Wall Street suffered Monday morning as the major U.S. stock indexes dropped further, building on losses gathered last week. Reports indicate that investors are concerned about the upcoming Federal Reserve rate hikes and China’s recent Covid-19 outbreak. As equities floundered on Monday, the crypto economy slid under the $2 trillion mark and gold prices dropped 1.6% against the U.S. dollar during the past 24 hours. However, after Elon Musk revealed he acquired Twitter at 2:50 p.m. (ET), both equities and crypto markets rebounded a great deal following the announcement.

Global Markets Shake Over Fears of Covid-19 Related Supply Chain Issues and the Possibility of Aggressive Rate Hikes

Four days ago, Jerome Powell, the current U.S. Federal Reserve chair, explained at an International Monetary Fund (IMF) panel discussion on April 21, that the U.S. central bank may have to move “more quickly” when it comes to bank rate hikes. Powell further noted that the U.S. central bank could implement a 50 basis-point rate hike at the next Fed meeting. The hawkish comments from Powell have spooked investors and U.S. stock indexes took losses before the weekend started last week.

On Monday, Wall Street continued to suffer as the Dow Jones Industrial Average, NYSE Composite, and the S&P 500 all saw losses. At 10 a.m. (ET), the Dow shed 415.23 points and by the afternoon, it recovered a little more than half of the losses back. The blame is currently being placed on the Federal Reserve’s upcoming rate hikes, and China’s Covid-19 lockdowns. The chief equity strategist at MAI Capital Management, Christopher Grisanti, told Reuters that China’s current lockdowns have caused fear of possible supply chain problems.

“China lockdowns are getting worse. It slows general economic growth and also creates supply chain issues that will continue to make inflation bad and lower earnings growth in the United States,” Grisanti said. “I don’t think we’ve seen the bottom yet. We haven’t had that big sell-off yet where we have huge volumes,” the strategist added.

Gold and Crypto Markets Suffer, Portfolio Manager Says ‘Markets Are Struggling’

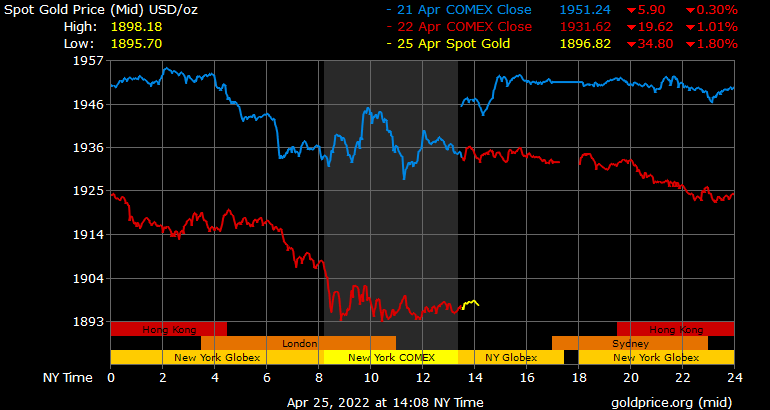

Gold and cryptocurrencies have also seen a downward trend in recent times. The crypto economy has shed billions over the last week, slipping back below the $2 trillion mark. A number of the top ten digital assets saw losses between 2 and 10% during the last seven days. Furthermore, the price of one ounce of fine gold has seen some percentage losses during the last 24 hours.

One ounce of fine gold has shed 1.6% in value over the last day, and one ounce of fine silver has lost 2.04%. Gold prices over the last 30 days have been stagnant too, and one-month stats show an ounce of gold’s USD value increased by a slight 0.39%. Silver, on the other hand, dropped more than 3% during the last 30 days. The precious metals’ decline in value is also being blamed on China’s Covid-19 outbreak and current U.S. Treasury yields could be pulling gold investors away.

Steven Violin, a portfolio manager at F.L.Putnam Investment Management Co. told Marketwatch in an interview on April 23, that investors are struggling with “very strong forces.” Violin remarked that it’s very likely that nobody can predict what’s going to happen with the economy. “The tremendous economic momentum from the recovery from the pandemic is being met with a very rapid shift in monetary policy,” Violin said. “Markets are struggling, as we all are, to understand how that’s going to play out. I’m not sure anyone really knows the answer.”

U.S. Equities and Cryptocurrencies Erase the Day’s Losses After Musk Buys Twitter

Despite the stock market downturn and the recent crypto economy losses, both equities and crypto prices rebounded after Twitter announced that Tesla’s Elon Musk purchased Twitter. The entire crypto economy jumped from $1.93 trillion to $1.96 trillion after the announcment. After dropping below the $40K mark, BTC once again jumped back above the $40K region.

I hope that even my worst critics remain on Twitter, because that is what free speech means

— Elon Musk (@elonmusk) April 25, 2022

Major U.S. stock indexes recovered from the morning losses as well as NYSE, the Dow, S&P 500, and Nasdaq erased much of the day’s losses. As the trading day on Wall Street neared the closing bell, the major indexes flashed from red to green. After the company was acquired by Musk, Twitter’s current CEO Parag Agrawal said: “Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.” It seems stock investors and crypto market participants like the fact that Musk purchased the social media firm.

What do you think about global markets today? Do you expect markets to continue sliding or do you think a rebound is coming in the near future? Let us know what you think about this subject and the economy in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.