Bitcoin strong move to $7,600 signals that trend change could be in the making and has also created buying opportunities for select altcoins.

Bitcoin is leading the recovery from the front, which is a positive sign. This shows that bulls have used the recent dip to buy. As a result, Bitcoin’s dominance has increased to 68.9%. Former Wall Street trader Tone Vays believes that Bitcoin will increase its dominance further in 2020, perhaps as high as 85%.

Although institutional money will enter Bitcoin first, it is unlikely that other altcoins will wither away. After investing in Bitcoin, large investors are likely to diversify into select altcoins. The next bull run is likely to be led by Bitcoin and a handful of altcoins. Hence, traders should keep a watch on the leaders and invest in them rather than buying the laggards in hopes of a dramatic recovery.

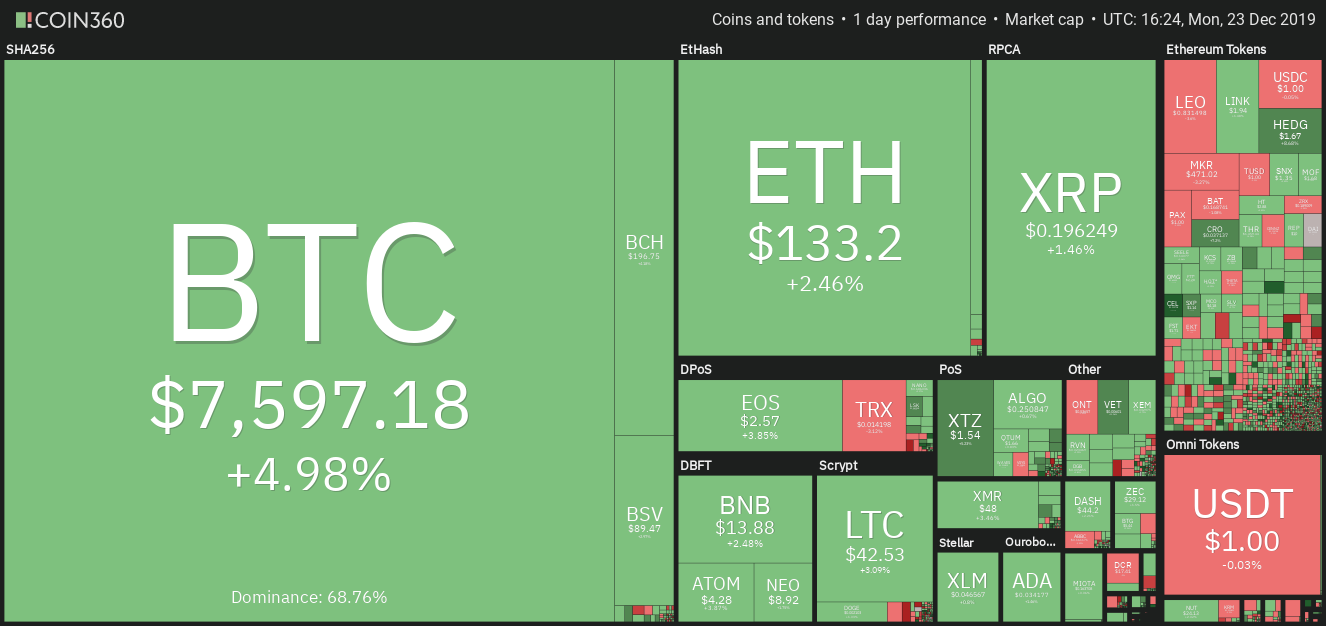

Daily cryptocurrency market performance. Source: Coin360

Most investors who bought the Initial exchange offerings (IEOs) in 2019 have been on the losing end those who purchased these IEOs after their listing on the exchanges fared much worse.

According to a report by BitMEX Research, almost all of the major IEOs launched in 2019 are down over 80% compared to their price upon listing. This shows that traders should be prudent with their investments and should not be driven by greed.

With the recent recovery in prices, we have identified several trades for the short-term. Traders do not need to take all these trades, rather, they can pick and choose the one they are most confident with.

Short-term trades should be monitored regularly and the stop loss should be trailed to protect the paper profits. Let’s see which major cryptocurrencies offer a buying opportunity?

BTC/USD

The bulls pushed Bitcoin (BTC) above the 20-day EMA at $7,294 on Dec. 22. This was Bitcoin’s first closing (UTC time) above the 20-day EMA since Nov. 10. With the recent rise, the 20-day EMA has flattened out and the RSI has risen into the positive territory, which suggests that bulls are back in the game.

BTC USD daily chart. Source: Tradingview

If the bulls can push the price above $7,856.76, the BTC/USD pair will complete a double bottom pattern. This pattern has a minimum target objective of $9,201.51 and above it $10,360.89.

Therefore, traders can buy on a close (UTC time) above $7,856.76 and keep an initial stop loss of $7,000. Though there is stiff resistance at the downtrend line, we anticipate it to be crossed.

Our bullish view will be invalidated if the pair turns down from $7,856.76. In such a case, a few days of range-bound action is likely. The trend will turn negative on a close (UTC time) below the recent low of $6,435.

ETH/USD

The bulls are struggling to sustain the price above $131.484. Both moving averages are sloping down and the RSI is in the negative zone, which shows that bears are in command.

The bears will now attempt to sink Ether (ETH) below the immediate support at $125. If successful, a drop to the recent low at $117.09 is likely. A break below this level will resume the downtrend. The next support on the downside is $100.

ETH USD daily chart. Source: Tradingview

However, if the bulls support the price at $131.484, we anticipate another attempt to scale above the 20-day EMA at $143. If successful, a rally to the 50-day SMA at $157.50 is possible.

The short-term traders can stay on the long side if the ETH/USD pair closes (UTC time) above the 20-day EMA at $143. However, we suggest positional traders wait for a new buy setup to form before initiating long positions.

XRP/USD

The intraday range in XRP has been shrinking for the past few days, which shows a build-up of energy. As the price has been trading close to the overhead resistance at $0.20041, we anticipate the bulls to push the price above it.

XRP USD daily chart. Source: Tradingview

Though the 20-day EMA is placed just above $0.20041 resistance, we expect the bulls to push the price above it. On a close (UTC time) above $0.20041, a rally to $0.2326 is possible. The short-term traders can buy on a close (UTC time) above $0.20041 with a stop loss of $0.1740.

Contrary to our assumption, if the bulls fail to propel the price above $0.20041, the XRP/USD pair might retest the recent low at $0.17468.

BCH/USD

Bitcoin Cash (BCH) is currently trading inside a descending channel. We anticipate the bears to mount a stiff resistance at the resistance line of the descending channel, which is just above the 20-day EMA at $201.

BCH USD daily chart. Source: Tradingview

If the price turns down from the resistance line of the channel, it can again dip to $183.40 and below it to $169.62.

However, during the next fall, if the bulls keep the price above $192.52, it will be a positive sign and a breakout of the channel is likely. A breakout of the channel can carry the price to $227.01. The short-term traders can buy if the price sustains above $204 for four hours with a stop loss of $183.

LTC/USD

Litecoin (LTC) has pulled back to the 20-day EMA at $43, which is just above the resistance line of the descending channel. We anticipate the bears to defend this resistance aggressively. If the price turns down from the current levels, it can correct to $39.2520. A break below this level can drag the price to the recent low of $35.8582.

LTC USD daily chart. Source: Tradingview

However, if the bulls push the LTC/USD pair above the 20-day EMA, it will be a positive sign. The next level to watch on the upside is $50. The short-term traders can buy on a close (UTC time) above the 20-day EMA and keep a close stop loss of $39.

EOS/USD

EOS has been trading between $2.4001 and $2.5804 for the past four days. This is a positive sign as it shows consolidation close to the overhead resistance. If the bulls can sustain the price above $2.5804, a rally to $2.8695 is likely. The short-term traders can buy on a close (UTC time) above $2.5804 with a stop below $2.4001.

EOS USD daily chart. Source: Tradingview

Contrary to our assumption, if the price turns down from the current levels, it will extend its stay inside the range for a few more days. If the bears sink the price below $2.4001, a drop to the low at $2.1624 is possible.

BNB/USD

The relief rally in Binance Coin (BNB) has reached the overhead resistance zone of $13.88 to $14.2555. The 20-day EMA at $14.35 is placed just above this zone. We anticipate the bears to defend this zone aggressively.

BNB USD daily chart. Source: Tradingview

If the price turns down from this zone, the BNB/USD pair can dip to $12.9624 and if this level also cracks, a retest of the recent low at $12.1111 is possible.

However, if the bulls can sustain the price above 20-day EMA, a rally to $16.50 is possible. The short-term traders can buy on a close (UTC time) above $14.40 with a stop below $12.90.

BSV/USD

Bitcoin SV (BSV) has broken out of the downtrend line. The bulls will now try to push the price above the overhead resistance at $92.693. If successful, a move to the 50-day SMA at $106.9 and above it to $113.96 is possible. The traders can buy on a close (UTC time) above $92.693 with a stop below $83.

BSV USD daily chart. Source: Tradingview

However, if the price turns down from $92.693, the BSV/USD pair might retest $78.506. If this support holds, the pair might consolidate between $78.506 and $92.693 for a few more days. The downtrend will resume on a break below the recent low at $77.203.

XTZ/USD

Though the intraday price action in Tezos (XTZ) has been volatile, its daily closing (UTC time) has been just above or below the 20-day EMA for the past five days. This shows indecision among the buyers and sellers.

XTZ USD daily chart. Source: Tradingview

The 20-day EMA has flattened out and the RSI is close to the midpoint, which suggests a range-bound action in the near-term. The level to watch on the downside is $1.18 and on the upside is $1.65. Though positive, we would wait for the XTZ/USD pair to sustain above the 20-day EMA before suggesting a trade in it.

TRX/USD

TRON (TRX) has once again claimed its spot among the top ten cryptocurrencies by market capitalization, hence, it has been included in our analysis. During the recent fall, the altcoin did not break below its critical support at $0.01124, which shows that the bulls are accumulating on dips.

TRX USD daily chart. Source: Tradingview

The relief rally from the recent low has risen above the 20-day EMA, which is a positive sign. However, we anticipate the bulls to hit a roadblock close to $0.0163957. If the price turns down from this level, a few days of range-bound action is likely.

Contrary to our assumption, if the bulls can push the price above $0.0163957, a rally to $0.0234 is possible. We will wait for the TRX/USD pair to rise above $0.0163957 before suggesting a long position in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

If You Liked This Article Click To Share