The now-defunct cryptocurrency exchange Mt. Gox reportedly liquidated around $312 million worth of Bitcoin (BTC) throughout February and June of 2018 through a Japanese exchange called BitPoint.

GoxDox, an organization that was established to assist Mt. Gox creditors, released a photograph of a bank account statement on February 5 showing the alleged transactions sent from BitPoint to the Mt. Gox trustee led by Nobuaki Kobayashi.

If the report of GoxDox is accurate, the trustee went out of his way to disregard the suggestion of Kraken CEO Jesse Powell, who explicitly told the trustee to refrain from selling the company’s BTC holdings. If needed, Powell previously said that the trustee has to liquidate the remaining Bitcoin funds on an over-the-counter (OTC) trading platform to minimize its impact on the price of Bitcoin.

It is possible that the trustee and the rest of the individuals dealing with the Mt. Gox case were rattled by the circumstances, prematurely liquidating a significant portion of the organization’s assets to move forward with the bankruptcy.

Was the dump of Mt. Gox the primary cause of Bitcoin’s crash in 2018?

According to GoxDox, the Mt. Gox trustee began to sell the exchange’s Bitcoin holdings starting in early 2018, possibly even before February. From early February to June, the trustee is said to have sold tens of millions of dollars worth of Bitcoin on a weekly basis.

The researchers said that the frequent wire transfers supposedly initiated from the bank account of BitPoint to that of the Mt. Gox trustee show the trustee’s intent to hide the transactions in an event of a security breach on the side of BitPoint.

The trustee likely expected a public backlash if it were revealed that the trustee had been selling large amounts of Bitcoin in the public cryptocurrency exchange market, putting the price of BTC at a significant risk of dropping.

“It seems fair to conclude that the reason for sending frequent wires was to prevent counterparty risk. A hack at BitPoint could expose the MtGox Estate to a loss and the trustee didn’t want to get Goxxed. It follows that the trustee would have instructed BitPoint to wire JPY [Japanese yen] over as soon as he had it. This way, MtGox Estate assets wouldn’t be exposed to any hacking incident at BitPoint.”

On May 2, based on the data provided by GoxDox, the trustee received 3,822,436,400 yen from BitPoint, worth around $34,845,330. From then on, at an interval of one to four days, the trustee continued to receive tens of millions of dollars from BitPoint.

Coincidentally, in the exact same time frame, the price of Bitcoin, which initiated a strong recovery from $7,000 to $10,000 from April to May, began to plunge. Since May 4, the price of Bitcoin began to drop substantially against the United States dollar. By the end of June, less than two months since the sell-off of Mt. Gox holdings began, the price of the dominant cryptocurrency dropped from nearly $10,000 to $5,912, by over 40 percent.

In February 2018, when the trustee started to sell BTC on a cryptocurrency exchange, Kraken CEO Jesse Powell reaffirmed that the company, which was hired to track the lost coins of the exchange, advised the trustee not to dump millions of dollars worth of BTC in the market.

“We were explicit about not dumping a large amount of coins on the market. Unfortunately, it looks like the trustee made their own decision or was taking advice from elsewhere — maybe whatever exchange they dumped those coins on. We had zero knowledge of these sales happening until it was announced at the recent creditors’ meeting.”

The initial correction of the cryptocurrency market in January of last year may have been completely unaffected by the Mt. Gox situation, which cannot be confirmed due to the lack of information presented in the leaked bank statement of the trustee. Some analysts have suggested that the opening of the CME Bitcoin futures market crashed the price of the asset.

The San Francisco Federal Reserve wrote that the time frame of the decline in the price of Bitcoin aligned with the launch of the CME Bitcoin futures market.

“The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence. It is consistent with trading behavior that typically accompanies the introduction of futures markets for an asset.”

Others have said that the short-term bubble of BTC initiated by retail traders came to an end, and it was not caused by a specific set of factors.

But, from February onward, it is believed by traders that the unexpected liquidation of a large chunk of Bitcoin’s circulating supply had a drastic impact on the short-term trend of the asset.

The trustee was heavily criticized by industry experts including GoxDox researchers, who said that Mt. Gox creditors need to demand an explanation from the trustee to clarify the reasoning behind the dismissal of the advice of Kraken.

“Simple possession of a crypto license is not suitable criteria for selecting an expert. A non-expert judge’s approval does not equate to a sound plan. Reliance on an appeal to authority is never a substitute for good judgment.”

How does Mt. Gox move on from here?

On Jan. 22, Brock Pierce, a cryptocurrency investor and the co-founder of Blockchain Capital, who played a vital role in the development of EOS, revealed an ambitious plan to revive Mt. Gox and to repay all of the creditors of the exchange.

While the exchange is said to have around $1.2 billion worth of Bitcoin, with the supposed sale of more than $300 million worth of Bitcoin in 2018, it remains unclear precisely how much BTC the exchange currently possesses. It is not possible, given the circumstances of Mt. Gox, to repay all of the creditors through the sale of the company’s existing BTC.

Instead, Brock Pierce, who claims to acquire Mt. Gox for 2 BTC from Mark Karpeles and Jed McCaleb in 2014, decided to try to reopen the exchange and pay the creditors using the equity of the company.

As a first step, Pierce condemned the work of the Mt. Gox trustee and prevented the trustee from liquidating the company’s holdings with his authority over the company, according to the official statement of GoxRising, a British Virgin Islands-based company established to oversee Mt. Gox:

“Acknowledging that the Mt. Gox trustee had done a laudable job of managing an unwieldy estate, the group suggested that the inherent limitations on the trustee’s discretionary powers as a fiduciary, prevented him from maximizing creditor returns going forward.”

At the North American Bitcoin Conference (TNABC), Pierce further explained that the company intends to revive Mt. Gox through a unified Civil Rehabilitation Plan, a law in Japan that forces lenders of a company to change the terms of the loan. In the upcoming months, the company is expected to pay out $1.2 billion in BTC to creditors as fast as possible and move on with resuming operations.

One hurdle worth $16 billion

Mt. Gox could distribute its $1.2 billion Bitcoin holdings in the next two months and rush the process of obtaining a license from Japan’s Financial Services Agency (FSA) to begin operating as a regulated cryptocurrency exchange.

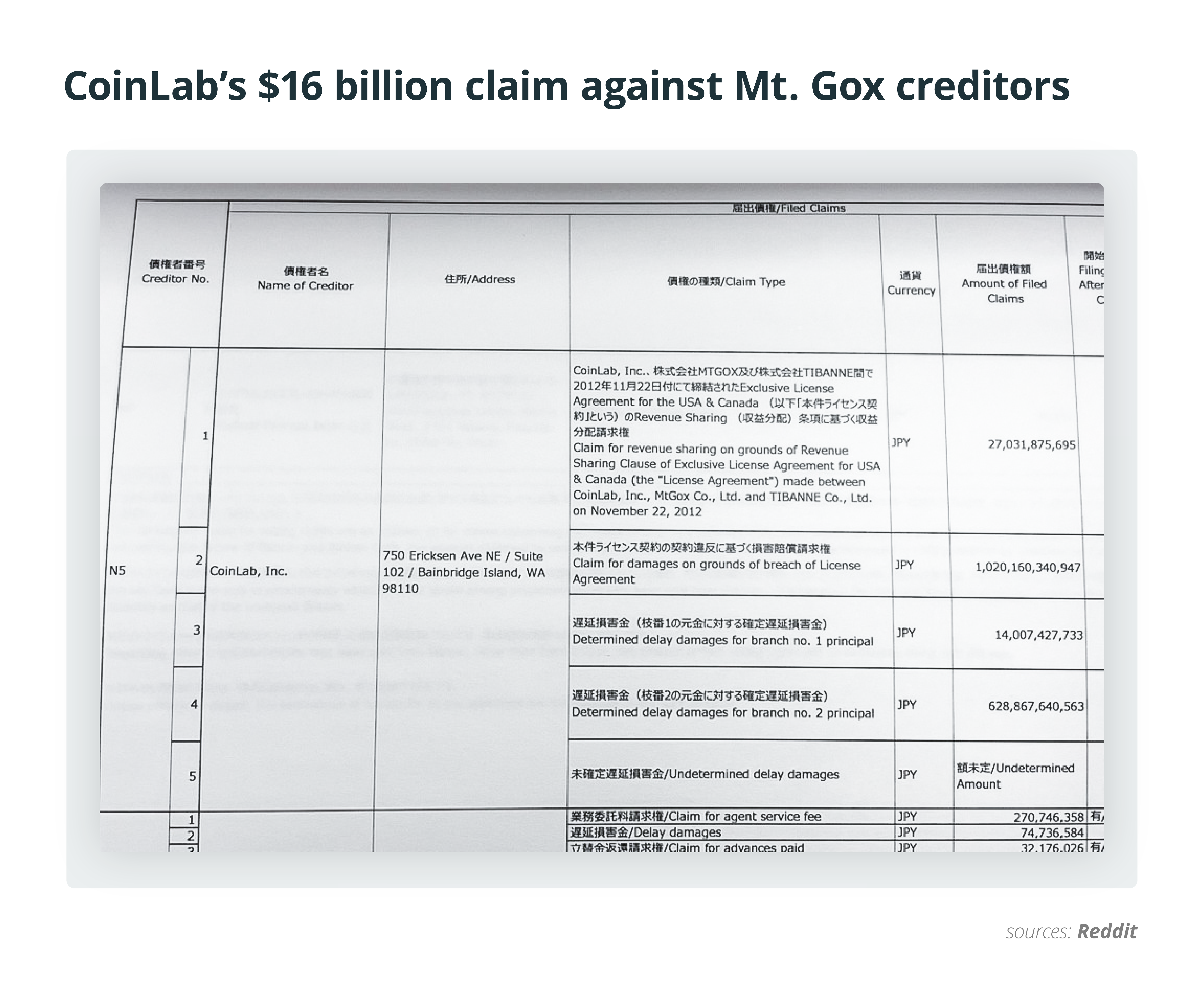

But, in 2017, blockchain incubator CoinLab reportedly filed a $16 billion claim against Mt. Gox, alleging Mt. Gox of breaching a contract with the company. Previously, CoinLab filed a $75 million lawsuit. Last week, according to a leaked document, the firm bumped up its lawsuit to a 16 billion claim.

In an event in which the claim is approved by the court, even with a compromise, it could result in the loss of a significant portion of the exchange’s $1.2 billion holdings of BTC.

Following the filing of the complaint, Kraken CEO Jesse Powell expressed his disappointment.

Powell stated there are claims from insiders that the lawsuit is stopping the exchange from distributing the funds to creditors.

“I’m disappointed to hear that this lawsuit is responsible for holding up payouts, and that any judgement for CoinLab would be treated on par with the depositor victims. I think people are having a hard time getting their heads around the $75m+ claim given that common perception is that CoinLab never performed and owes $5m+ back to MtGox. If the deal had been carried out, it might be CoinLab on the hook for the shortfall of client deposits.”

The core issue with the lawsuit is that it is filed against the creditors of Mt. Gox, not the exchange itself. “This lawsuit today is not CoinLab vs. Mt. Gox, but CoinLab vs. the MtGox customers, now [current] creditors, who have done nothing to deserve being involved in this,” Karpeles said in 2017. As such, if the lawsuit continues on, it will be the creditors with the $1.2 billion holdings of Mt. Gox that will have to settle with the lawsuit for $16 billion.

Will creditors get their money back and could Mt. Gox continue to affect the price of Bitcoin?

If the $16 billion complaint filed by CoinLab remains as the only hurdle in settling creditor funds, it is likely that creditors will receive their share of the Mt. Gox Bitcoin holdings by the latter half of 2019.

The distribution of funds would primarily depend on the result of a court hearing or a settlement of the lawsuit and the outcome of the case could certainly affect the amount of BTC that is distributed to the creditors.

Once the $1.2 billion holding is distributed, then it will be in the hands of individual or retail traders. There still exists a possibility that the creditors could immediately sell the BTC in the exchange market, which may have a similar effect as the reported Mt.Gox’s trustee sell-off in February of last year.

But, it is highly improbable that the creditors would dump all of their newly obtained BTC in the exchange market in the short term, especially during a period in which BTC is demonstrating resilience in its low price range and is down by more than 80 percent since its all-time high.