Recent data from Skew shows that Bitcoin’s (BTC) implied volatility plummeted after yesterday’s halving occurred. Generally, volatility is at the heart of any professional trader as it measures daily average price oscillations and gives insight into market conditions.

As previously reported by Cointelegraph, Bitcoin’s halving event tends to increase volatility due to its significant uncertainties. Traders anticipated that the price would either rally or dump during and after the event, thus the short term spike. At the time of writing the metric has gone back to previous levels.

Uncertainties can drive volatility

For the past few months analysts have spun the narrative that a significant hashrate drop could occur after the halving. This would supposedly be driven by miners shutting down their ASIC-based operations due to Bitcoin’s block subsidy cut to 6.25 BTC from the previous 12.5 BTC.

To date there still is a valid concern of a ‘death spiral’ beginning, which would force large miners to sell reserves, and possibly even bankrupt those who are more leveraged. One possible driver of this breakdown would be the fact that revenue vital for miners has been cut.

Keep in mind that transaction fees rarely exceed 5% of miners’ revenue, which is composed mostly by this block subsidy reward. Cutting the $5 billion mining industry revenues by half can produce wavelengths of unexpected results, including hard forks.

Traders rely on implied volatility, and the halving impacted this metric

BTC ATM Implied Volatility. Source: Skew

There are two ways of measuring volatility, either using historical data or analyzing current options market premiums. It is important to note that historical data has a disadvantage when approaching price-sensitive events as it favors past movements.

For Bitcoin, volatility had been on a continuous reduction since its peak after Bitcoin’s $3,600 crash on March 12. Entering May, Bitcoin implied volatility stabilized around the 80% level as the Bitcoin’s halving approached.

Options markets present a perfect way to measure potential price swings because they rely on traders’ skin-in-the-game. The higher premiums demanded by options sellers reflect increased fear of incoming volatility.

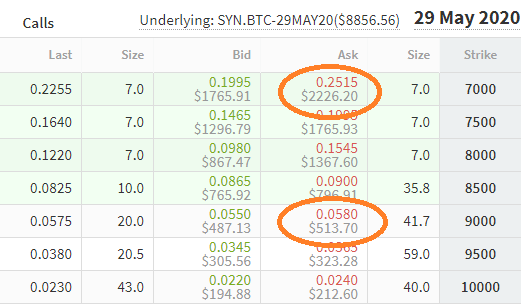

As shown by the chart below, ATM options mean that strikes used to calculate are at the money, meaning $9,000 for the current Bitcoin (BTC) underlying price of $8,900.

Call (bullish) options pricing. Source: Deribit

Those are the standard for volatility measures due to their near absence of intrinsic value. A buyer of a call (bullish) option with a $7,000 strike faces a $1,900 intrinsic value, as Bitcoin is trading significantly above that level.

How traders may interpret the drop in implied volatility

Implied volatility reaching peak levels means options markets premiums spiked. This should be interpreted as the market charging higher for insurance, and it goes both ways for calls (bullish) and puts (bearish) options.

The basic strategy of buying a call option grants protection if the market goes up. By paying a premium upfront, one will then be able to acquire Bitcoin for a predetermined price. The opposite holds for the put option buyer, who’s buying insurance in case of a sudden price drop.

One thing to note is that a change in volatility is not a bullish nor bearish indicator. Unusually high levels reflect uncertainty and should lead traders to ensure stop-loss orders are in place and significant margin deposited for leverage trades.

Low volatility does not equal lower risk

Some traders tend to extrapolate that low volatility scenarios mean lower risks for unexpected large candles. Rest assured, there is no such indicator. One should use such periods to build insurance positions via option markets.

On the other hand, if a trader is caught off guard during a high volatility scenario, they should either close all positions to avoid unnecessary stop-loss execution or brace for ups and downs that will almost certainly liquidate leveraged traders.

For more information on how to understand the complexities of the crypto market, have a look at 10 tips to keep your crypto portfolio profitable during a crisis.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.