Several traders believe that the price of Ether (ETH) could pull back after it achieved a new all-time high on Jan. 25, gaining nearly 100% in January. Ether has outperformed Bitcoin (BTC) so far this year, buoyed by the growing number of users on Ethereum.

Primarily due to the growing demand for DeFi, the Ethereum network has seen an increase in user activity and transaction volume.

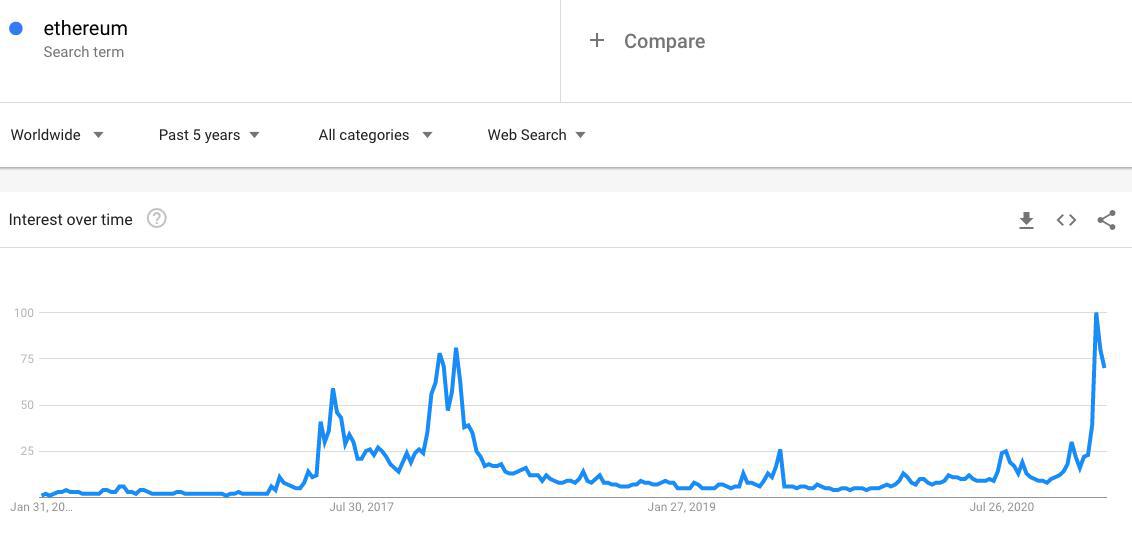

This has also led the popularity of the term “Ethereum” to increase significantly on Google Trends, breaking its previous high from January 2018.

Ether pulls back against Bitcoin as BTC begins to rally

In the past week, the price of Ether has seen some inverse correlation with Bitcoin. The ETH/BTC pair broke out against Bitcoin, hitting the highest levels since September 2019.

But oftentimes, when the price of Bitcoin rose, ETH pulled back, and vice versa. When Bitcoin rallied, altcoins also performed poorly, which suggests that profits are flowing into and out of Bitcoin based on market sentiment.

If the market is more confident and is attracted to high-risk bets, then altcoins tend to rally while Bitcoin consolidates.

Hence, when the market becomes focused on Bitcoin once again, altcoins and Ether typically consolidate, as BTC sees an explosive upside movement.

On Jan. 25, Bitcoin broke out of its four-day range, rising by more than 7% on the day. In the same period, the ETH/BTC pair dropped by around 4.9%.

Loma, a cryptocurrency trader, said that the price action of ETH suggests a pullback is likely to flush late buyers. He said:

“Something about this $ETH PA tells me we’re going to rinse some ATH breakout longs over the next few days.”

The trader predicted the drop as ETH surpassed $1,470, and the price of ETH has dropped by more than 5% since.

Record options expiry coming

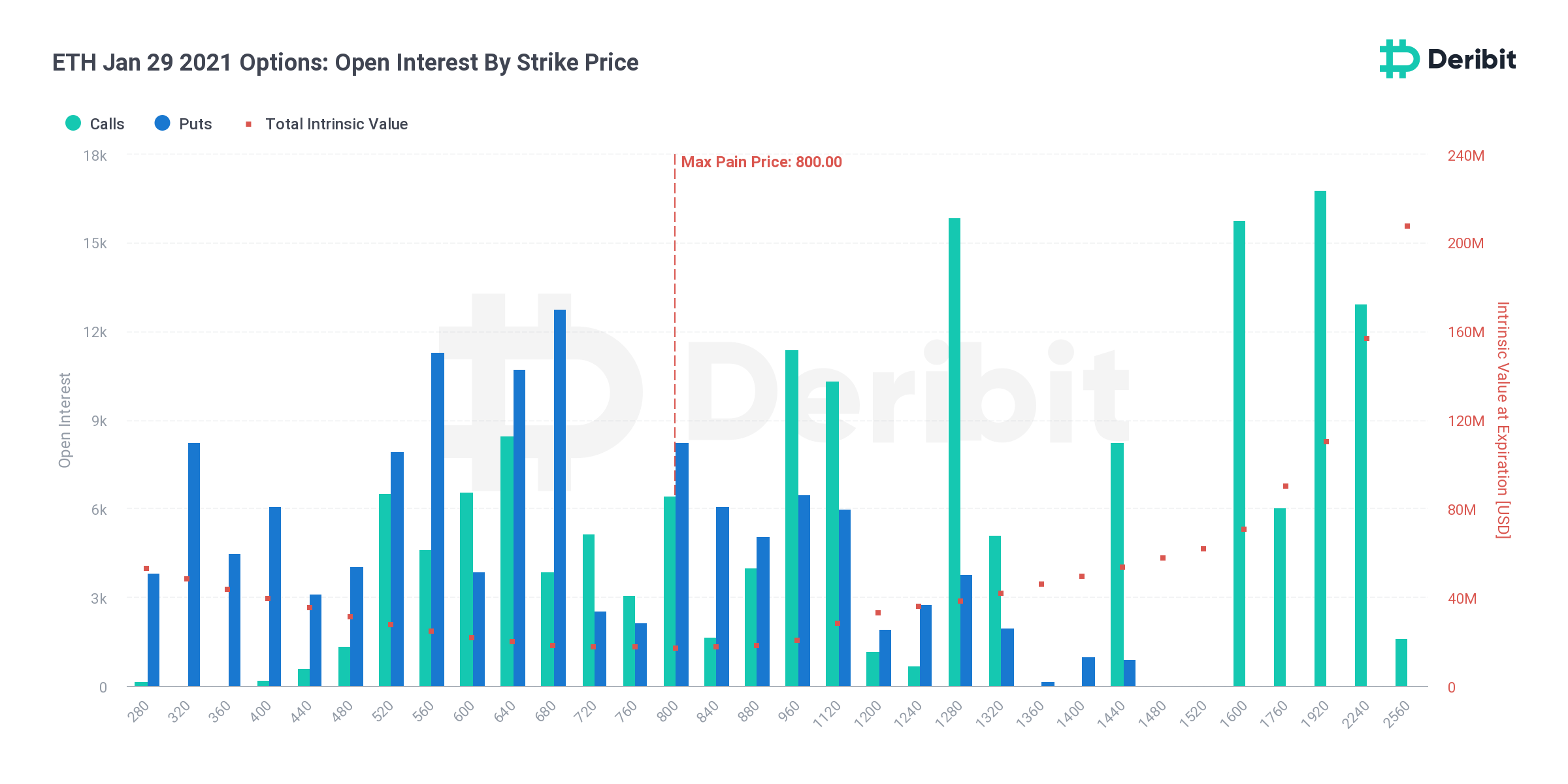

A variable that could affect the near-term price trend of Ether is a record options expiry.

Around $400 million worth of options is set to expire on Jan. 29. Considering that many traders are likely to adjust their positions before the expiry, ETH could see a big spike in volatility.

The expiry may play into ETH’s favor or could place selling pressure on it. If the price of ETH drops steeply in the coming days and pushes it toward the max pain price at $800, then it could amplify the downtrend of ETH.

The term “max pain” in options refers to the price point where the highest number of traders would face the most losses.

ETH is highly unlikely to fall by nearly 50% to $800 by Jan. 29, especially considering its momentum. But due to the unprecedented demand for ETH and the cryptocurrency’s high volatility, a minor pullback before the expiry could have a negative impact on the short-term price cycle of ETH.

The fundamentals for ETH still remain strong, however, as analysts at Intotheblock said. They wrote:

“The price of #Ethereum broke a new ATH today of $1,475. On Friday, we wrote about a few of the reasons why we are bullish on $ETH including: – Increasing supply scarcity – DeFi exponential growth throughout 2020 – Network adoption and growth.”