweet-thread and Tuur Demeester’s tweet analysis for more.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN Markets.