The price of bitcoin continues its rise ahead of next week’s anticipated halving. That event is trending as a topic on social media, even as few appear to be considering what may happen after it’s over.

At press time bitcoin (BTC) was trading up 6.5% over 24 hours, currently at $9,882. It’s been on a run upward on high volume since 12:00 UTC (8 a.m. ET), moving from $9,270 during that time to as high as $9,971 on spot exchanges like Coinbase.

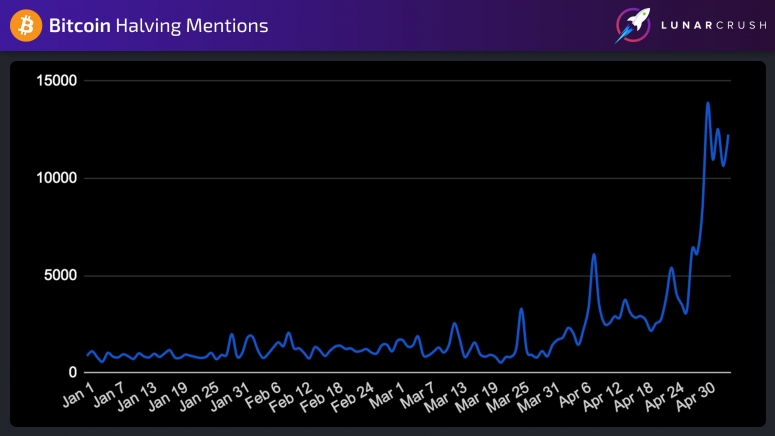

Discussion of “bitcoin halving,” the once-every-four-year event that will lower by half the supply of new bitcoins awarded to miners, has spiked higher than ever over the past week, according to social media data tracked by data aggregator LunarCRUSH. “After months of suppression, mentions of the bitcoin halving event on social media have now exploded,” Mati Greenspan, founder of Quantum Economics, noted in a tweet.

Bitcoin’s price climb could be partially attributed to new investor interest in the midst of the recent economic tumult, says Matthew Ficke, head of market development for cryptocurrency exchange OKCoin. “This halving has received an incredible amount of publicity, far surpassing previous halvings particularly against the backdrop of the traditional financial markets.”

Read More: Bitcoin Halving Explained 2020

Many newer crypto investors see that, historically, bitcoin’s price has gone much higher, and it can rise to those levels again, Ficke points out. “BTC/USD topped out around $10,400 in October 2019 and February 2020, so it is reasonable to view this as a short-term attraction.”

Ficke may be right about the halving being of short-term interest to investors. Darius Sit, partner at Singapore-based trading firm QCP Capital, is not bullish on a soaring post-halving bitcoin price.

“Regarding halving, we hold the view that impact on price might not be material,” said Sit.

Demand-side buying before the halving has been attributed to “fear of missing out,” or FOMO, as one driver in the crypto market right now. But can it last? Sit is skeptical. “Daily mined supply to 900 BTC, or just under $7 million at these levels, is a small fraction of the current daily trading volume. BTC price would be driven more by demand-side than supply-side dynamics,” he said.

That supply-side dynamic of the mining business might not look good either, as miners are going to have to make some operational decisions once the halving is complete.

Many mining machines will become worthless for bitcoin mining because they won’t be profitable after the reward drops from 12.5 to 6.25 BTC, said Zach Resnick, partner at crypto investment firm Unbounded Capital. “Bitcoin miner revenue will go down by close to 50% once the block subsidy is cut in half, which means for all but the most professionalized miners BTC mining will become unprofitable overnight absent a significant run-up in the price.”

That could mean bitcoin selling might be on the way from smaller miners who can’t hack the halving’s reduction in crypto inflow. “Our view is that the less-efficient miners might capitulate and sell their BTC holdings,” QCP’s Sit told CoinDesk.

Other markets

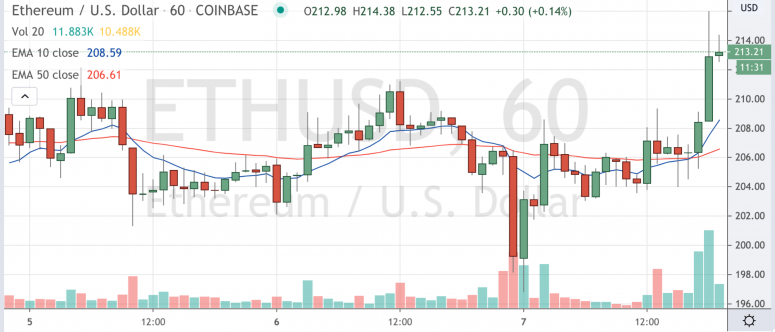

Digital assets on CoinDesk’s big board are up on Thursday. The second-largest cryptocurrency by market capitalization, ether (ETH), gained 3.8% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Cryptocurrency winners include neo (NEO) in the green by 7.2%, monero (XMR) up 7% and dogecoin (DOGE) out of the doghouse, up 5.6%. The lone loser is lisk (LSK) in the red 1.5%. All price changes were as of 20:00 UTC (4:00 p.m. EDT) Thursday.

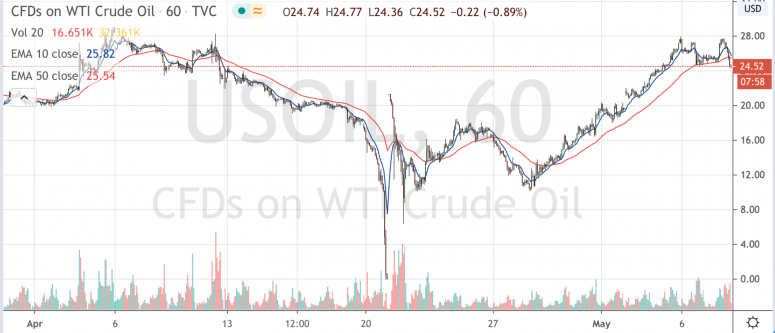

After remarkable turmoil in the oil market since April, crude is trading sideways, and is down 3.5% in trading Thursday.

Gold is making some gains in trading today, up 2% and closed the New York trading session at $1,716.

In the United States, the S&P 500 index of large-cap stocks was up 1%. U.S. Treasury bonds all slipped Thursday. Yields, which move in the opposite direction as price, fell most on the two-year bond, down a whopping 25%.

Europe’s FTSE Eurotop 100 index of the continent’s largest publicly traded companies closed up less than a percent. In Asia, the Nikkei 225 index in Tokyo opened trading for the first time this week after a holiday had the markets closed and was up less than a percent with gains in transportation and real estate.

Equities performing either flat or up this week belies the looming danger of an increasingly uncertain global economy, according to Chris Beauchamp, chief market analyst at investment platform IG. “Warnings of terrible economic performance this year have been followed by predictions of a moderate rebound for next year. But as companies around the globe are discovering, it is almost futile to predict what the next few quarters will look like,” Beauchamp said.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.