By CCN Markets: In Denmark, some depositors are now paying the bank to look after their money.

In Germany, the 30-year bond yield just went negative.

A total $17 trillion of global bonds are now negative and it’s rising at a rate of a trillion a week.

On the flip-side, Danish banks will pay you interest to take out a mortgage.

Welcome to the bizarre new world of negative interest rates, where you pay a price to store your wealth.

Surprise, surprise! The total amount of negative-yielding #debt has topped USD 16 trillion for the for the first time ever. More than 28% of outstanding debt, tracked by the Bloomberg Barclays Global Aggregate Index, comes with a #yield below 0%. pic.twitter.com/9pLZ8jp0Pa

— jeroen blokland (@jsblokland) August 15, 2019

Negative interest rates coming to the US?

This trend to zero is the fault of central banks. Japan, China, and the eurozone have pursued a relentless policy of monetary easing over the last decade by slashing interest rates to zero and flooding the money supply through quantitative easing (QE).

Hedge fund manager Kyle Bass rightly points out that this is “insane.”

“This is insane. The Japanese are going to keep going. The Chinese print money like it’s a national pastime today. Europe is going to restart QE.”

Bass thinks negative rates are probably coming to the US too. As CCN reported, President Trump is aggressively pressuring the Federal Reserve to follow Europe towards low or zero interest rates. And former Fed chairman Alan Greenspan sees nothing to stop America going negative.

“There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level.”

This is why bitcoin matters

In this “insane” future, bitcoin offers a possible oasis.

A world of negative interest rates punishes savers because your money is continually devalued by central banks.

Bitcoin is different. With a strictly limited hard cap and predictable daily output, the bitcoin supply cannot be manipulated. Central banks can’t devalue it. No-one can “print more.”

As Pierre Rochard points out, this makes it an ideal alternative savings technology:

bitcoin is the world’s most efficient savings technology

— Pierre Rochard (@pierre_rochard) July 16, 2019

Over the long-term, bitcoin has rewarded ‘hodlers’ or savers, helping establish its narrative as a store of value.

Bitcoin: a hedge against negative interest rates?

The dominant cryptocurrency is also emerging as a hedge in the ongoing currency war. When China let the yuan fall against the dollar, we saw a clear uptick in bitcoin. Although, this correlation is far from proven over the long-term.

Lastly, in a world of negative-yielding bonds, investors will desperately seek out gains elsewhere. As the best-performing asset of the year, not to mention the decade, it’s getting harder to ignore bitcoin.

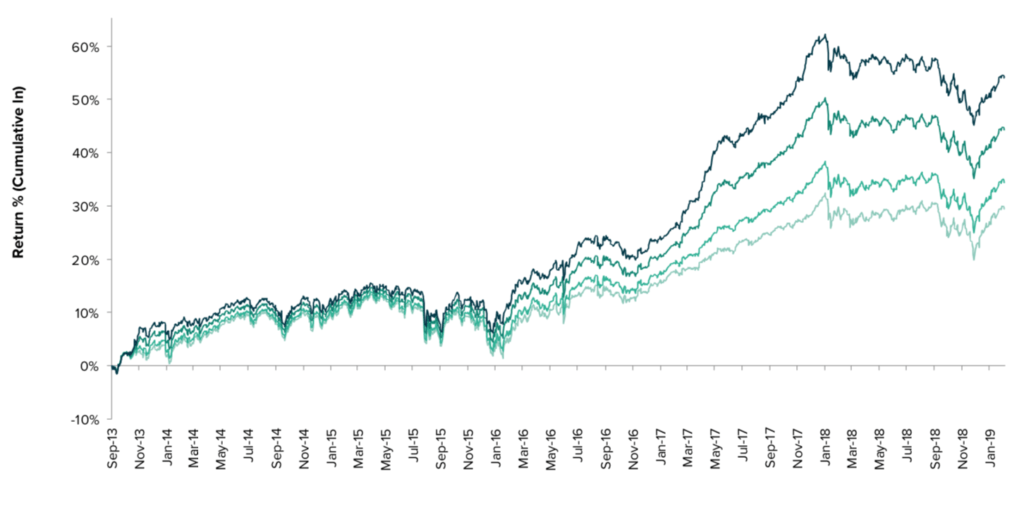

A small allocation of bitcoin in a wider portfolio has a proven net positive effect, according to Grayscale. Their simulated performance shows that even a one percent allocation to BTC boosts the traditional 60-40 portfolio by 20 percent over the long-term.

As the world moves to negative interest rates, bitcoin’s monetary policy and price performance make it an appealing alternative.

This article is protected by copyright laws and is owned by CCN Markets.