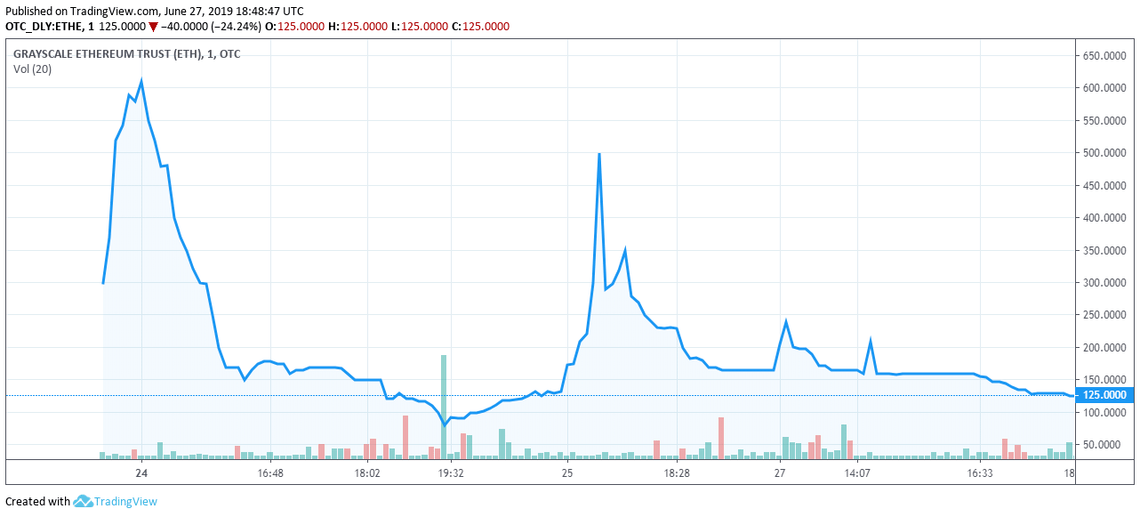

According to Charlie Bilello, an investor and a finance researcher, Ethereum is being traded with substantial premiums above spot value through Grayscale’s Ethereum Investment Trust (ETHE).

Grayscale’s Ethereum Trust started trading last week. These are the premiums investors have paid above the net asset value of the Ethereum holdings…

June 20: 1,059%

June 21: 2,022%

June 24: 347%

June 25: 643%

June 26: 408%

Today: 312%

Efficient Market Hypothesis be damned. pic.twitter.com/KMaJKB8ni6— Charlie Bilello (@charliebilello) June 27, 2019

On June 24, Ethereum traded with a 2,022 percent premium at around $580 per share. Each share of ETHE represents 0.09624748 ETH, less than 10 percent of one Ethereum (ETH).

“Someone bought this last Friday at $580 betting that ethereum would rise, and they were right. Underlying ethereum rose from 27.33 to 30.34, an 11% gain. Only problem was they paid a 2,022% premium & today investors ‘only’ paid a 312% premium, resulting in a 78% loss thus far,” Bilello said.

As of June 28, Ethereum is valued at $305. The underlying assets of ETHE – 9.6 percent of one ether token – would be around $28.87. Instead, on June 24, investors purchased ETHE at $580, investing in the asset at a price of over $5,800.

Why are investors buying Ethereum with a high premium?

The premium-related issues in the crypto market are not specific to Ethereum. Investors in the U.S. market have been purchasing bitcoin with high premiums as well through the Bitcoin Investment Trust (GBTC).

On May 29, CCN reported that the bitcoin price surpassed $11,000 in OTCMarkets through GBTC, demonstrating a premium of over 37 percent following a substantial increase in volume in early May.

“Trading volume on Grayscale Bitcoin Trust (symbol: $GBTC) exceeded $50 million today and was again the most actively traded stock on OTC Markets,” Digital Currency Group CEO Barry Silbert said at the time.

Investors have been paying premiums to purchase crypto assets through Grayscale’s investment vehicles because many accredited investors cannot purchase digital assets through existing exchanges.

Some investors are required to utilize strictly regulated, insured, and transparent channels to invest, causing premiums to soar.

GBTC and ETHE are operated by Grayscale, a crypto-focused investment firm with more than $3 billion in assets under management, operated by Silbert’s DCG.

For that specific reason, many companies including exchanges in the crypto market and major institutions on the broader financial sector have moved towards creating custody businesses to target accredited and institutional investors.

But, until better alternatives like an exchange-traded fund (ETF) is introduced, for retail investors individual investors, regulated products like Grayscale’s GBTC and ETHE are likely to remain compelling options.

Analysts have suggested that the premium may have soared to more than 2,000 percent because of its recent launch. ETHE was only introduced to the market last week.

Still, as of June 27, ETHE is trading at $125 per share, at a price substantially higher than ETH holdings per share at $30.34. That means investors are still paying a hefty premium to purchase ETH through ETHE.

If an investor buys ETHE at a price of $125 today, the investor will only get 25 percent worth of Ethereum back, paying a premium of over 312 percent.

Shouldn’t an ETF be introduced to prevent this issue?

Due to high premiums in various over-the-counter (OTC) markets and platforms offering regulated products, industry executives have suggested that the authorities in the U.S. have to favor the approval of an ETF around crypto assets to prevent investors from paying premiums.

“Sometimes I wonder if regulators wish they approved a bitcoin ETF. Here is an example of a $1B+ OTC Bitcoin product, that often sells at a 30%+ premium, marketed on public TV & reaching millions. Crypto exchanges also have millions of clients. Thoughts,” VanEck digital asset strategist Gabor Gurbacs said.

Click here for a real-time Ethereum price chart.