Bitcoin price (BTC) has taken a bearish course, leading some analysts to call for a drop to $8,300 and a few even suggest $7,100 is where the digital asset will bottom.

Over the weekend, the price attempted to recover from the dip to $8,600 and a quick pop to $9,141 excited investors looking for the digital asset to return to its previous weekly range at $9,000 to $9,500.

As of now, Bitcoin is lightly supported by the 200-day moving average where it has bounced on the last four daily candles. Currently, the price is capped by resistance at $9,100 and the latest drop below $8,800 could see BTC in for a bit of tumult over the short term.

Crypto market data daily view. Source: Coin360

Last week, crypto Twitter debated whether Bitcoin’s surprise run up to $10,540 was solely driven by President Xi Jinping’s call for blockchain development or other factors such as an increase in on-chain activity on the Bitcoin network.

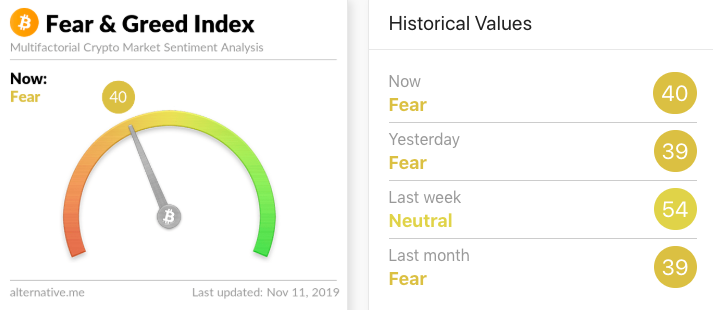

Fear & Greed Index creeps higher

Currently, the Crypto Fear and Greed Index has a reading of 40, a noticeable decline from last week’s reading of 49.

Crypto Fear and Greed Index. Source: Alternative.me

According to Alternative.me, when Bitcoin price rises this triggers FOMO — or fear of missing out — amongst investors, this increased inflow into digital assets leads to a higher reading on the index.

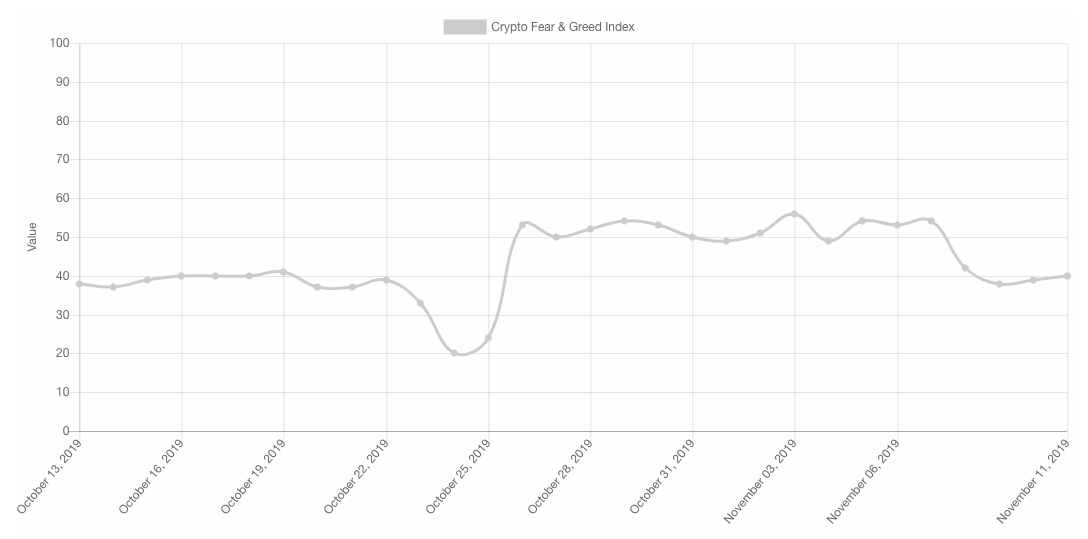

Crypto Fear and Greed Index monthly chart. Source: Alternative.me

As shown by the monthly chart, investor fear rose significantly on Oct. 25 as Bitcoin price staged its 42% rally. The index maintained this level around 50 to 56 for the following week as traders sat in their positions and waited to see if the price would test the local high, which at the time was $10,540.

As the likelihood of this dwindled and discussion of bears setting up shorts made its way across the internet, traders began to pull profits and Bitcoin notched a lower daily high.

Subsequently, the fear and greed index dropped from 54 to 39. As Alternative.me explains:

“Extreme fear can be a sign that investors are too worried. That could be a buying opportunity. When Investors are getting too greedy, that means the market is due for a correction.”

But is a buying opportunity is being presented as Bitcoin price drops further below $9,000 and the Crypto Fear and Greed Index rises? Let’s look at a few other metrics to determine whether this is the case.

Bitcoin perpetual swaps and implied volume

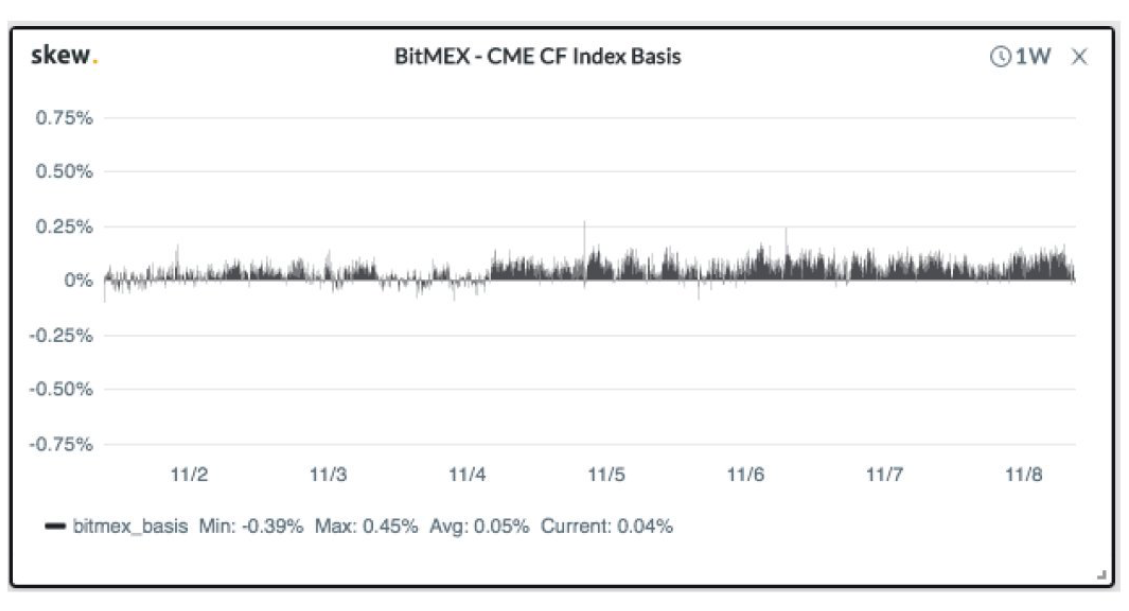

BitMEX-CME CF Index Basis. Source: Skew.com

On Nov. 8, Skew Analytics tweeted a chart showing a steady positive basis between BitMEX perpetual swaps and Bitcoin’s underlying price on spot markets. In simple terms, the basis is the difference between the spot price and the derivative, and Skew suggests that:

“Consistent positive basis between perpetual swaps and the underlying spot is steepening the futures term structure as [the] market expects positive funding for longer!”

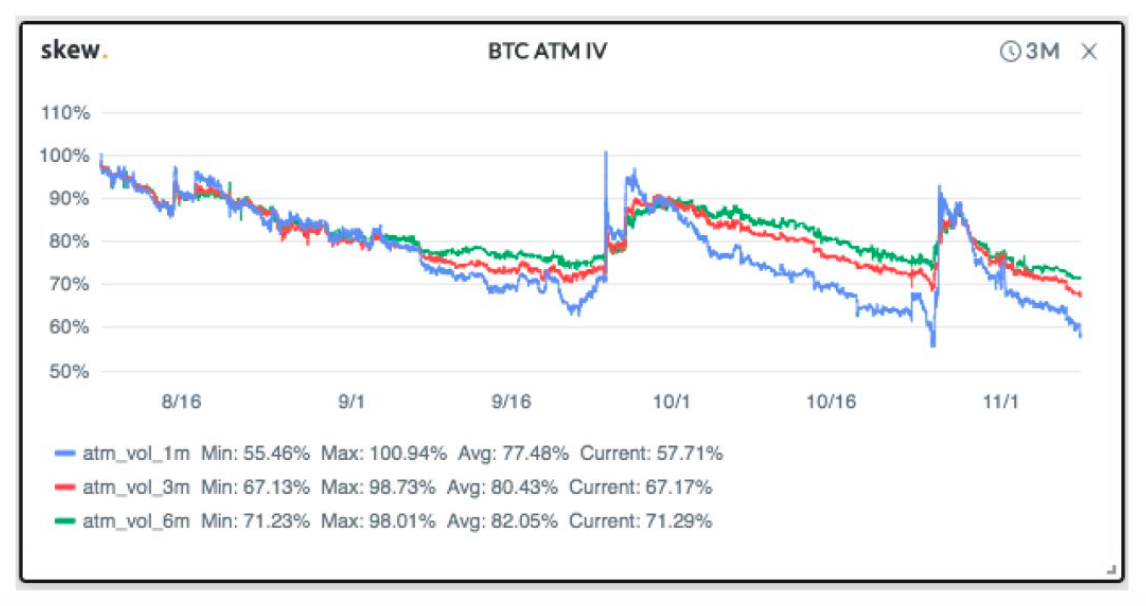

BTC ATM IV. Source: Skew.com

Interestingly, Skew also presented a chart of Bitcoin’s volume and pointed out that “implied volume has retraced all the move from the China Blockchain announcement!”

Considering today’s newly published report from China’s state-backed Xinhua journal acknowledging Bitcoin as the first successful implementation of blockchain, it will be interesting to see how trading volume is impacted depending on whether investors interpret the news as bullish or bearish for Bitcoin.

It has also been reported that China has scrapped all plans to ban cryptocurrency mining, possibly another bullish signal to cryptocurrency investors.

What do Bitcoin’s on-chain metrics provide?

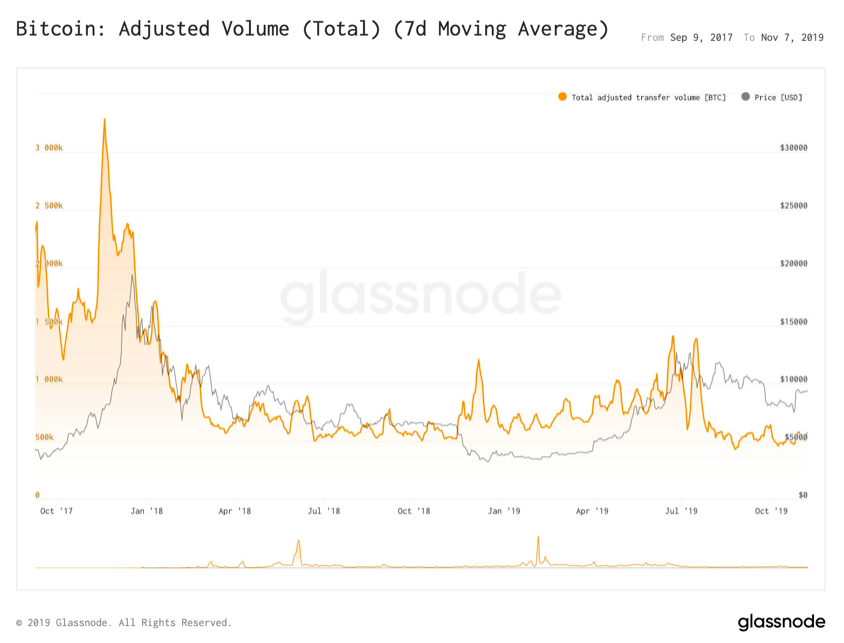

Blockchain analytics firm, glassnode, has also been keeping a close eye on Bitcoin’s on-chain activity since the Oct. 25 spike to $10,540 and deftly pointed out that key on-chain metrics like exchange inflow, active addresses, and adjusted transaction volume have dropped to monthly lows. Therefore, these metrics must rise to produce an upward surge in Bitcoin’s price.

Bitcoin: Adjusted Volume (Total). Source: glassnode.com

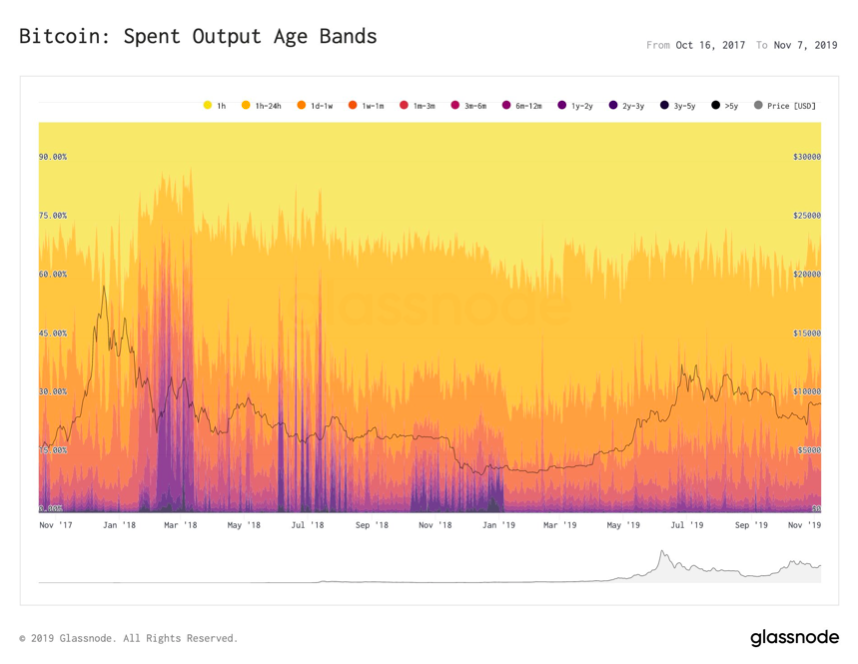

Nevertheless, a recent tweet from the analytics firm also pointed out that the investors’ interest in holding Bitcoin is growing and this claim is supported by the Bitcoin: Spend Output Age Bands (SOAB), which shows that approximately 80% of the Bitcoin “transacted daily are less than 1-week old”.

The chart also shows that many long-term holders capitulated in 2018, as evidenced by the long purple “flames” on the chart. Notice that this phenomenon is absent throughout 2019.

Bitcoin: Spend Output Age Bands. Source: glassnode.com

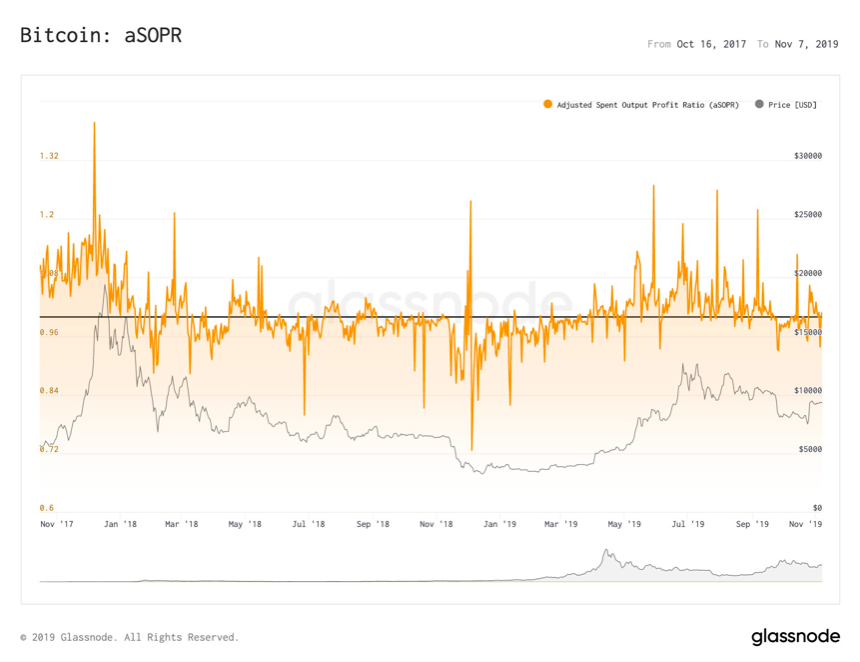

Further proof that — despite Bitcoin’s currently bearish price action — interest in purchasing and holding grows comes from the adjusted spent output profit ratio (ASOPR) and the Spend Output Profit Ratio (SOPR).

The ASOPR ignores all transaction outputs with a lifespan of less than one hour, whereas the SOPR calculates profit ratio by dividing the realized value of Bitcoin by its value at creation. As explained by SOPR creator Renato Shirakashi:

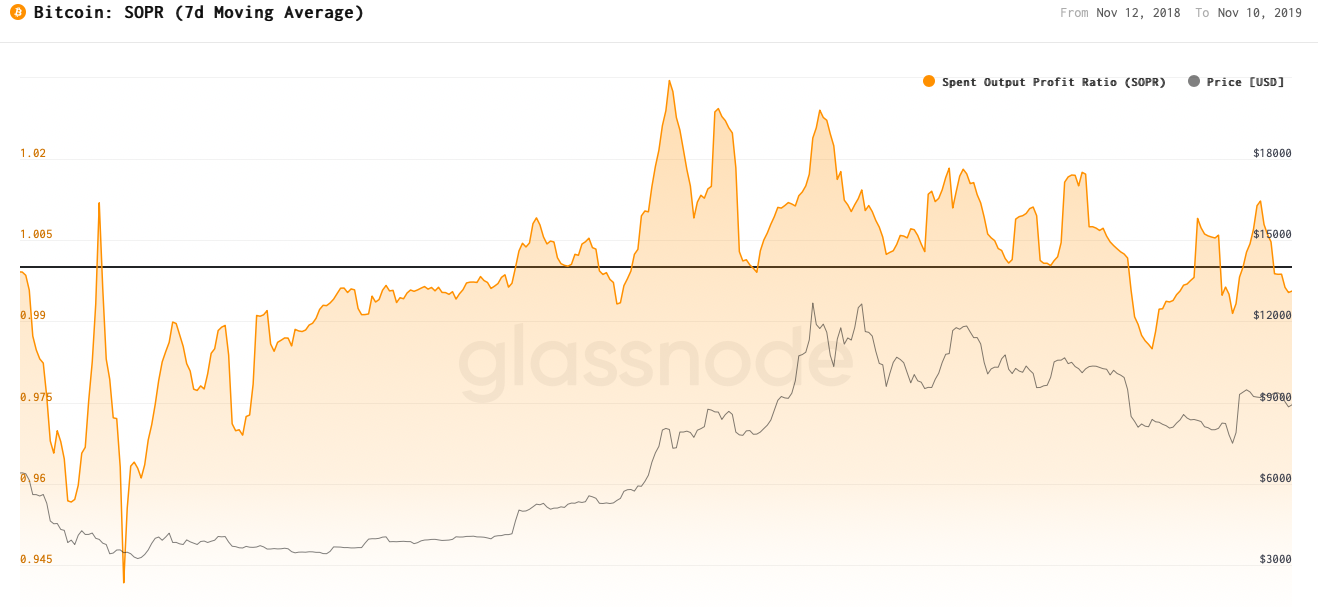

“SOPR appears to oscillate around the number 1. Secondly, during a bull market values of SOPR below 1 are rejected, while during a bear market values of SOPR above 1 are rejected.”

Bitcoin Adjusted Spent Output Profit Ratio. Source: glassnode.com

glassnode points out that:

“SOPR below 1 shows that more spent outputs are at a loss than in a profit [and the] SOAB suggests that SOPR deltas are currently due to short term $btc holders. As they realize their gains or prices increase, SOPR slowly recovers to 1.”

Glassnode’s assessment makes perfect sense. Less than two weeks ago Bitcoin price skyrocketed from $7,400 to $10,540 and whether or not this was driven by President Xi Jinping’s blockchain announcement remains a topic of deliberation. But the profit-taking by short term investors and a drop in trading volume as sentiment and momentum wanes is to be expected.

Bitcoin Spent Output Profit Ratio. Source: glassnode.com

When set on the one-year time frame, using the 7-day moving average, traders can see that the significant dips below 1 on SOPR were all fantastic purchasing opportunities when the price peaked and began to curve above 1.01.

This typically signaled that Bitcoin price rallies have become overextended and matching these dates against the traditional Heiken Ashi charts and oscillators like the relative strength index, stochastic RSI and the moving average confluence divergence showed overbought readings.

According to the SOPR, even the most recent dip to $8,600 could have been a good time to “buy the dip” and currently the SOPR line is beginning to curve up form 0.99561092 to reapproach 1.0 where it last was on Nov. 3 when the price was near $9,400.

Ultimately, traders should pay more attention to the data produced by blockchains and consider incorporating some of the valuable data produced from on-chain activity to their trading routine.

At the moment, the traditional Heiken Ashi charts suggest that Bitcoin is bearish over the short term but on-chain data tells a different story.

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.