Bitcoin returned above $42,000 at press time as the broader crypto market bounces back after a sell-off earlier this week. Traders expect volatility to remain elevated ahead of bitcoin’s September options expiry on Friday. And technical charts show limited upside for BTC toward the $47,000 resistance level.

On Wednesday, the U.S. Federal Reserve signaled that it could start to scale back, or taper, its monthly asset purchases sooner rather than later. Fed officials are preparing to reverse the central bank’s pandemic stimulus programs in November and expect to raise interest rates by the end of next year.

While overall market sentiment is improving, some analysts are concerned that tighter monetary policy could be a headwind for assets deemed to be risky such as equities and cryptocurrencies.

“With so little room for additional central bank accommodation, given an already depressed interest rate environment, the prospect for sustainable runs to the topside on stimulus, should no longer be as enticing to investors,” Joel Kruger, currency strategist at LMAX Group, wrote Wednesday in a report.

Latest Prices

- Bitcoin (BTC), $43,400, +3.3%

- Ether (ETH), $3,023, +4.8%

- S&P 500: +1.0%

- Gold: $1,768, -0.4%

- 10-year Treasury yield closed at 1.306%

Bitcoin options expiry

Major crypto options exchanges, including industry leader Deribit, are due to settle billions of dollars’ worth of bitcoin options contracts on Friday. Analysts don’t expect the monthly expiration to have a notable impact on bitcoin, which has been under pressure this week because of macro and regulatory concerns, CoinDesk’s Omkar Godbole reports.

Data provided by Skew shows a total of 73,700 options contracts worth $3.14 billion due for expiry Friday, of which nearly 50,000 are call options and the rest are puts. Deribit alone will be settling more than 85% of the total open interest.

While short-term prospects appear to be bleak, the options market continues to exhibit long-term bullishness, with the June 2022 expiry risk reversals holding above zero, according to Godbole.

Risk reversals measure the difference between the implied volatility of out-of-the-money (OTM) calls and OTM puts.

Volatility on watch

“The options market reflects a tremendous amount of nervousness,” crypto hedge fund QCP Capital wrote in a Telegram post on Tuesday. The firm highlighted bitcoin resistance near $47,000, which could stall a short-term bounce.

“We entered Monday long gamma in ETH (particularly long puts) and short spot in BTC and ETH,” QCP wrote.

Options traders who are long gamma essentially make money based on large movements in the underlying asset.

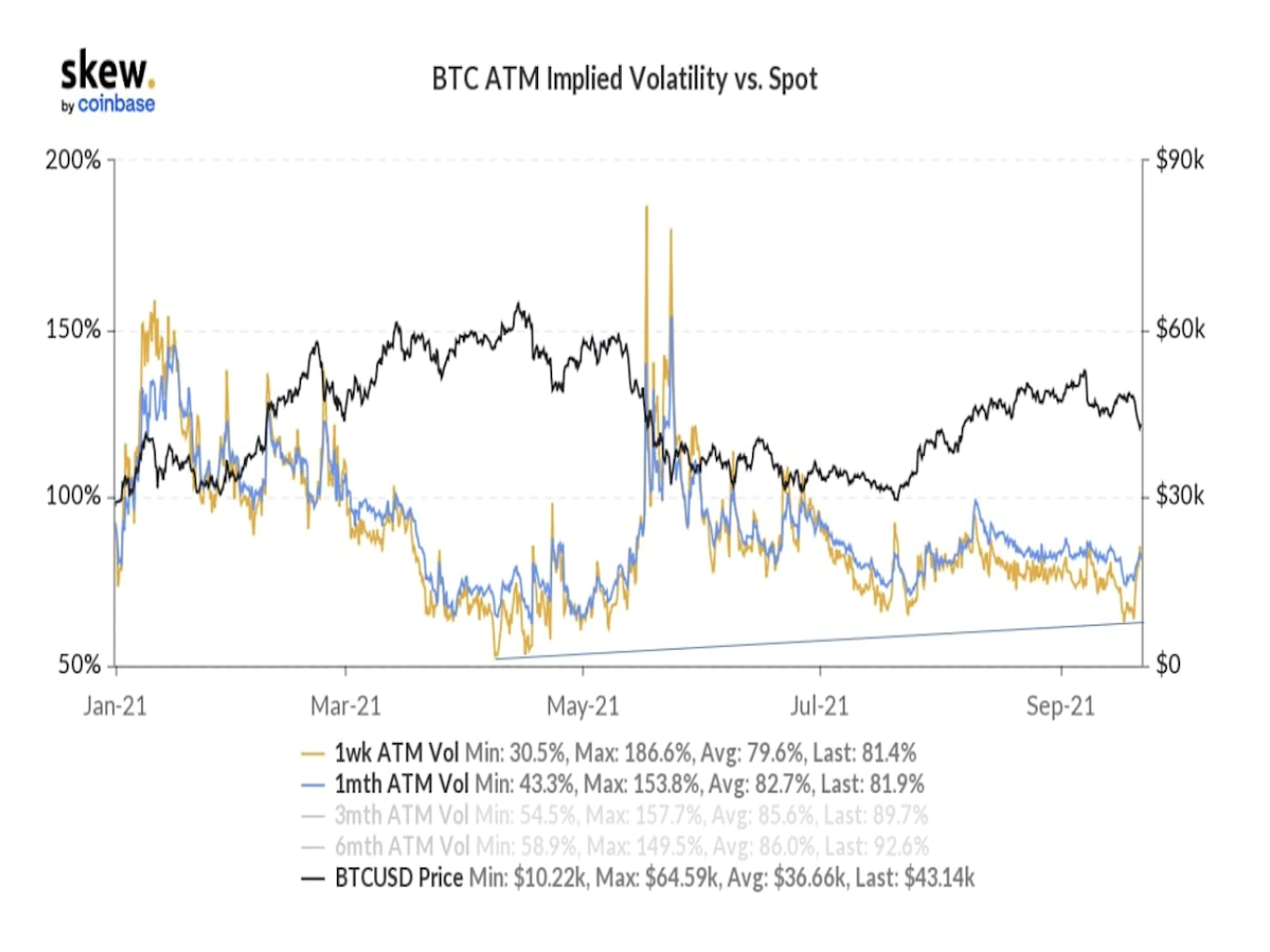

The chart below shows a slight pickup in bitcoin’s implied volatility from low levels last seen in May.

NFT active supply

Elsewhere, the market for non-fungible tokens (NFT) continues to heat up with a growing presence of long-term holders.

The chart below shows the percentage of the CryptoPunks supply that transferred (not necessarily sold) during a given time period. Released in June 2017, CryptoPunks were one of the first set of NFTs on the Ethereum blockchain.

“The supply of CryptoPunks has been the most active it has ever been in 2021,” CoinMetrics wrote in a Tuesday newsletter. “At the end of May, about 50% of the 10K CryptoPunks had moved within the last 3 months (yellow+red+dark red bands).”

However, the six- to 12-month band has been growing, which could be a sign that buyers from earlier this year view CryptoPunks as assets to hold, according to CoinMetrics.

Flash crash on Pyth network

Bitcoin briefly crashed to $5,402 (not a typo) Monday on Pyth Network oracle’s BTC/USD feed, causing liquidations to occur on a highly uncertain published price.

The Solana-based oracle network acting as a bridge between blockchains and real-world data said the flash crash was caused by two of its data sources publishing a near-zero price and receiving a relatively higher weight from the network’s aggregation logic. As such, the average price crashed to lows near $5,000, reports CoinDesk’s Lyllah Ledesma.

Altcoin roundup

- Boba Network launches as Ethereum’s newest layer 2, announces $BOBA token: The new network, which was built by Enya, the developers behind the OMG Foundation, went live Monday morning. Existing $OMG token holders are expected to receive a one-to-one drop of $BOBA tokens later next month if they bridge their $OMG tokens to the new Boba network. The price of $OMG has surged 140% over the past three months, bringing OMG Network’s market capitalization to about $1.3 billion.

- Dapper Labs said to reach $7.6B valuation in $250M funding round: Dapper Labs, the company behind NBA Top Shot and the Flow blockchain, closed a $250 million funding round, reported CoinDesk’s Eli Tan. Coatue led the funding round, which also included Andreessen Horowitz, Google’s GV and Version One Ventures. According to a source familiar with the deal, Dapper Labs received a $7.6 billion valuation. The FLOW token is up 6.8% over the past 24 hours.

- Solana-based DEX Orca raises $18M Series A: Orca, a Solana-based decentralized exchange (DEX), has raised $18 million in a Series A funding round that was led by Polychain, Three Arrows Capital and Placeholder, CoinDesk’s Jamie Crawley reported. Orca will use the funds to continue developing its automated market maker (AMM). The protocol launched its governance token last month and now has nearly $240 million in total value locked on its platform and $735 million in lifetime trading volume.

Relevant News

- Since ‘Golden Cross,’ Bitcoin Is Down 12%; Blame the Fed?

- Robinhood to Roll Out Crypto Wallet Fully by Early 2022

- Neopets Looks to NFTs to Revive Its Early-Aughts Glory

- Riccardo ‘Fluffypony’ Spagni Released by US Court, ‘Actively Working’ on Return to South Africa

Other markets

All digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polkadot (DOT), +13.6%

- Algorand (ALGO), +11.6%