Bitcoin’s intense multi-day uptrend is slowing as the cryptocurrency reaches $13,000. A confluence of positive news regarding BTC’s adoption amongst corporations helped drive this recent push higher, but it remains unclear how long this uptrend will last.

Bears have been ardently trying to stop the cryptocurrency from breaking above $13,000. Each time it reaches this price region, it sees heightened selling pressure that slows its ascent.

If this selling pressure continues persisting in the near-term, it could spark a retrace that causes the benchmark cryptocurrency to cut into its recent gains.

It remains unclear whether this potentially imminent retrace will invalidate the bullish market structure established throughout the past few days.

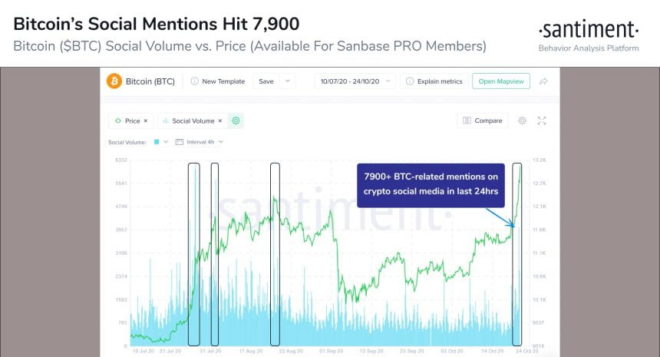

One analytics firm explained in a recent tweet that Bitcoin’s “social volume” saw a massive surge this week.

They note that the “peak hype” phase seen during pumps like that which is ongoing can often mean that consolidation or a retrace is imminent.

This may not bode too well for Bitcoin in the near-term, as a confluence of peak euphoria amongst investors, coupled with resistance in the lower $13,000 region, could signal that some downside is imminent.

Bitcoin Consolidates as Resistance in Lower-$13,000 Region Mounts

At the time of writing, Bitcoin and the aggregated cryptocurrency market are caught within a consolidation phase as BTC struggles to break above $13,000.

It is currently trading down slightly as it hovers just below this key level, with bulls and bears deadlocked as they both try to take the reins.

Whether or not $13,000 is firmly surmounted in the near-term will likely provide some significant insights into where it trends in the days and weeks ahead.

Analytics Firm: BTC’s Social Volume Suggests Consolidation is Imminent

Analytics firm Santiment explained in a recent tweet that Bitcoin’s rocketing social volume suggests that consolidation or a retrace is imminent.

“Extreme social volumes during pumps can often signal ‘peak hype’ and increasingly irrational market confidence. This doesn’t necessarily a mean a full collapse is imminent, but it does generally lead to consolidation.”

Image Courtesy of Santiment.

The longer Bitcoin remains trapped beneath $13,000, the lower its social volume will likely trend.

Because this is often viewed as a counter indicator, this could mean that a short-term consolidation phase in the upper-$12,000 region will ultimately prove to be bullish for Bitcoin.

Featured image from Unsplash. BTCUSD pricing data from TradingView.