Is the current fall the start of a new bear market or is this a bear trap? Let’s analyze the charts.

The total cryptocurrency market capitalization had repeatedly taken support close to the $250 billion mark since mid-July of this year. However, the recent collapse in crypto markets led by Bitcoin (BTC) has broken the support and market capitalization has dipped to just under $220 billion.

It is difficult to pinpoint the exact reason that started the fall. A few speculators might have built up positions expecting the prices to surge following the launch of Bakkt. However, when that did not play out, they started closing their trades in a hurry. As a result, important support levels cracked and the rest of the traders were forced to close their long positions.

Another possibility is that the flight to safety following the news of an impeachment inquiry into United States President Donald Trump might have resulted in the quick drop. While the fundamental reasons can be debated, the technical picture gives a reasonable idea on what to expect next and how traders should approach this correction. With the current fall, there will be many overly bearish voices that can scare the traders. However, we do not believe that there are enough reasons to panic yet. Let’s see why.

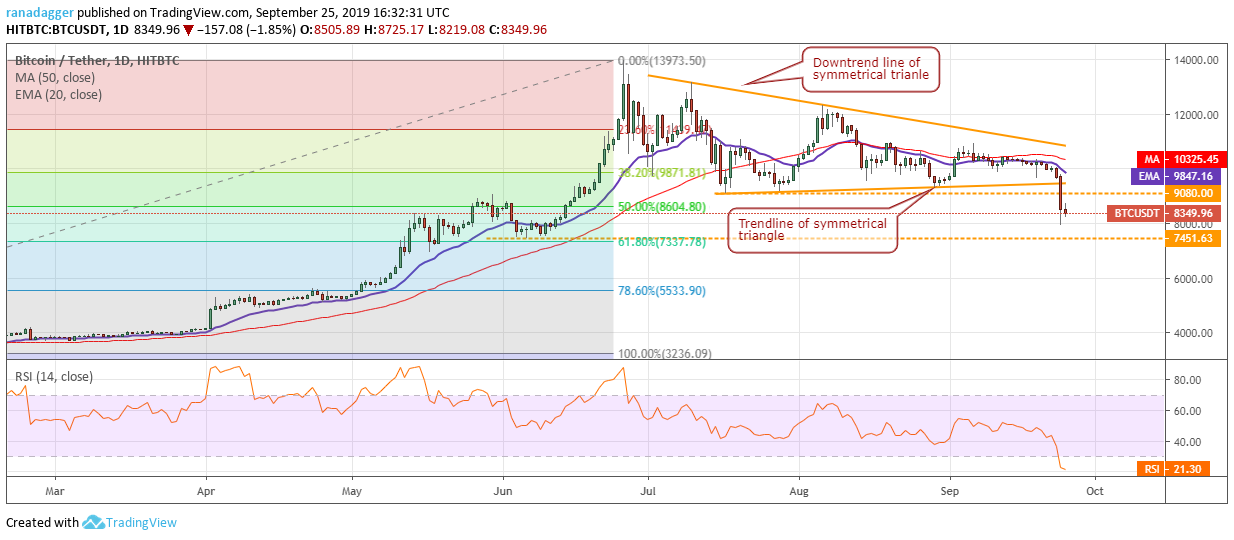

BTC/USD

We have been mentioning in the past few analysis that the tight range in Bitcoin will be followed by a trending move. That happened on Sept. 24 as the prices broke below the symmetrical triangle and the horizontal support of $9,080. The next support on the downside is $7,451.63.

Even if the BTC/USD pair declines to $7,337.78, it will only be a 61.8% Fibonacci retracement of the entire rally from the low of $3,236.09 to a high of $13,973.50. Though it is a deep correction, traders should not panic because if the bulls can arrest the decline between $7,451.63 and $7,337.78, the pair can still stage a recovery.

However, if the bears sink the price and sustain below $7,337.78, the sentiment will weaken further and a quick recovery will be in danger. With the recent fall, the RSI has dipped deep into the oversold territory, which indicates that a relief rally is possible. Any pullback will face resistance at $9,080 and above it at the symmetrical triangle. The price action of the next few days will give us a better idea of whether this fall is a good buying opportunity.

ETH/USD

Ether (ETH) plunged below the support of $163.755 on Sept. 24 and triggered our suggested stop loss at $160. The bulls are currently attempting to defend the support at $150 because if it breaks down, a fall to $122 is possible.

The 20-day EMA has started to turn down and the RSI has dropped into negative territory, which suggests that bears have the upper hand in the short term. However, if the bulls defend the $150–$163.755 zone, we might see a relief rally, which will face resistance at the 20-day EMA. We like the developing positive divergence on the RSI but will wait for the ETH/USD pair to form a new buy setup before recommending a trade in it.

XRP/USD

XRP slipped below the moving averages on Sept.23 and followed it up with a sharp move to a new yearly low on Sept. 24. This fall triggered our proposed stop loss on the long position at $0.24. Currently, the bulls are attempting to push the price above the previous support-turned-resistance of $0.24508.

The RSI has formed a positive divergence, which is a bullish sign. If the XRP/USD pair sustains above $0.24508, it will be a positive sign and will indicate that the current fall was a bear trap.

However, if the price fails to rise above $0.24508, the bears will again try to resume the downtrend. Below $0.22, the next support on the downside is way lower at $0.19. The 20-day EMA has started to turn down once again and the RSI is in the negative zone, which suggests that bears have the upper hand. We will wait for a new buy setup to form before recommending a trade in it.

BCH/USD

Bitcoin Cash (BCH) plummeted below the neckline of the head-and-shoulders pattern on Sept. 24, which completed the bearish setup. The first target to watch on the downside is $166.98 and below it $105.

However, as the RSI has dipped deep into oversold territory, a minor pullback to the breakdown level is possible. This pullback is likely to be sold into. Our bearish view will be invalidated if the bulls push the BCH/USD pair back above the neckline, but we give it a low probability of occurring. We do not find any buy setups at current levels.

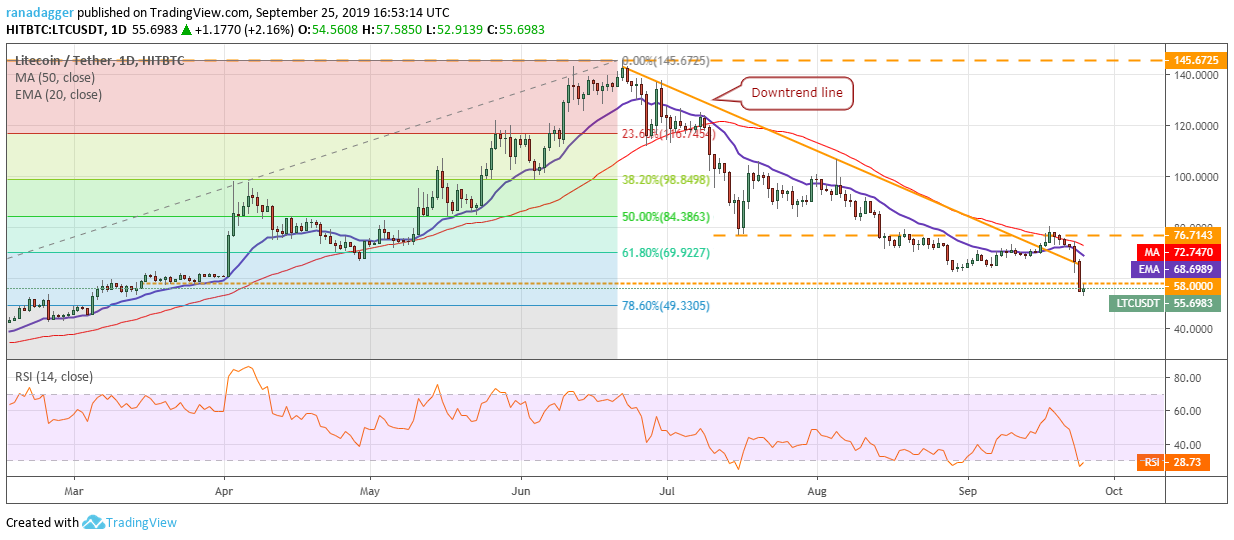

LTC/USD

Litecoin (LTC) turned down sharply on Sept. 23 and broke below our suggested stop loss of $62. It was followed by another down-move the next day, which broke below the critical support at $58. There is a minor support at $49.3305, which is the 78.6% Fibonacci retracement level of the rally.

If this support also cracks, the LTC/USD pair can drop to $30. Any pullback is likely to face resistance in the $58–$62.0764 zone. Both moving averages are sloping down and the RSI in the oversold zone, which shows that bears are in firm command. We will wait for the decline to end and a new reversal pattern to form before suggesting a trade in it once again.

EOS/USD

EOS plunged on Sept. 24 to a low of $2.4001. This sharp fall triggered our stop loss at $3. With the breakdown, the cryptocurrency has resumed its down-move that can extend to $2.20. If this level also breaks down, a retest of the yearly low at $1.55 will be in the cards.

The EOS/USD pair might attempt a pullback, which is likely to face stiff resistance at $3.1534 and above it at the downtrend line. The traders will use every relief rally to lighten up their positions. Hence, we suggest traders wait for a new reversal buy setup to form before attempting a long position in it.

BNB/USD

Binance Coin (BNB) broke below the critical support of $18.30 and $16.2501 on Sept. 24. This has resumed the down-move that can extend to the support line of the descending channel. As the RSI has dipped into deep oversold territory, a minor pullback to $18.30 cannot be ruled out.

However, as the sentiment has turned decidedly bearish, every rally in the BNB/USD pair will be sold into. We are not in favor of cherry-picking at these levels because when panic sets in, it is difficult to project where the downtrend will end. Hence, we suggest traders remain on the sidelines.

BSV/USD

The fall on Sept. 24 broke below the critical support of $107 and the 78.6% Fibonacci retracement level of $92.933. After this, a complete 100% retracement is possible. Therefore, Bitcoin SV (BSV) now has a target objective of $48.640.

With the fall, the RSI has dropped deep into oversold territory, which indicates that a minor pullback might be in the cards. However, any relief rally is likely to hit a wall close to $107. We will wait for a turnaround in the BSV/USD pair before proposing a trade in it.

XLM/USD

Stellar (XLM) broke below the moving averages on Sept. 23 and dove to a new 52-week low on the next day. Whenever a new low is formed, buyers do not step in because they are unsure of the bottom. There is a psychological support at $0.050, below which the selling can exacerbate.

The only minor positive on the chart is that the RSI is forming a positive divergence. However, unless the price actions suggests a bottom, the positive divergence, in itself, can not be used as a buy setup. As the XLM/USD pair has plummeted to new lows, we withdraw the buy suggestion given in the previous analysis. We will wait for a new setup to form before recommending a trade in it.

LEO/USD

UNUS SED LEO (LEO) has entered our analysis as it has risen into the top 10 list by market capitalization. It has has been gradually grinding lower since topping out on June 26. The bulls have not been able to sustain above the 20-day EMA for more three days since June 27, which shows a lack of demand.

The LEO/USD pair can now drop to the low at $1.0075. A breakdown of this support will be a huge negative as it will start a new downtrend that can drag the prices lower to $0.80. However, if the support holds, the bulls will try to push the price above the moving averages once again. We will wait for the pair to form a new buy setup before recommending a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.