The decentralized finance (DeFi) market saw a massive upswing in 2019 and its growth is expected to continue in 2020. Yet, only a handful of accounts are responsible for much of the industry’s value.

DeFi is the movement to transform old financial products into trustless and transparent protocols that run on decentralized applications built using smart contract platforms like ethereum.

The most popular DeFi protocol right now is MakerDAO’s multi-collateral Dai system, where users create “collateralized debt positions” (CDP) by putting up ether or other ERC-20 tokens as collateral to generate DAI tokens up to two-thirds of the value of the ether.

The generated DAI serves as a debt and can be used in the same manner as any other cryptocurrency; it can be freely sent to others, used as payments for goods and services, or held as long-term savings. Since DAI’s value is pegged to the U.S. dollar, a user only owes back what he or she initially borrowed with interest.

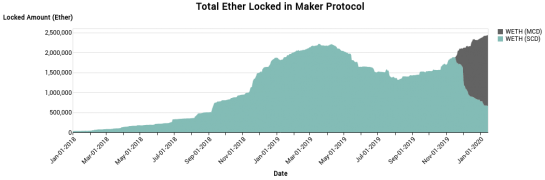

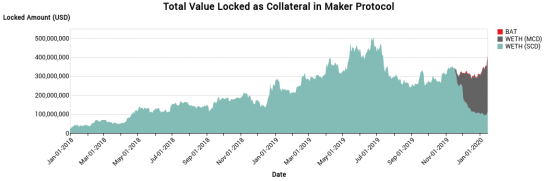

As of Jan. 17, about $400 million worth of assets used as collateral were locked up in MakerDAO protocol Stability system, according to Digital Assets Data.

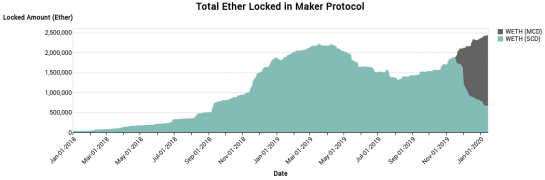

Meanwhile, the number of ether tokens locked up on the Dai system has reached an all time high of nearly 2.5 million, about 2.2 percent of the total ether supply.

The amount of DAI locked in DeFI recently rose to $50 million, representing a 65 percent month-on-month growth, according to Arcane Research. The total value locked in various DeFi protocols rose above $800 million earlier this month – up over 236 percent year-on-year, according to defipulse.com.

Concentrated market

Although the DeFi market has exploded over the last 12 months, activity has been dominated by a very small portion of addresses.

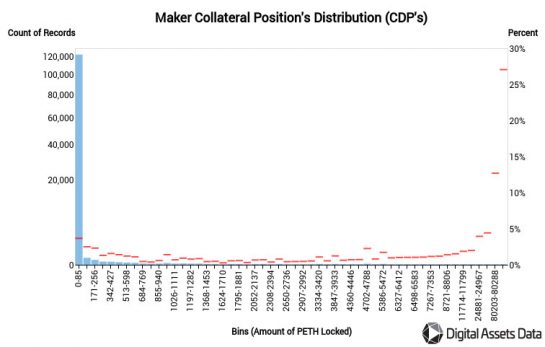

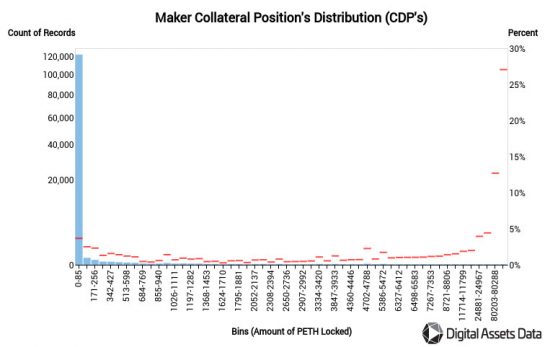

On the old Maker protocol, what they now refer to as “Single-Collateral Sai,” approximately 155,000 CDPs were created. Yet, 77 percent with positive amounts locked held less than 0.05 ETH ($81 as of publication time) as of Jan. 15, Brandon Anderson, data science lead at Digital Assets Data, told CoinDesk.

Categorizing accounts based on locked pooled ether (PETH) collateral balances shows just how large the disparity is. Just one account holds 171,000 PETH — or 27 percent — of total PETH held on Jan 15.

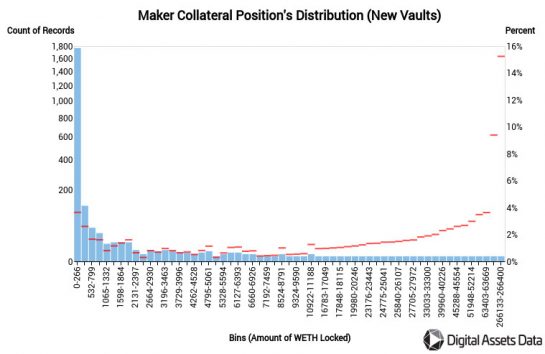

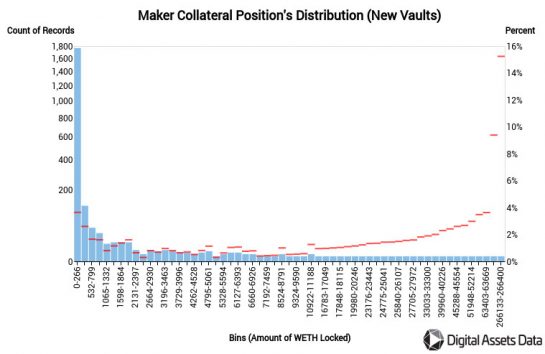

A similar distribution is seen under the new system launched in November 2019, which now refers to CDPs as “vaults” and where the DAI is backed by multiple collaterals.

Again, most accounts are small in size, however, with these addresses holding just 4 percent of the total wrapped ether (WETH) locked. Meanwhile, a single address holds 15 percent of the value locked as of Jan. 15 and another one holds nearly 8 percent. Essentially, two accounts were holding nearly a quarter of total collateral.

The owners of these big accounts are not yet known. “Neither the Maker Protocol nor the Maker Foundation track personal details of Vault (formerly known as CDP) holders. It’s a core component of the decentralized system,” Mike Porcaro, head of communications at MakerDAO, told CoinDesk.

“The accounts in the lower tier of vaults (lowest balances) appear to be actual adopters with more than 1 ETH being locked into the accounts”’, according to Anderson. “As Maker continues to grow, we will see how these distributions play out and if there is more adoption within the [group of smaller account balances].”

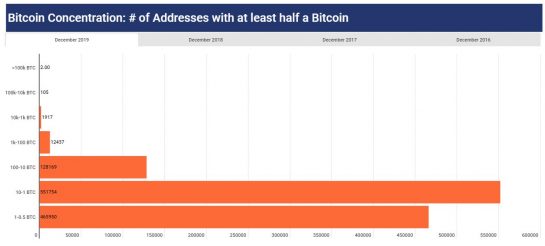

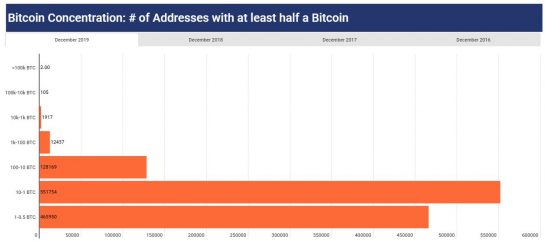

The concentration of ownership is nothing new in crypto, of course. It’s also an issue in the bitcoin market. As of December 2019, only two addresses had 100,000 or more bitcoins, according to blockchain intelligence firm IntoTheBlock.

Most addresses hold under 10 bitcoin, and while there were only 2,022 addresses holding 1,000 to 1 million BTC, these addresses controlled over 40 percent of bitcoin’s total supply. Further, the top 1,000 addresses controlled 34.8 percent of all available coins, according to Coin Metrics.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.