A few major cryptocurrencies are showing signs of life. Can bulls build on the gains? Let’s analyze the charts.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Market data is provided by the HitBTC exchange.

After facing opposition from regulators across the world, Facebook has warned that its Libra project might not see the light of the day. If Libra has to succeed, it has to obtain the necessary approvals from regulators and policymakers, which looks increasingly difficult. With Libra, the adoption and use of cryptocurrencies could have surged due to Facebook’s large user base. Without it there might be a delay, but cryptocurrencies will continue to attract new users to its fold.

Analysts are confident that the upcoming halving in Bitcoin in 2020 will be a major confidence booster and will propel the price to new highs. CNBC Squawk Box co-host Joe Kernen is the latest to project a huge upside in Bitcoin. He expects a rally to $55,000 by May 2020, which is an over 450% return from current levels.

While we are also bullish on Bitcoin and a few other major altcoins, we believe that the best time to buy is when they resume their uptrend. Buying in a downtrend can quickly result in losses and during a downtrend, the news tends to become bearish. Many traders dump their positions out of fear of losing their capital. Hence, it is best to buy when the tide turns in favor of bulls. Let’s see if we can spot any buy setups today.

BTC/USD

The bears have not been able to capitalize on the weakness and are finding it difficult to sink Bitcoin (BTC) below the critical support of $9,080. This support has held twice in the past 14 days. The moving averages are also flattening out, which suggests that bears are losing their grip. Now, if bulls can carry the price above the moving averages, it will signal strength. Therefore, we retain our buy recommendation given in an earlier analysis.

Contrary to our assumption, if the BTC/USD pair fails to rise above the moving averages, it will indicate selling at higher levels. A breakdown of $9,080 will weaken sentiment and can result in a fall to the next support zone of $7,451.63 to $6,933.90. We expect the pair to make a decisive move within the next few days.

ETH/USD

Ether (ETH) has been hovering around the uptrend line for the past three days. Hence, it becomes important that bulls defend it because if the price plummets below the line with force, it can enter a free fall. There is a minor support at $192.945, but we do not expect it to hold.

On the other hand, if the ETH/USD pair rises from the current level and scales above $235.70, it will signal strength. Therefore, we maintain the buy recommendation given in an earlier analysis. This tight range trading is unlikely to continue for long. We expect a large range move in either direction within the next few days.

XRP/USD

XRP is attempting to bounce from just above $0.30. If bulls can carry the price above the 20-day EMA and $0.34229, it will be a bullish sign. It will also keep the play of the large range between $0.27795 and $0.45 alive. The traders can wait for the price to break out of $0.34229 before initiating long positions. The stop loss can be kept at $0.275. However, as the digital currency tends to spend long periods in consolidation, we suggest traders allocate only 50% of the usual position size to this trade.

Contrary to our expectation, if the bounce falters either at the 20-day EMA or at $0.34229, the bears will again attempt to sink the XRP/USD pair below the critical support of $0.27795. If this support breaks down, all bets are off because the decline can then extend to $0.19.

LTC/USD

Litecoin (LTC) is stuck between the downtrend line and $83.65. It formed a doji candlestick pattern on July 29, which shows a balance between both buyers and sellers. A break out of the downtrend line will be the first sign of a possible trend change.

Conversely, if the LTC/USD pair drops below the $83.65–$76.7143 support zone, it will signal weakness. We expect the bulls to defend $69.9227, which is the 61.8% Fibonacci retracement level of the rally because if this cracks, the decline can extend to $58. The traders can wait for the price to breakout and sustain above the downtrend line before turning positive.

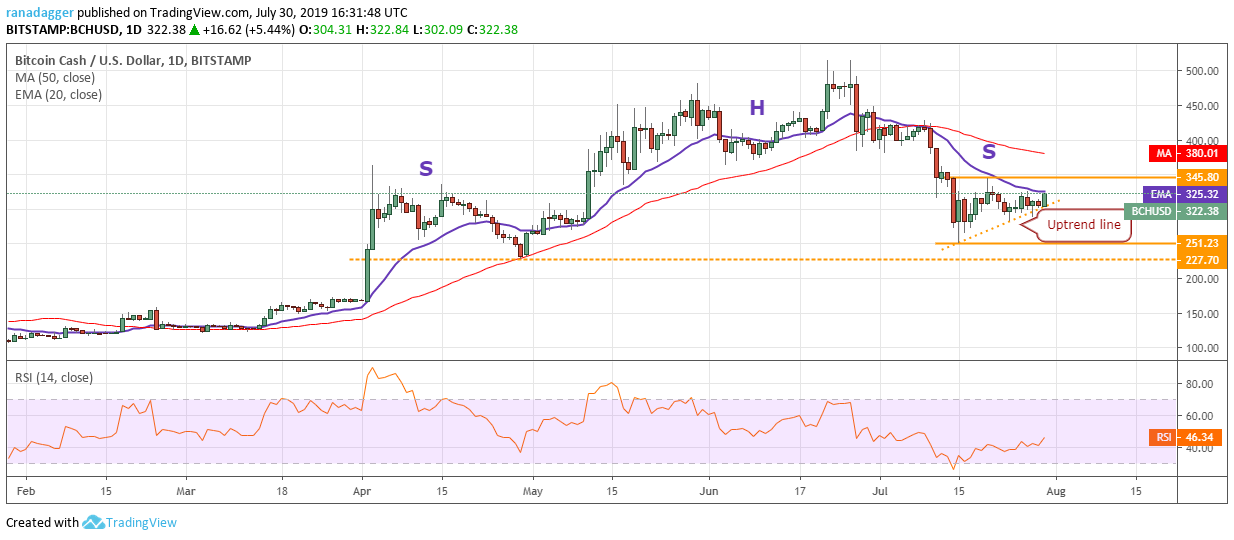

BCH/USD

Bitcoin Cash (BCH) is attempting to bounce from the uptrend line, which is a positive sign. If bulls push the price above the 20-day EMA and the overhead resistance of $345.80, it will complete an ascending triangle pattern that has a target objective of $440.37. Therefore, traders can buy on a close (UTC time frame) above $345.80 and keep a close stop loss of $280.

Contrary to our assumption, if the BCH/USD pair fails to break out of the overhead resistance and drops below the uptrend line, it can slip to $251.23. A breakdown of this level will signal weakness. We have noticed a large head and shoulders pattern that is forming, hence, we remain cautious on it. However, we will turn bearish only after the pattern completes.

BNB/USD

Binance Coin (BNB) has been gradually moving lower. Its next support is at $24.1709. If the price fails to rebound sharply from this support, it will be a negative sign. A weak bounce will indicate a lack of buyers and will increase the possibility of a drop to $18.30.

Conversely, if the BNB/USD pair rebounds from the current levels or from $24.1709 and breaks out of the 50-day SMA, it will indicate strength. We expect the uptrend to resume above $32.60. As the pair is trading close to its lifetime highs, we remain positive on it and will suggest a trade as soon as we spot a bullish setup.

EOS/USD

When buyers do not step in to defend critical support levels, it is usually a bearish sign. EOS continues to trade close to $3.8723, which is an important support. Failure of the price to move above the 20-day EMA shows that bulls are not aggressively buying at these levels.

If the EOS/USD pair breaks down of $3.8723, there is a minor support at $3.30, below which the decline can extend to $2.20. The downtrending moving averages and RSI in the negative zone suggest that bears have the upper hand.

This bearish view will be invalidated if the pair bounces off the support and rallies above $4.7753. It might face some resistance at the 50-day SMA, but once it is crossed, it is likely to pick up momentum. We do not find any bullish setups at the current levels, hence, we remain neutral on the pair.

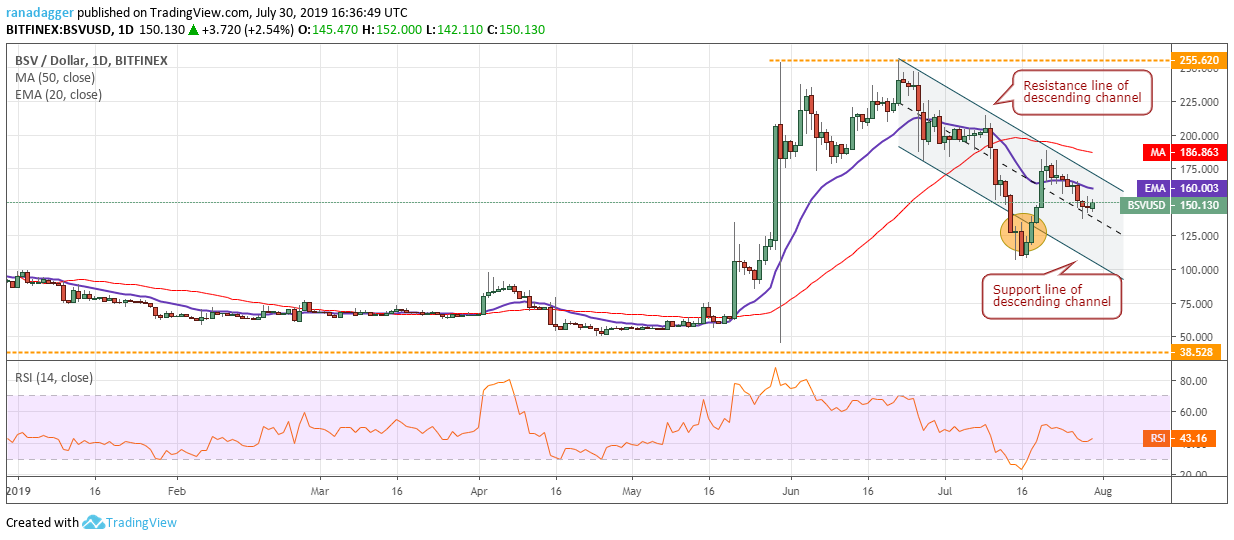

BSV/USD

The bulls are attempting to keep Bitcoin SV (BSV) in the top half of the descending channel. However, unless they push the price back above the 20-day EMA quickly, bears will once again try to sink the digital currency into the bottom half. With both moving averages trending down and the RSI below 50, the advantage is with the bears.

On the downside, the next support is at $107. If this support breaks down, the BSV/USD pair can sink to $61.832, which is the level from where the up move started on May 21.

Conversely, if bulls push the price above the resistance line of the descending channel, the pair might either start a new uptrend or consolidate in a range for a few days. We do not find a bullish setup at the current levels, hence we remain neutral in it.

XLM/USD

Stellar (XLM) has formed а doji candlestick pattern ин the past two days. This shows indecision among both bears and bulls. The price remains stuck between the 20-day EMA and $0.076. On the downside, we anticipate the bulls to defend the $0.072545–$0.076 support zone. However, the digital currency is likely to pick up momentum only after it scales above the 20-day EMA and $0.097795.

The downtrending moving averages and RSI in negative territory suggests that bears have the upper hand. If bears sink the XLM/USD pair below $0.072545, it will signal a resumption of the downtrend and will be a huge negative. Due to the uncertainty at current levels, we are not suggesting a trade in it. We will turn bullish if the price sustains above the 20-day EMA.

ADA/USD

Cardano (ADA) has been trading inside the symmetrical triangle for the past few days. It is difficult to predict the direction of the breakout. Therefore, taking positions inside the triangle can lead to losses. The best way is to wait for the breakout before jumping in to buy.

Both moving averages are sloping down and the RSI is below 50, which suggests that bears have the upper hand. A breakdown of the triangle will resume the down-move and has a target objective of $0.041.

On the other hand, if the ADA/USD pair breaks out of the triangle, it will signal a probable reversal and has a pattern target of $0.079. The rally might face some selling between the 50-day SMA and $0.082, but if this zone is scaled, a retest of $0.10 is likely. Aggressive traders can buy on a breakout and close (UTC time frame) above the triangle and keep a stop loss of $0.056. We recommend keeping the position size only 50% of usual.

Market data is provided by the HitBTC exchange.