Bitcoin’s (BTC) recent rejection at $12,400 triggered $234 million in futures contract liquidations across derivatives exchanges. Despite a 30% rally in the past 30 days, maintaining the $11,700 level as support is undecided.

Bitcoin hasn’t seen a lower low ever since the mid-March 50% shakedown, which caused the price to test the sub-$4,000 level.

Bitcoin USD 4-hour chart. Source: TradingView

Surely there have been ups and downs over the past three weeks, although a clear uptrend has been present. Traders’ sentiment certainly wasn’t positive on August 2 after a $1,400 crash that liquidated $1 billion in futures contracts.

It’s natural for the human mind to give more relevance to recent events, especially when presenting a negative outcome.

Traders using leverage will undoubtedly have a more agonizing experience when facing such large unexpected red candles during more extended timeframe uptrends.

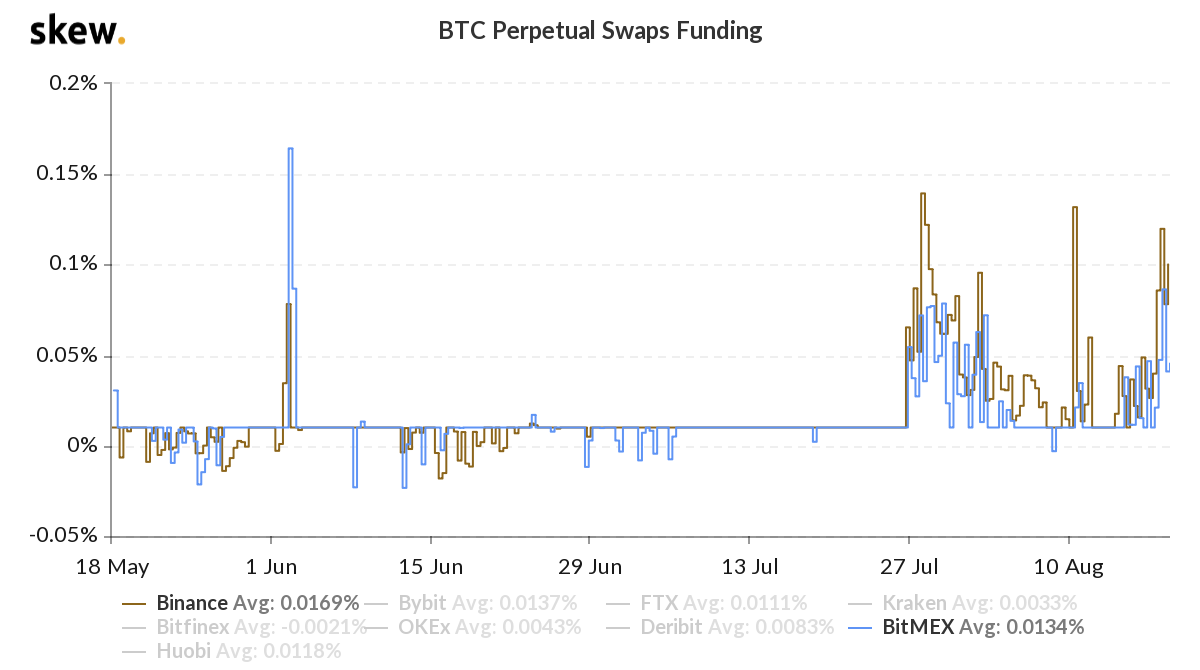

Measuring leverage by funding rate

Excessive leverage from buyers will be reflected in the funding rate. This is because perpetual futures contracts, also known as inverse swaps, have an embedded fee for margin usage.

Funding rates are usually changed every 8 hours and they ensure that there is no exchange risk overexposure imbalances.

If buyers are using more leverage than sellers, the funding rate will be positive and buyers will pay. The opposite occurs when future contracts sellers are the ones demanding more margin.

Bitcoin perpetual swaps 8-hour funding rate. Source: Skew

After a brief positive spike on August 10, the funding rate was relatively calm during the next seven days. This trend changed earlier this week as the indicator reached 0.10%, equivalent to 2% per week.

This doesn’t necessarily translate to bullish investors, but it does signal that buyers are the ones using more leverage.

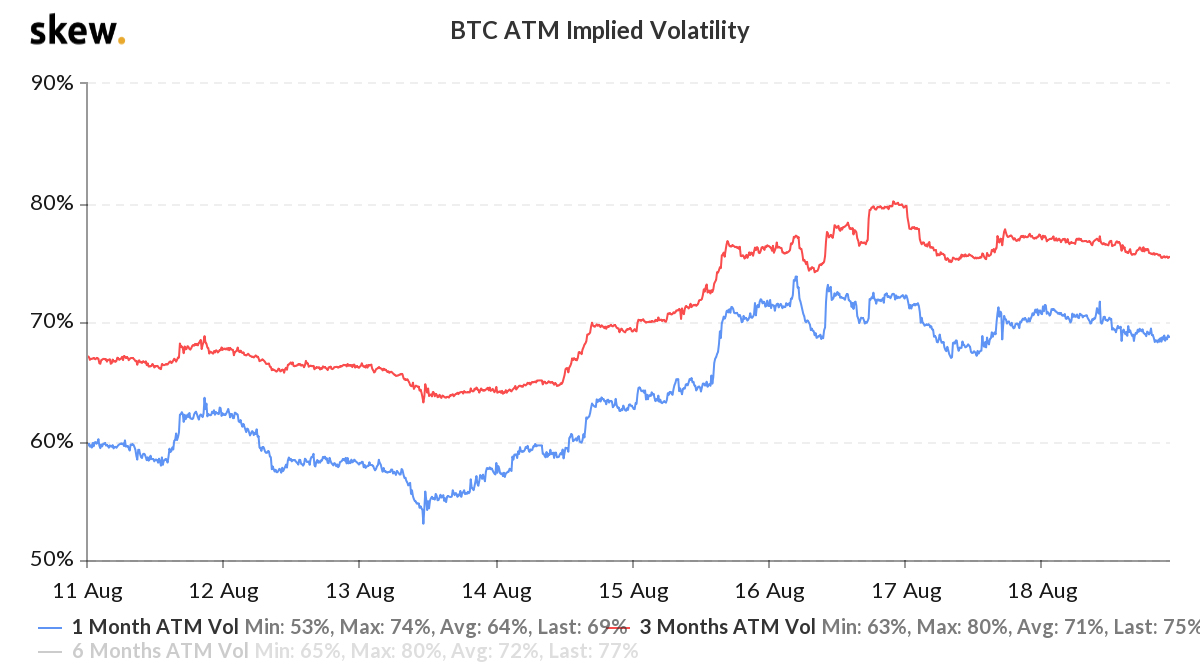

Options markets show few signs of stress

Volatility is the main gauge of price oscillations and it can either be calculated by historical prices or by the options market pricing, known as implied volatility. This means that regardless of the daily swings of the past week or month, implied volatility measures the present scenario.

Only those Bitcoin options with the strikes closest to current underlying market levels are used, meaning $11,000 to 13,000 ones at the present moment. Those are known as at-the-money options and used for the implied volatility calculation.

Bitcoin at-the-money options implied volatility. Source: Skew

Take notice of how the indicator barely moved over the past 48 hours. That certainly wouldn’t be the case had the market experienced a sudden $2,000 drop. This reinforces the thesis of the current Bitcoin correction being a healthy pullback, rather than a trend changing market move.

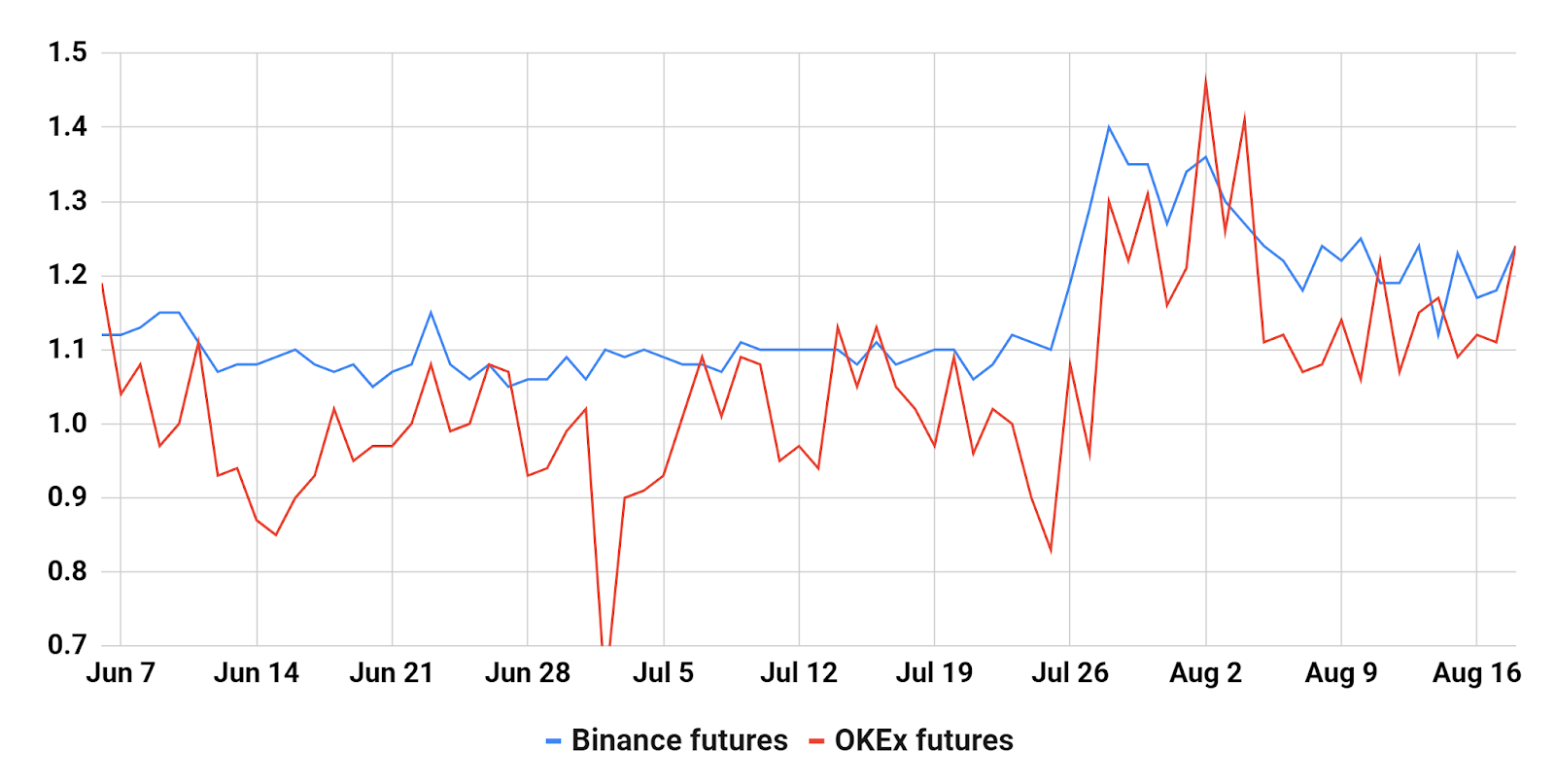

Top traders remain net-long

Exchange-provided data highlights traders’ long-to-short net positioning, allowing one to determine whether professional traders are leaning bullish or bearish.

Despite discrepancies in methodologies, viewers will be able to monitor changes in this index and it provides a clear enough view of top traders’ net exposure.

Top traders longs/shorts. Source: Binance, OKEx, and Cointelegraph

Overall, traders at Binance and OKEx have held net long exposure since July 27 and not even the sharp $1,500 Bitcoin price drop on August 2 was able to shift this bullish position.

Analysts became even more bullish on Bitcoin after the U.S. Federal Reserve reportedly considered not raising interest rates until inflation hits 2%.

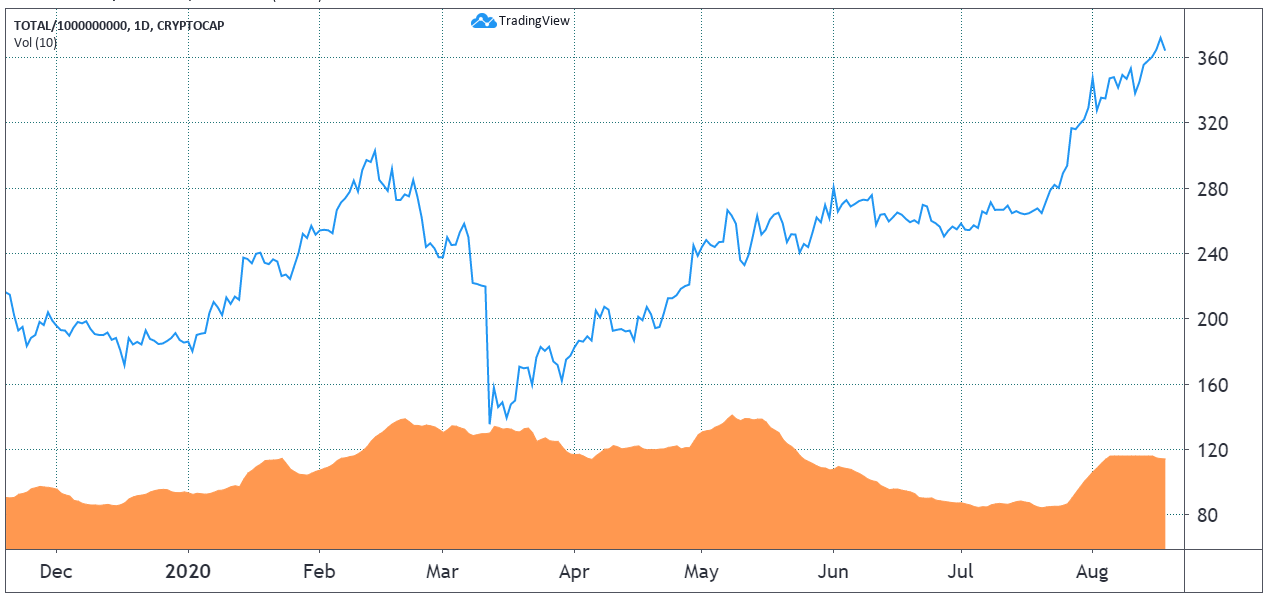

Volumes remain strong

Volume changes provide insight on increasing and diminishing activity, especially after strong price movements.

Crypto total market capitalization and volume. Source: Tradingview

The trading volume within the entire crypto market faced a downtrend as total market capitalization drifted sideways near $260 billion from mid-May until late-July when it finally broke the $280 billion resistance.

Although it is yet to be seen if the recent total market capitalization will hold the $360 billion level, the current 10-day average volume is an indicator of a healthy market trend.

There seems to be no signal of stress both in Bitcoin futures and options, as both perpetual contract funding and implied volatility indicators remain healthy.

While there is not a single indicator or analysis that provides certainty over short-term price movements, the net exposure of top traders points to unfazed bullish momentum.

By avoiding excessive leverage, traders will not be heavily impacted by natural price swings that will occur even during long and unquestionably bullish markets.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.