While the market expects bitcoin to be calm over the next few days, attention is now on the economy, with the U.S. looking as if it turned a corner in May. However, some observers see fundamental problems ahead.

Bitcoin (BTC) was trading around $9,735 as of 20:00 UTC (4 p.m. ET), gaining 1% over the previous 24 hours.

At 00:00 UTC on Friday (8:00 p.m. Thursday EDT), the world’s largest cryptocurrency by market capitalization was changing hands around $9,800 on spot exchanges like Coinbase. The price stayed around there until 10:00 UTC (6:00 a.m. EDT), when selling caused bitcoin to drop as low as $9,584. Bitcoin is now close to its 50-day and 10-day technical indicator moving averages, indicating sideways trading heading into the weekend.

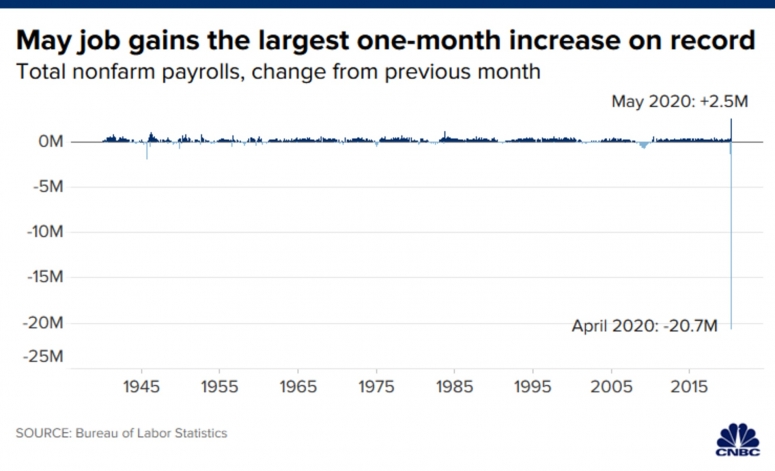

The markets story of the day was the surging performance of stocks on Friday. Economic data released from the U.S. Labor Department showed May to have the largest one-month employment increase ever. That was after a record drop in April due to the coronavirus pandemic wreaking havoc on the global economy.

As a result, Europe posted big gains in late trading, as the FTSE 100 of top public companies closed the day up 2.25%, thus making the week positive by 6.7%. In the United States, the S&P 500 index climbed 2.6%, closing the week in the green 5.2%.

Yet the total employment number likely belies bigger economic problems ahead and the rally in equities might be short lived, said George Clayton, managing partner of Cryptanalysis Capital.

“Stocks are on Prozac,” Clayton said. “Unemployment came in better than forecast, but it’s still at 13.3%.”

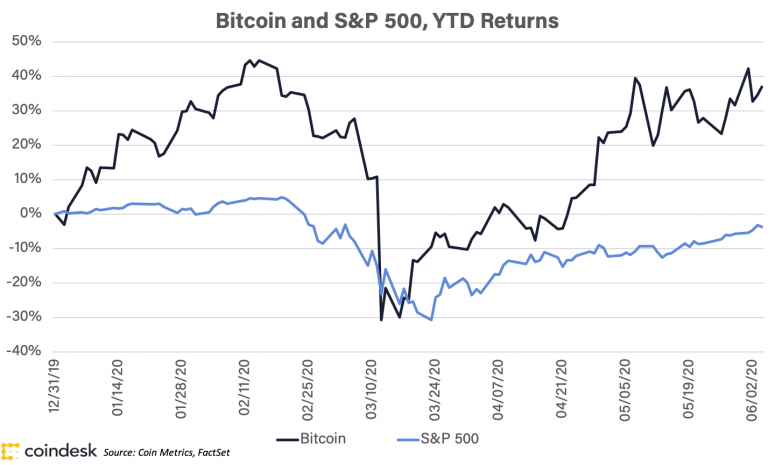

Some traders skeptical of traditional markets see crypto as the best investment during turbulent times. That likely has been one of the reasons for bitcoin’s continued outperformance relative to the S&P 500 year-to-date.

“For the last two years, many have been anticipating a global economic crisis. 2008-2009 did not change anything in the fundamental faults of global debt, money printing and wealth distribution,” said Sweden-based over-the-counter crypto trader Henrik Kugelberg.

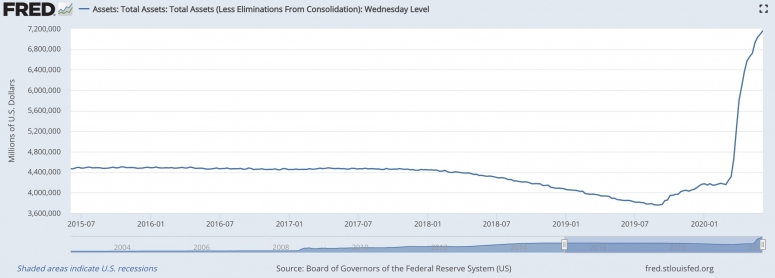

Although equities appear to be turbocharged Friday, many forget the increasing role of the U.S. Federal Reserve in traditional markets in 2020.

“There seems to be no stopping this market with the Fed liquidity pump, but they can’t hold it up forever,” said Rupert Douglas, head of institutional sales at digital asset brokerage Koine. “Bitcoin still looks good to me; I would much rather hold that than equities now,” he added.

“Eventually, share prices are going to follow the economy and it is not headed in a good direction,” Cryptanalysis Capital’s Clayton said. “Meanwhile the crypto ecosystem marches forward; bitcoin mines another block. The money printing and every other macro trend sets crypto up for a rally.”

Other markets

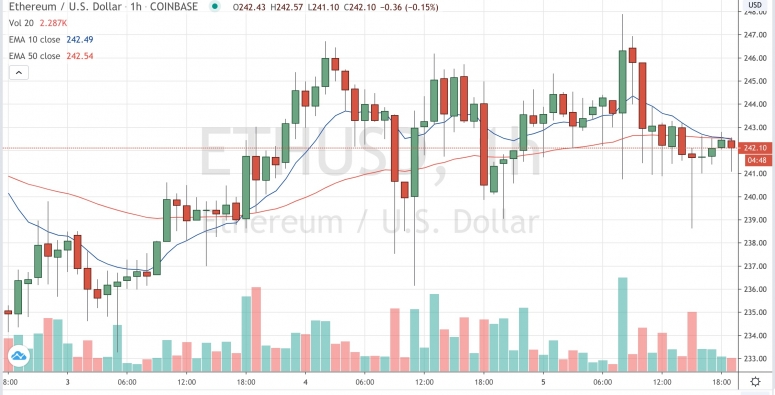

Digital assets on CoinDesk’s big board are mixed Friday. The second largest cryptocurrency by market capitalization, ether (ETH), is trading around $242 and slipped less than a percent in 24 hours as of 20:00 UTC (4:00 p.m. EDT).

Cryptocurrency winners on the day include lisk (LSK) in the green 13%, eos (EOS) climbing 5% and zcash (ZEC) up 1.6%. Cryptocurrency losers Friday include decred (DCR) down 4.6%, stellar (XLM) in the red 2%. and dogecoin (DOGE) in the doghouse 1.4%. All price changes were as of 20:00 UTC (4:00 p.m. EDT).

In commodities, oil is making big gains, UP 5% as a barrel of crude is priced at $39.17 as of press time. Gold dropped significantly in early trading Friday and while it recovered somewhat, it’s still in the red, down 1.8% for the day.

Japan’s Nikkei 225 of top companies missed the equities party by ending the day flat in the green less than a percent although up 50% from March lows.

U.S. Treasury bonds all climbed Friday. Yields, which move in the opposite direction as price, were up most on the 10-year in the green 6.7%.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.