Solana has been caught in the crossfire as investors woke up to a bloody Monday due to hurdles in the Asian markets. The top cryptocurrencies by market cap are in the red recording moderate to heavy losses in the 24-hour chart.

Solana Follows The General Sentiment In The Crypto Market

At the time of writing, Solana (SOL) trades at $143,53 with a 10.9% loss in the daily chart. In the weekly chart, the cryptocurrency is amongst the worst performers on the crypto top 10 with a 17.9% loss.

After Solana, Polkadot (DOT) is the closest to record similar losses for the weekly chart with 17.6%, followed by Cardano (ADA) with 17.1%, XRP with 16.5%, and Binance Coin (BNB) with an 11% over the same period.

Bitcoin and Ethereum outperformed other cryptocurrencies on the weekly chart, with BTC recording only a 4.7% loss. Solana dropped during the weekend following a long period of profits and an-all time high north of the $200 mark.

As it has happened in the past, investors seemed to favor BTC and ETH, the largest cryptocurrencies, in expectations of further downside in the macro-economic outlook due to the potential risk of default by Chinese real estate developer titan, Evergrande.

Related Reading | Bitcoin Price Sinks 10% As Market Braces For Macro Storm Ahead

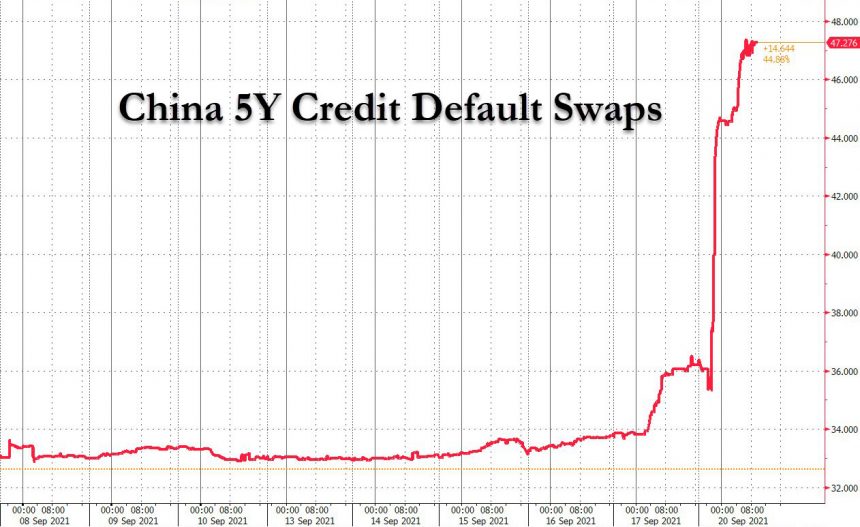

As seen below, the China 5-year credit default swap has increased, according to data shared by ZeroHedge. This suggests that many investors are betting on the possible failure to honor its financial commitments by the Asian giant.

However, Primitive Crypto founder Dovey Wan believes the opposite. Commenting on the Evergrande situation, Wan highlighted that the Chinese market and its companies operate differently than those in the West.

Therefore, she expects the situation with the real estate to not escalate to the point of Lehman Brothers, the financial services firm that defaulted in the U.S. during the 2008 economic crisis. Wan said:

Evergrande is not a vapor financial co, tho it’s high leveraged real estate developer sill retains good trunk of property/lands+ good cash flow biz like property mgmt co on its book. The situation can trigger macro panic but the substantial threat is far less than Lehman.

Bitcoin Holds The Key For Solana In The Short Term?

In previous bearish momentum for the crypto market, most of the assets followed Bitcoin. Therefore, BTC’s price could determine what happens to Solana in the near future.

BTC stands on critical support in the daily, trading at $43,855, and could find its next support in the high area of $30,000 potentially returning to its previous range.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

However, Solana (SOL) has demonstrated resilience in that scenario, and it could potentially become one of the few cryptocurrencies capable of enduring another major sell-off.