The association between blockchains and energy is usually a negative one. “The Bitcoin blockchain is so wasteful of electricity,” or so the argument goes, “that it would push global warming to dangerous levels if it were ever used on a massive scale.” Research published in the influential journal Nature backs up this warning. Yet, if we were to look beyond Bitcoin, it becomes apparent that blockchains in general are being increasingly put to good use by the energy industry.

From their use in energy trades to their incorporation in microgrids, distributed ledgers are making possible a range of new transactions and systems. By enabling micro-suppliers to receive quick and easy payments for contributing electricity to a network, they’re increasing the decentralization of the energy industry, with consumers likely to see their bills become cheaper as a consequence of their entry.

And a similar effect will hopefully be the outcome of allowing energy giants to trade with each other using blockchains, since increases in efficiency and security can hopefully be passed on to consumers in the form of lower energy prices — although there’s always the risk that energy companies will simply take bigger profits for themselves.

Microgrids

The most exciting use of blockchain in the energy industry — and the one that fits best with the whole ethos of decentralization — comes in the context of microgrids. Even before Bitcoin and blockchain, such grids have been distributed by definition, comprising smaller sources of energy generation (e.g., wind turbines, solar farms) that link together in localized networks in order to provide electricity that isn’t dependent on centralized power plants and utility companies.

However, while the microgrid market has been forecasted by Navigant Consulting to grow to around $30 billion by 2030, projected growth has actually stalled in recent years, with Navigant’s research director, Peter Asmus, telling Microgrid Knowledge in August that “the overall spend is declining” relative to predictions made in 2014. Fortunately, blockchain and distributed ledger technology will increasingly help to kickstart the sector’s growth in the coming years, as it offers a number of advantages over alternative ways of delivering microgrids.

For one, the use of blockchain tech promises to increase interoperability between the numerous energy sources, suppliers and customers that make up microgrids. In particular, this is the aim being pursued by the Energy Web Foundation (EWF), an international nonprofit organization that, according to its director of marketing, Peter Bronski, is bringing blockchain tech to all areas of the energy industry.

“EWF is actually building a core blockchain — similar to but importantly distinct from Ethereum — specifically tailored to the energy sector and the industry’s unique regulatory, operational, and market needs: the Energy Web Chain,” he tells Cointelegraph.

“It’ll come as no surprise, I suspect, that blockchain offers significant cybersecurity and decentralization benefits to the energy sector. Globally, the energy sector is amidst a fundamental transition from a centralized electricity grid with a relatively small number of very large power plants to a decentralized, low-carbon electricity grid with billions of connected devices such as rooftop solar panels, batteries, smart thermostats, electric vehicles, etc. Blockchain, and especially the Energy Web Chain, is very well suited to helping managing that future grid.”

Already released in beta and expecting its genesis block in the second quarter of 2019, one of the advantages offered to microgrids by the Energy Web Chain is the ability to use smart contracts to efficiently monitor the production and distribution of (renewable) energy. “For example, whenever a large-scale renewable energy generator such as wind farm or solar farm generates a megawatt-hour of clean electricity, that can trigger the generation of a renewable energy certificate (REC),” Bronski explains. “The creation and ownership tracking of RECs is a great use case for blockchain technology.”

It’s a testament to the promise shown by EWF and its Energy Web Chain that a number of big corporations have already signed up to use and partner with the platform. In November, Siemens joined EWF as a member, while the foundation also counts the likes of Shell, E.On, Centrica, Engine and Iberdrola as affiliates. And as Stefan Jessenberger at Siemens Digital Grid explains to Cointelegraph, blockchain won’t simply enable greater security and efficiency, but also the possibility for changing how energy companies and producers operate:

“In our view, the blockchain technology might revolutionize the way DERs [distributed energy resources], grid operators and marketplaces will interact in a secure, efficient and transparent way while also enabling new business models. Especially in combination with artificial intelligence, advanced forecasting algorithms and the usage of geographical information of the assets, the technology offers promising capabilities in order to enable the autonomous trading of energy and flexibility, while incorporating the locational value of DER’s and loads.”

In addition to heightened efficiency and transparency, a key ingredient in the creation of new business models is blockchain’s ability to enable small producers of energy to be paid quickly for their contributions to grids.

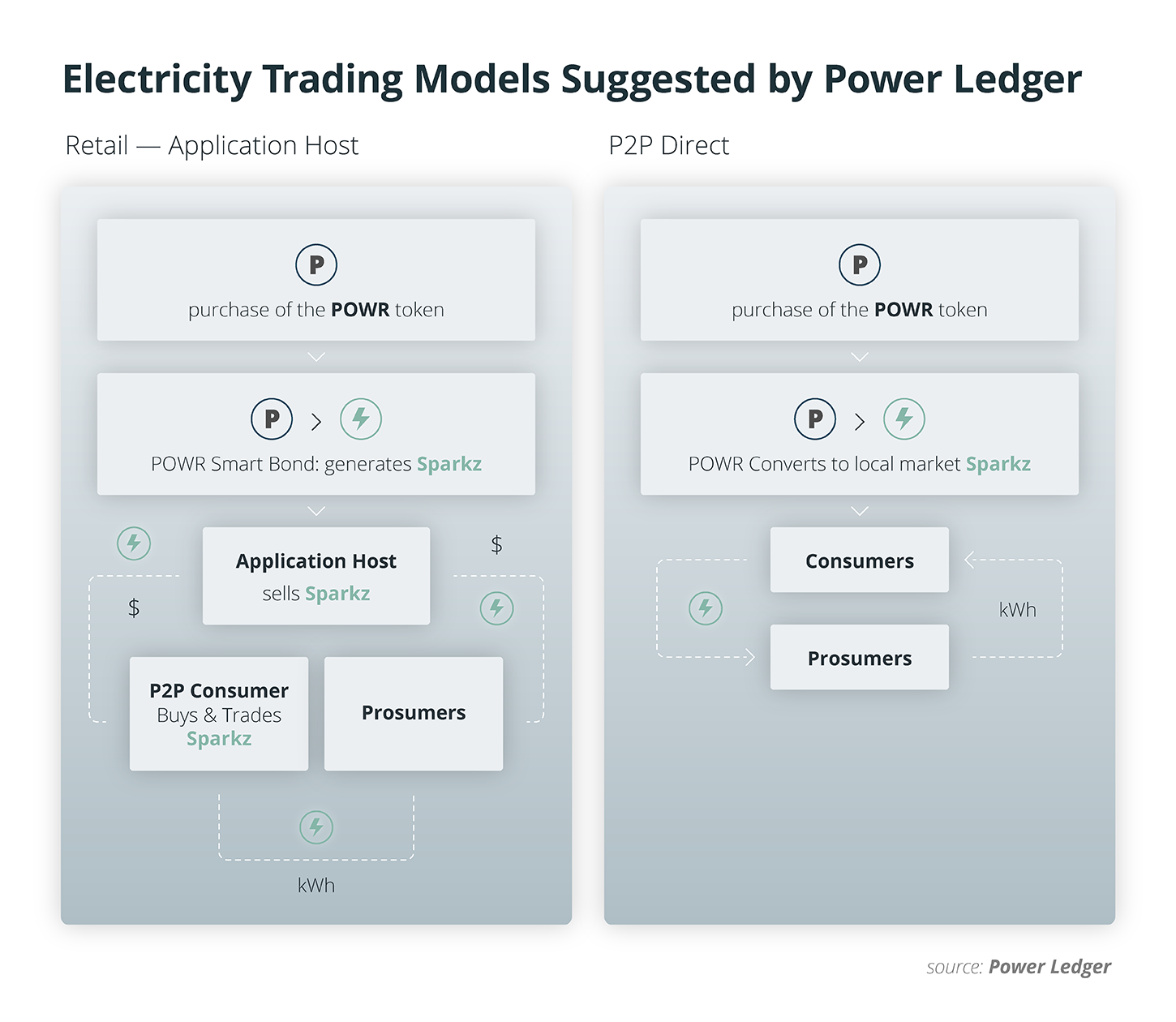

For example, in September, Australian company Vicinity Centres announced that it would begin using a blockchain-based delivery platform for the small energy networks it runs in shopping malls throughout Australia. This platform has been built by Power Ledger, and it will enable Vicinity’s malls to sell energy to nearby residents and consumers. And to do this, the platform will make use of its native Sparkz token, an ERC-20 token which enables producers and customers to engage in “frictionless” trades with each other without having to rely on intermediaries.

Trading energy

Aside from offering a secure record of transactions and also rewards for producers, blockchain tech is set to serve the energy industry in other ways. One of its most significant uses will be in the area of energy markets, where oil, gas, coal and other sources of energy are traded between producers, distributors and financial institutions.

It’s here that Vakt operates, having established itself in June 2018 with the aim of creating a “post-trade processing platform” for any kind of tradable commodity, including energy. In November, it launched its first usable platform, which will, for the time being, allow for the recording of trades in oil, but which Vakt plans to expand to “all physically traded energy commodities.”

For a company that has only just launched its first product, Vakt boasts some high-profile users — including BP, Shell, Equinor, Gunvor and Mercuria — which will all use Vakt’s platform in parallel with their internal systems for recording trades. The post-trade platform will run on J.P. Morgan‘s Quorum blockchain, which is essentially a permissioned version of Ethereum that allows for private — as well as public — smart contracts and also for zero-knowledge proofs. This makes it convenient for any enterprise that doesn’t want to broadcast the value of its purchases and trade deals to the world, while Vakt itself advertises that its platform will offer up to “40% savings across operations” as a result of putting details on a shared ledger.

Speaking at the time of the launch, Shell’s executive vice president of trading and supply, Andrew Smith, explained in broad terms what he expects blockchain tech to bring to the industry.

“Digitalisation is changing how the energy value chain works. It’s an exciting time. Collaboration with our peers and some of the industry’s key players is the best way to combine market expertise and achieve the scale necessary to launch a digital transaction platform that could transform the way we all do business. Ultimately the aim is improved speed and security, which benefits everyone along the supply chain from market participants to customers.”

Something very similar to Vakt is being built by Komgo, a Switzerland-based alliance of “fifteen of the world’s largest banking and commodity companies,” according to an article published on the organization’s own website in October. What’s interesting is that Komgo includes some of the same companies as Vakt (e.g., Shell, Gunvor, Mercuria), suggesting that the energy industry is very interested in having some kind of blockchain-based system for the processing of energy commodity trades — and is currently trialling more than one in an effort to see which one works best. The fact that it will be working with ConsenSys — which builds apps and platforms based around Ethereum — indicates that it’s drawing on plenty of pre-existing knowledge of blockchain architecture.

Challenges

But as promising as blockchain tech seems for the energy industry, there are, as ever, a number of challenges that have to be overcome before distributed ledgers become an integral part of the sector.

“First, technical challenges have to be solved, e. g. scalability, interoperability, energy efficiency,” says Stefan Jessenberger. “Second, the regulatory and legal frameworks in relevant markets have to be adapted in order to make full use of the potential efficiency gains provided by […] future blockchain based energy systems.”

From the technical side of things, scalability is the biggest issue here, although the platforms surveyed above all believe they’re well on their way to producing workable solutions.

“EWF and our 90+ Affiliates are actively designing solutions into the Energy Web Chain to address known variables that we believe will be important for broad adoption across the energy sector,” explains EWF’s Peter Bronski. “A few examples: a) We’re using a Proof-of-Authority-based approach to consensus, because we believe that degree of validator oversight will be important, especially to regulators, in the highly regulated energy sector. b) At the same time that the Energy Web Chain is an open-source, public blockchain, we’re also building in features that can keep sensitive information private, so that only approved actors can access confidential data.”

It may not be immediately obvious as to how a proof-of-authority (PoA) consensus mechanism and privacy options improve scalability. However, because PoA avoids the intensive cryptographic computations of proof-of-work (PoW), any chain using it can thereby reach greater capacities. Similarly, the permissioned aspect of the Energy Web Chain means that not all information produced by the chain will be broadcast to every participant, a feature that once again avoids a considerable amount of excess computation.

And while these specific features are being implemented by only one blockchain, most other energy-related platforms are similarly circumventing PoW in order to achieve more scalable results. So even if blockchain-based energy networks still have a way to go before they enjoy widespread use, they look increasingly prepared to handle such use.