“The price will likely show no clear direction until Friday’s U.S. PCE announcement, and it could be a make-or-break event for bitcoin,” bitBank said in an email. “If the inflation data comes in hotter than expected, bitcoin could give up about a half of its gain in the past two weeks and decline to around $65,000.” Original

Tag: Report

Report Shows Grayscale Could Keep ETH Price Down With $110M Daily Outflows

A recent market report by research firm Kaiko noted how Grayscale’s Spot Ethereum ETF could have a negative impact on Ethereum’s (ETH) price. This is based on the firm’s expectations that Grayscale’s Ethereum Trust (ETHE) could follow a similar path to Grayscale’s Bitcoin Trust (GBTC). Ethereum Could Face Significant Selling Pressure From Grayscale’s Outflows Kaiko noted that Ethereum could face significant selling pressure from Grayscale’s ETHE once the Spot Ethereum ETFs begin trading. This is because the fund has been trading at a discount between 6% and 26% over the…

Report: Investigation Finds No Fault With Sullivan & Cromwell in FTX Bankruptcy

An investigation into the law firm Sullivan & Cromwell LLP, which worked with the now-defunct crypto exchange FTX, revealed that the firm was neither involved in the fraud nor aware of the financial troubles that plagued the collapsed trading platform. Sullivan & Cromwell Cleared of Negligence in FTX Collapse Following a recent investigation, former U.S. […] Source BitcoincryptoexchangeExchanges CryptoX Portal

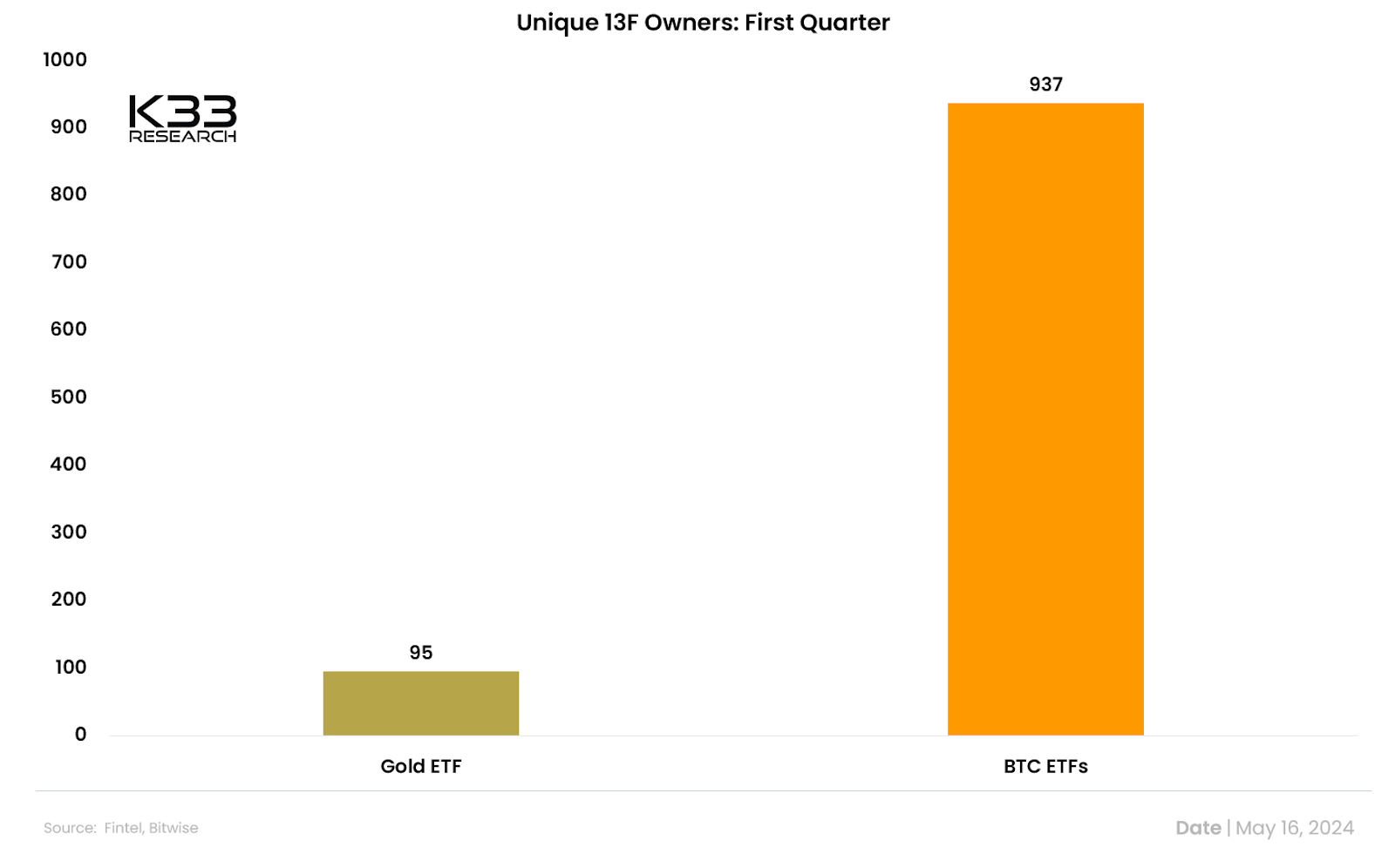

why 13F report matters for the crypto industry

A new quarterly 13F report has revealed that the world’s largest companies are investing considerable sums in Bitcoin ETFs. What does this mean for the crypto industry? A few hundred U.S. firms have filed Form 13F with the Securities and Exchange Commission (SEC). Of particular interest to the crypto market is that many institutional investors own shares of spot Bitcoin ETFs. How Form 13F works 13Fs are quarterly reports filed with the SEC by institutional investment managers with at least $100 million under management. 13Fs provide insight into stock ownership…

Ether ETF Approval Imminent? SEC Asks 3 Exchanges to Amend Filings: Report

The expectation for the approval of an Ether exchange-traded fund (ETF) is heightened as the Securities and Exchange Commission (SEC) asked Nasdaq, CBOE, and NYSE to amend their applications for the crypto instrument by the end of Tuesday, Reuters reported. Bringing Enthusiasm among Crypto Investors Although there is no official confirmation, the regulator’s reported approach to the exchange has sparked enthusiasm in the crypto markets, as the dollar value of Ether has jumped significantly in the past couple of days. Ether ETF hopes are revived on flurry of application updates…

Crypto Exchange Kraken Mulls Pulling Support for Top Stablecoin USDT in the EU: Report

The San Francisco-based crypto exchange Kraken is reportedly mulling whether to pull support for the stablecoin USDT in the European Union (EU). Bloomberg reports that Kraken is “actively reviewing” its European support for the Tether-issued stablecoin. European digital asset trade associations and think tanks have warned that the EU’s Markets in Crypto-Assets Regulation (MiCA) could ban the largest stablecoins by trading volume. MiCA is the upcoming EU legislation that will provide rules covering the supervision, consumer protection and environmental safeguards of crypto assets. The law also includes measures that aim…

Coinbase Shares Sink 9% on Report CME to Consider Listing Spot Bitcoin

Recently launched spot bitcoin exchange-traded funds (ETFs) gave traders a safer way to invest in the token, which over 500 institutions took advantage of within only the first three months of existence, allocating over $10 billion in the funds alone. The rest, over $40 billion, came from retail traders. Source

Millennium Management and Morgan Stanley Report Significant Spot Bitcoin ETF Holdings

According to 13F filings with the U.S. Securities and Exchange Commission (SEC), Millennium Management, a highly successful hedge fund, holds nearly $2 billion in spot bitcoin exchange-traded fund (ETF) shares. This week, it was further revealed that Morgan Stanley, a giant multinational investment and financial services firm, also has exposure to spot bitcoin ETFs. Top […] Original

Report: CME Group to Launch Bitcoin Trading Amid Rising Demand From Wall Street

CME Group, the world’s largest futures exchange, is planning to launch bitcoin trading to capitalize on the surging demand among Wall Street money managers for exposure to the cryptocurrency sector, according to a report from the Financial Times. The Chicago-based group has reportedly been in discussions with traders interested in buying and selling the cryptocurrency […] Original

Bitcoin, Ethereum prices rise after U.S. inflation report

Bitcoin and stocks experienced a notable price increase following the release of the April U.S. inflation data. The Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, indicated a 3.4% increase in consumer prices from last year. The year-over-year inflation figure represents a slight decrease from March’s inflation rate of 3.7%, as reported by the U.S. Bureau of Labor Statistics (BLS). 24-hour price of BTC from CoinMarketCap Shortly after the BLS published…